In the realm of financial markets, where risk and reward intertwine, options trading stands as a sophisticated yet potentially lucrative strategy. Whether you’re a seasoned investor seeking to enhance your portfolio or a budding enthusiast eager to navigate the nuances of this complex domain, this comprehensive guide will illuminate the path to successful options trading.

Image: www.connectfx.org

Understanding Options: A Foundation for Success

Before venturing into the intricate world of options trading, it’s imperative to grasp the underlying concepts. Options are derivative contracts that provide the buyer with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before a specified date (expiration date). This flexibility offers investors the potential to profit from price fluctuations without actually owning the underlying asset.

Types of Options: Navigating the Spectrum

The options market comprises a vast array of options contracts, each tailored to specific investment objectives. Understanding the differences between call and put options is crucial. Call options grant the buyer the right to purchase an asset, while put options confer the right to sell. American options can be exercised at any time before expiration, while European options can only be exercised on the expiration date. Additionally, investors can choose between standard vanilla options and more complex options strategies, such as spreads and combinations, to fine-tune their risk-reward parameters.

Risk Management: A Vital Component

Options trading inherently involves risk, and prudent risk management is paramount. Leverage, the ratio of an investor’s position to their capital, can amplify both profits and losses. Options traders must carefully consider their risk tolerance and manage their positions effectively. Protective strategies, such as stop-loss orders, limit orders, and position sizing, can help mitigate risk and safeguard capital.

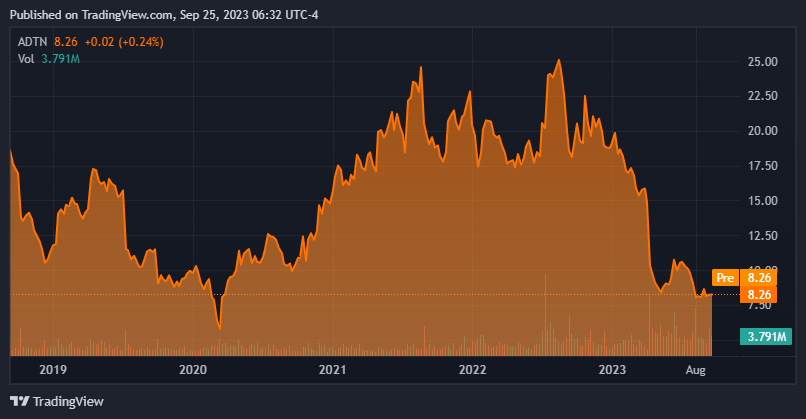

Image: seekingalpha.com

Market Analysis: Unlocking Hidden Opportunities

Successful options trading demands a deep understanding of market dynamics. Technical analysis, which examines historical price data to identify trends and patterns, plays a pivotal role. Fundamental analysis, focusing on economic indicators, company earnings, and industry developments, offers valuable insights into the underlying value of assets. By combining these analytical methods, traders can better gauge market sentiment and make informed trading decisions.

Trading Strategies: A Toolkit for Profitability

The options market offers a diverse range of trading strategies to suit varying risk appetites. Covered calls involve selling a call option against an underlying asset that the trader owns, generating income while retaining limited downside risk. Long calls and long puts are bullish strategies that benefit from rising (calls) and falling (puts) prices, respectively. Short calls and short puts, on the other hand, are bearish strategies that profit from falling (calls) and rising (puts) prices. By tailoring trading strategies to their risk profile and market outlook, traders can optimize their return potential.

FAQs: Clarifying Common Queries

- Q: What is the difference between a call option and a put option?

A: Call options provide the buyer with the right to purchase an asset, while put options grant the right to sell an asset.

- Q: When should I use technical analysis vs. fundamental analysis?

A: Technical analysis is ideal for identifying short-term trading opportunities based on price patterns, while fundamental analysis is more appropriate for assessing long-term market trends.

- Q: How do I manage risk effectively in options trading?

A: Utilize protective strategies, such as stop-loss orders or position sizing, to limit potential losses.

- Q: Can I make money in the options market during a bear market?

A: Yes, short calls and short puts can be used to profit from falling asset prices.

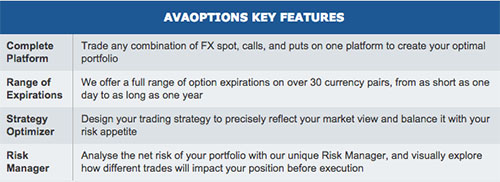

Trading Options Adva

Image: www.avatrade.com

Conclusion: Embracing the Potential

Options trading offers a realm of opportunities to discerning investors seeking to enhance their portfolios and outpace market averages. By mastering the concepts, navigating the types of options, managing risk prudently, and employing effective trading strategies, you can unlock the transformative power of options trading. So, the question remains, are you ready to embark on this captivating journey and elevate your financial prowess?