Introduction

In the tumultuous realm of financial markets, gold has long held a captivating allure as a safe haven asset. Its inherent value and resilience during economic downturns have made it a prized possession for investors seeking to preserve their wealth. With the advent of options trading, a new avenue has emerged to capitalize on the precious metal’s price fluctuations. In this article, we dive into the captivating world of gold options trading in Australia, exploring its intricacies, advantages, and strategies.

Image: www.kayak.co.th

Understanding Gold Options

An option is a contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a certain date (expiration date). In the case of gold options, the underlying asset is the spot price of gold. Two primary types of gold options exist: call options and put options.

- Call options: Grant the holder the right to buy gold at the strike price on or before the expiration date. They are typically used when an investor anticipates an increase in gold prices.

- Put options: Grant the holder the right to sell gold at the strike price on or before the expiration date. They are typically used when an investor anticipates a decrease in gold prices.

Advantages of Trading Gold Options

- Leverage: Gold options provide leverage, allowing investors to control a larger position in gold without having to commit the full purchase price. This can magnify potential profits, but also increase risk.

- Flexibility: Options trading offers flexibility, as investors can tailor their positions to suit their investment horizons and risk tolerance.

- Risk management: Options can be used as hedging instruments to manage risk in existing gold positions or to speculate on price movements without the full commitment of owning the physical asset.

Strategies for Trading Gold Options

- Bullish call spread: This involves buying an at-the-money call option and selling a higher strike price call option. The investor profits if gold prices rise above the strike price of the purchased option.

- Bearish put spread: This involves selling an at-the-money put option and buying a lower strike price put option. The investor profits if gold prices fall below the strike price of the sold option.

- Strangle: This involves buying both a call and a put option with the same expiration date but different strike prices. The investor profits if gold prices experience significant volatility.

Image: thewaverlyfl.com

Expert Insights

“Gold options trading provides investors with a powerful tool to navigate the complexities of the gold market,” says Dr. Mark Lester, an expert in bullion markets at the University of Sydney. “By understanding the different types of options and their uses, investors can position themselves to capitalize on both rising and falling gold prices.”

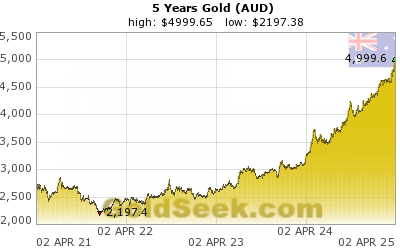

Trading Gold Options In Australia

Image: quotes.goldseek.com

Conclusion

Trading gold options in Australia presents a captivating opportunity for investors seeking to harness the price fluctuations of the precious metal. By understanding the mechanics, advantages, and strategies involved, investors can navigate the gold options market with confidence. Remember, as with any investment, thorough research and risk management are crucial. Embrace the golden opportunity and unlock the potential of this dynamic market.