It’s the age of instant gratification, where financial markets are buzzing round-the-clock. Trading options, once confined to traditional market hours, has evolved dramatically, allowing savvy investors to seize opportunities even when the clock strikes close. Enter the world of extended trading sessions, where nimble traders navigate the ebb and flow of markets beyond the confines of 9:30 AM to 4:00 PM EST.

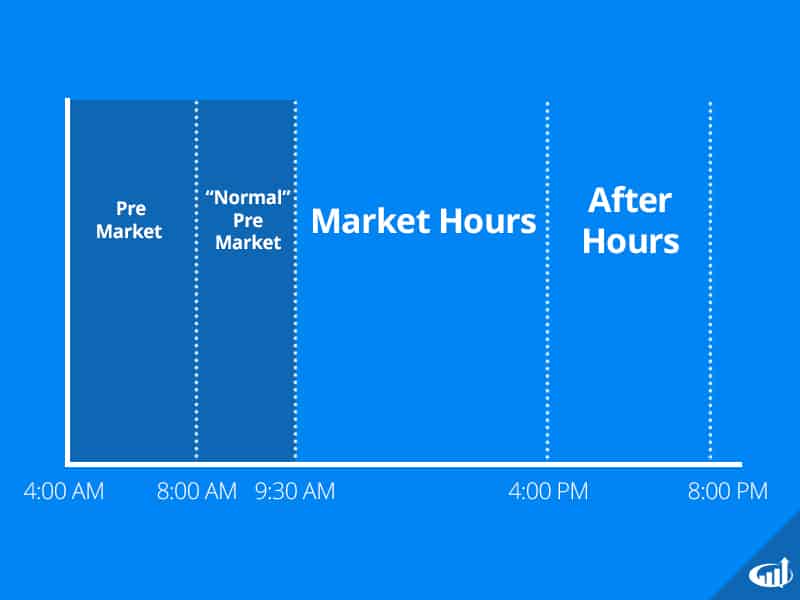

Image: www.investorsunderground.com

With options trading becoming increasingly accessible and flexible, it’s imperative to delve into the nuances of extending your trading horizons beyond regular market hours. This comprehensive guide will illuminate the intricacies of this dynamic trading landscape, empowering you to capitalize on its unique advantages.

Extended Trading: Demystifying the Extended Market Landscape

As the sun sets and traditional trading hours draw to a close, the financial landscape transforms into a dimly lit yet vibrant scene. Extending into pre-market and post-market hours, investors gain an extended window to strategize, react, and execute trades, offering unprecedented flexibility and access to market movements that unfold outside of regular trading hours.

Pre-market trading, commencing at 7:00 AM EST, provides a unique opportunity to gauge market sentiment before the official opening bell. Post-market trading, stretching from 4:00 PM EST to 8:00 PM EST, offers a crucial window to react to late-breaking news and position yourself for the next trading day.

The Allure of Extended Trading: Unlocking Market Opportunities

Embracing the extended trading realm unlocks a treasure trove of opportunities, including:

-

Seizing News-Driven Market Reactions: News events, press releases, and earnings announcements often surface outside of regular market hours. Extended trading empowers investors to respond swiftly, capitalizing on market reactions and shaping their trading strategies accordingly.

-

Navigating Pre-Market Volatility: Market fluctuations intensify during pre-market hours as investors anticipate economic data and company news. Extended trading provides a stage to participate in this dynamic environment, potentially reaping rewards from price movements that occur before the hordes of traders enter the market.

-

Reacting to After-Hours Announcements: Post-market hours offer a critical window to process earnings reports and other significant announcements, enabling investors to adjust their positions based on companies’ financial performance and outlook.

Mastering the Extended Trading Arena: A Guide for the Astute

Venturing into extended trading requires astute planning and precision:

-

Understand Market Dynamics: Extended trading hours exhibit distinct characteristics and volatility patterns. Familiarize yourself with these nuances to navigate the extended market landscape effectively.

-

Monitor News and Events: Stay abreast of news events and company announcements that may influence market movements during extended trading hours.

-

Choose Liquid Options: Opt for options with substantial trading volume during extended hours to ensure efficient trade execution.

-

Manage Risk Effectively: Exercise prudence in managing risk by tailoring your trading strategies to the heightened volatility of extended trading hours.

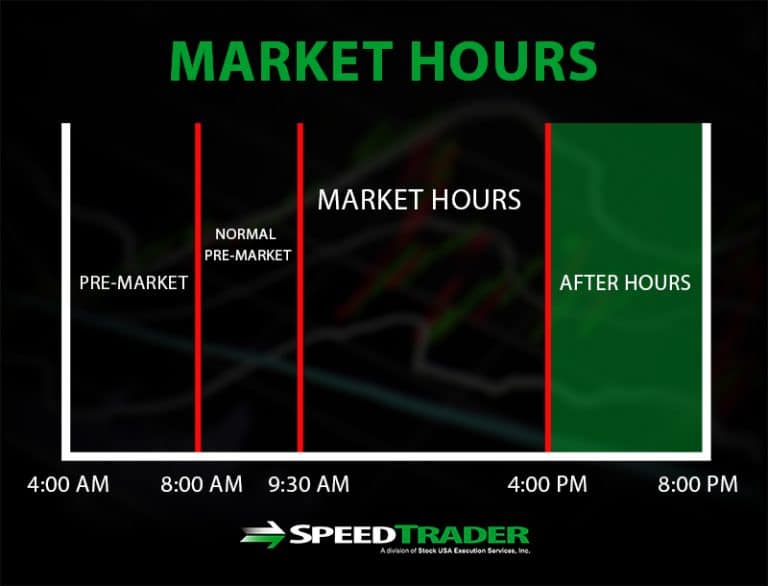

Image: yzypohu.web.fc2.com

Navigating Challenges: Overcoming Extended Trading Hurdles

While extended trading offers numerous advantages, it’s not without potential drawbacks:

-

Reduced Liquidity: Trading volume often diminishes during extended hours, resulting in wider bid-ask spreads and potentially impacting trade execution efficiency.

-

Price volatility: Market movements during extended hours can be more pronounced, requiring traders to exercise caution and adjust their risk management strategies accordingly.

-

Emotional Trading: The solitude of extended trading hours can amplify emotional reactions to market movements. Maintain discipline and avoid impulsive trading decisions.

Trading Options Outside Of Market Hours

Image: speedtrader.com

Conclusion: Harnessing the Power of Extended Trading

Trading options outside of market hours has emerged as a valuable tool for investors seeking to maximize market opportunities and respond to dynamic market conditions. By understanding the unique characteristics, potential advantages, and challenges of extended trading, investors can confidently navigate this evolving landscape, unlocking the path to informed and lucrative trading decisions.

As the financial markets continue to innovate, the boundaries of trading will undoubtedly continue to blur. Embrace the extended trading realm as a testament to this evolution, empowering yourself to seize opportunities and shape your financial future with newfound flexibility and agility.