The Thrill of the Trade

In the heart of Wall Street’s bustling trading floor, amidst the cacophony of orders, resides a breed of elite traders known as market makers. They are the maestros of the market, orchestrating the dance of supply and demand with precision and audacity. Let’s delve into the fascinating world of market making and uncover their secrets.

Image: tikloenglish.weebly.com

Becoming a Market Maker: The Key Ingredient

Market makers play a pivotal role in ensuring liquidity and stability in the financial markets. They stand ready to buy and sell options contracts, creating a market where buyers and sellers can transact. The key ingredient that sets them apart from traditional traders is their ability to quote prices bidirectionally, assuming the role of both buyer and seller simultaneously.

This unique position allows market makers to profit from the bid-ask spread, the difference between the price at which they buy and sell. Their success hinges on their ability to assess market sentiment, minimize risk, and execute trades with lightning-fast efficiency.

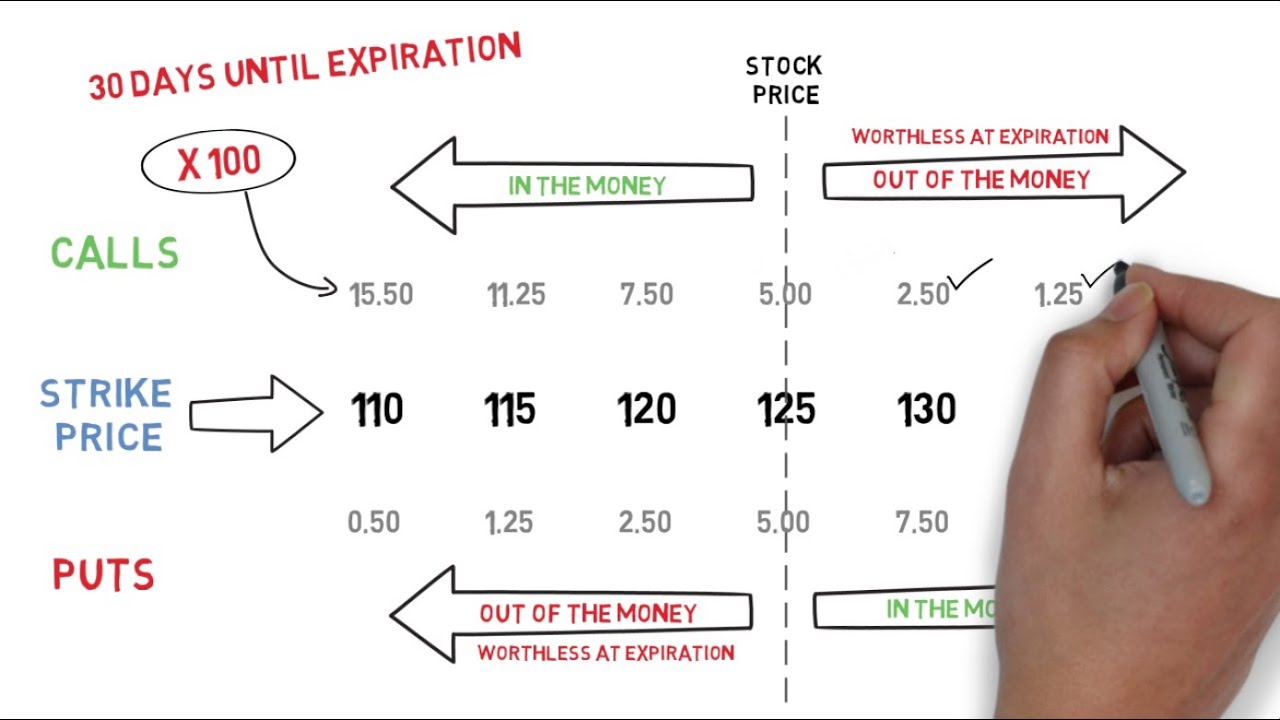

The Anatomy of an Option: Unveiling the Details

Options are financial instruments that grant the buyer the right, but not the obligation, to buy (in the case of a call) or sell (in the case of a put) an underlying asset at a predetermined price on or before a specific date. Market makers specialize in quoting prices for options contracts, opening up a world of possibilities for savvy investors.

Option contracts comprise several key elements, including the strike price, expiration date, and option type (call or put). By understanding these components, traders can tailor their strategies to suit their risk tolerance and profit potential.

The Art of Option Trading: A Delicate Balance

Trading options involves a delicate balance of risk and reward. Unlike stocks, which can only rise in value, options can fluctuate wildly based on various factors, making them both lucrative and perilous. Market makers navigate this volatility by meticulously managing their inventory, hedging their positions, and utilizing sophisticated quantitative models to forecast market movements.

Their expertise in assessing risk and applying complex trading strategies gives market makers an edge over the average trader. They are able to capitalize on short-term market inefficiencies, profiting from the constant ebb and flow of supply and demand.

Image: moneymunch.com

Insights from the Trading Trenches: Tips and Expert Advice

As seasoned option traders, market makers have a wealth of experience to share. Here are a few tips to help you elevate your trading game:

- Focus on Liquidity: Choose options contracts with high trading volume to ensure easy execution and minimize slippage.

- Manage Your Risk: Define your risk tolerance and never exceed it. Use stop-loss orders to protect your capital.

- Learn from Market Movements: Study historical market data to gain insights into market trends and price fluctuations.

- Seek Professional Advice: Consult with a financial advisor to discuss your trading strategy and risk appetite.

By implementing these principles, you can navigate the complex world of options trading with greater confidence and potential for success.

FAQs: Demystifying Option Trading

Q: What are the benefits of option trading?

A: Options trading offers numerous benefits, including increased profit potential, reduced risk compared to holding underlying assets directly, and the flexibility to customize strategies based on market conditions.

Q: What is the role of implied volatility in option pricing?

A: Implied volatility is a key determinant of option prices. It reflects market expectations of future volatility and significantly influences option premiums.

Q: How do market makers make a profit?

A: Market makers profit from the bid-ask spread, the difference between the price at which they buy and sell options contracts. They also employ various trading strategies to enhance their returns.

Trading Options Like A Market Maker

Image: scanz.com

Conclusion

Trading options like a market maker requires a deep understanding of the markets, a keen eye for risk, and the ability to execute trades with precision. By embracing the tips and advice presented in this article, you can unlock the potential of option trading and elevate your financial game.

Are you ready to step into the world of market making and master the art of options trading? Join the conversation below and share your insights and experiences. Let’s unravel the complexities of this fascinating financial instrument together.