In the bustling world of finance, navigating the complexities of trading options can be akin to a thrilling game of chess. As seasoned trader Henry Rutherford aptly put it, “Every move you make on the options board shapes the trajectory of your portfolio’s fate.” Among the myriad of option strategies, selling options has emerged as a strategic approach with its unique set of advantages and intricacies.

Image: www.markettradersdaily.com

Option selling involves granting others the right, but not the obligation, to buy or sell a specific asset at a predetermined price within a specified time frame. The seller of the option receives a premium in exchange for this granted option. Understanding the intricacies of option selling is paramount to successful execution of this strategy.

Decoding the Art of Option Selling

Understanding the Dynamics of Options

Before delving into the nuances of option selling, gaining a comprehensive understanding of options is essential. Options are financial instruments that grant the holder the right, but not the obligation, to engage in specific transactions involving an underlying asset. These transactions can include buying or selling the asset.

The Premium Factor

At the heart of option selling lies the concept of premium. The premium is the price paid to the seller of the option in exchange for the granted right. The premium amount is influenced by various factors, such as the strike price, time to expiration, and volatility of the underlying asset.

Image: db-excel.com

Call vs. Put Options

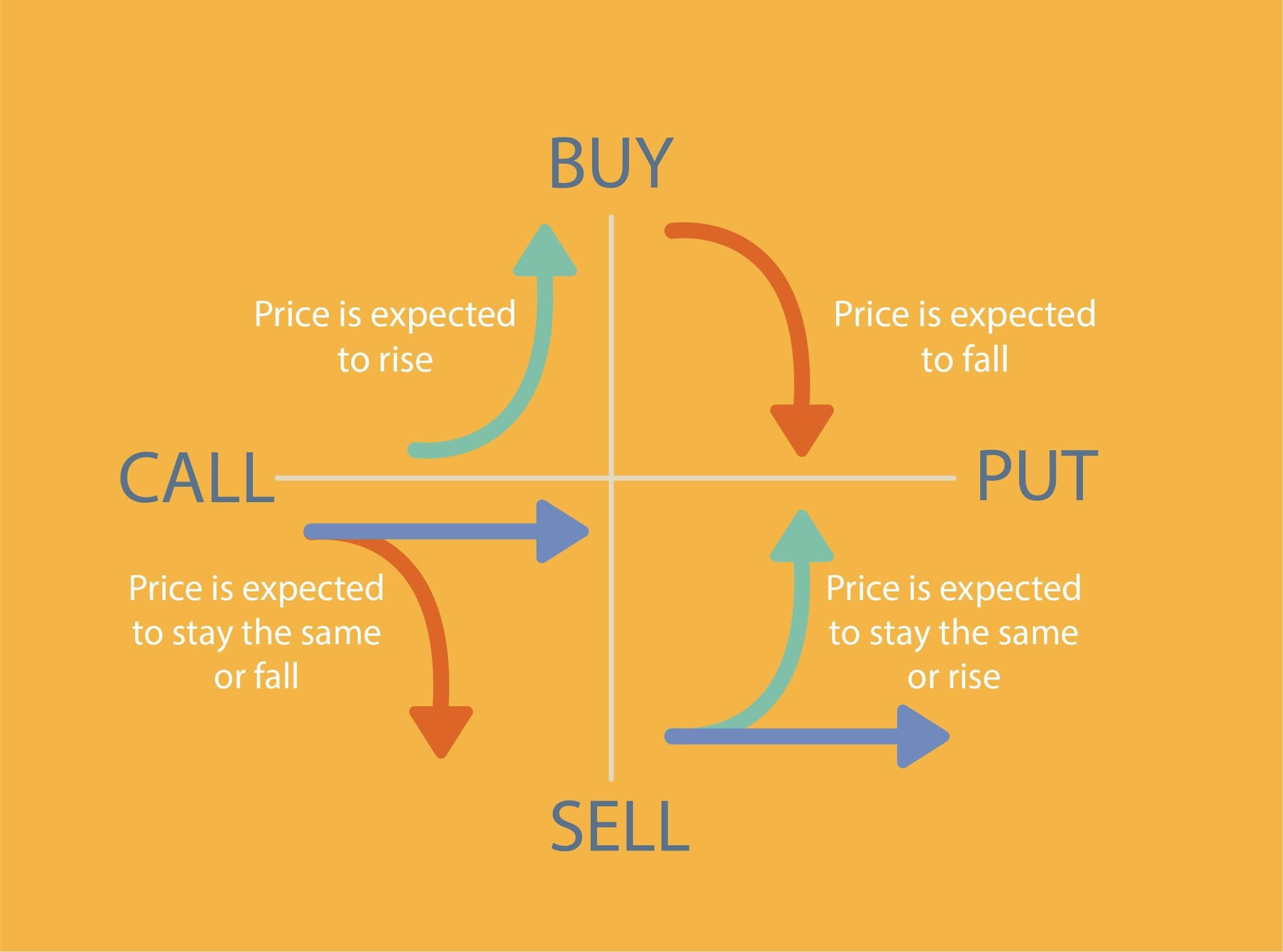

When selling options, it is crucial to understand the distinction between call options and put options. Call options grant the holder the right to buy the underlying asset at a specified price, while put options grant the right to sell.

Navigating the Strategy: Option Selling in Practice

Option selling encompasses a diverse range of strategies, each tailored to specific market conditions and risk tolerances. Some of the most common strategies include covered calls, naked puts, and married puts,

Covered Calls

In a covered call strategy, the seller owns the underlying asset they are selling the call option on. This approach allows the seller to generate income from the premium while maintaining exposure to potential gains in the asset’s value.

Naked Puts

Naked puts involve selling a put option without owning the underlying asset. This strategy is riskier than a covered call but offers the potential for greater profit if the asset price rises.

Married Puts

Married puts combine selling a put option with simultaneously purchasing a long call option with the same strike price and expiration date. This strategy aims to reduce the risk associated with naked puts while still offering the potential for income generation.

Staying Aligned with Evolving Trends and Developments

The realm of option selling is constantly evolving, with new strategies and insights emerging on a regular basis. To stay abreast of these developments, it is imperative to engage in continuous research and analysis.

Social media platforms, industry forums, and financial news sources provide a wealth of information on the latest trends, expert opinions, and market insights. By tapping into these resources, traders can stay informed and adjust their option selling strategies accordingly.

Option Selling Trading Strategy

Empowering Traders: Tips and Expert Advice

Embarking on option selling requires a well-rounded understanding of the market, coupled with calculated decision-making and risk management. Drawing upon my years of experience, I have compiled invaluable tips and expert advice to guide traders:

- Thorough Research and Due Diligence: Meticulous research is crucial before initiating any option selling trade.

- Selecting the Right Strategy: Identify the strategy that aligns best with your risk appetite and market conditions.

- Monitoring and Adapting: Monitor your option positions closely and adjust your strategy as needed.

- Understanding Risk Management: Risk management is param