In the ever-evolving financial landscape, options trading has emerged as a potent tool for investors seeking to mitigate risk or amplify potential gains. Options contracts, in their vast versatility, bestow upon investors the right, not the obligation, to buy or sell an underlying asset at a predefined price within a specified time frame. Among the myriad of options available, housing puts have garnered significant attention in recent times, offering investors a unique avenue to safeguard against potential downturns in the volatile housing market.

Image: www.projectfinance.com

Understanding Housing Puts: A Bastion Against Market Volatility

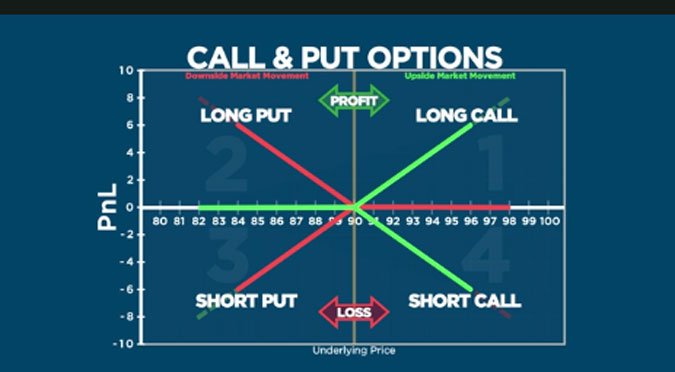

Housing puts, as their name suggests, are options contracts that grant the holder the right to sell a specified quantity of an underlying housing asset, typically a stock or index representing the broader housing market, at a predetermined strike price before a set expiration date. By purchasing a housing put, investors essentially secure a price floor, protecting themselves against potential declines in the value of the underlying asset. If the housing market experiences a downturn, the value of the housing put will increase, offsetting losses incurred on the underlying asset.

The mechanics of a housing put are relatively straightforward. Upon purchasing the contract, the investor pays a premium to the seller, granting them the right to exercise the option within the specified timeframe. If, at expiration, the market price of the underlying asset falls below the strike price, the holder can exercise the option to sell the asset at the strike price, realizing a profit on the difference between the exercise price and the lower market price. However, if the market price remains above the strike price, the option expires worthless, and the premium paid becomes a sunk cost.

Strategic Deployment of Housing Puts: Tailoring to Market Conditions

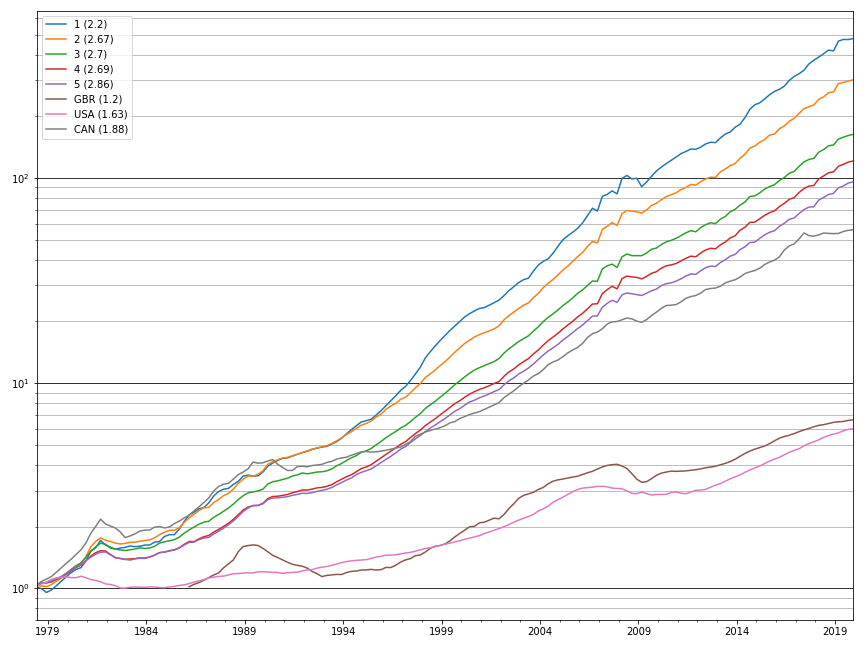

The judicious deployment of housing puts requires careful consideration of market conditions and investor objectives. During periods of market stability or anticipated growth, housing puts may serve as a hedge against unforeseen market downturns. Investors can purchase puts with strike prices slightly below the current market value, providing a safety net to mitigate potential losses should the market unexpectedly decline.

On the other hand, in markets characterized by heightened volatility or anticipated downtrends, housing puts can be employed more aggressively to capitalize on market declines. Investors can opt for puts with strike prices significantly below the current market value, increasing the likelihood of profitability in the event of a substantial market correction. However, this strategy entails a higher premium cost and carries a greater risk of the option expiring worthless.

Weighing the Considerations: Pros and Cons of Housing Puts

Housing puts, like any investment vehicle, come with their own set of advantages and disadvantages. Among the benefits of housing puts is their flexibility as a hedging tool, allowing investors to protect their investments against potential market downturns. Additionally, puts provide investors with the potential for significant profit if the market price of the underlying asset declines sharply.

However, it is imperative to acknowledge potential drawbacks associated with housing puts. The purchase of an option contract incurs a premium cost, which represents a non-refundable expense. Furthermore, housing puts possess a finite lifespan, expiring worthless if not exercised before their specified expiration date. Thus, investors must carefully assess their risk tolerance and market outlook before incorporating housing puts into their investment strategy.

Image: www.deepfaceswap.com

Navigating the Complexities: Expert Insights on Housing Puts

Seasoned investors emphasize the importance of thorough research and prudent decision-making when venturing into housing put territory. CNBC’s Brian Overby cautions against relying solely on housing puts to mitigate portfolio risk, advocating for a balanced approach that encompasses diversification across asset classes. Moreover, experts recommend exercising vigilance in evaluating market conditions and consulting with financial advisors to tailor put strategies to individual risk appetites and investment goals.

Trading Options Housing Put

Image: insigniafutures.com

Conclusion: Empowering Investors with Housing Put Knowledge

Housing puts, when employed judiciously, can serve as a valuable addition to an investor’s toolkit. By understanding the mechanics and strategic applications of housing puts, investors can navigate the complexities of the housing market with greater confidence. Whether seeking to hedge against risk or exploit market downturns, housing puts offer a versatile solution for investors willing to embrace a deeper understanding of options trading. As always, thorough research, careful planning, and consultation with financial professionals are crucial for navigating the dynamic landscape of the financial markets.