In the world of finance, the debate between trading futures and options often arises. Both futures and options are derivative financial instruments, but they differ significantly in their characteristics and how they’re traded.

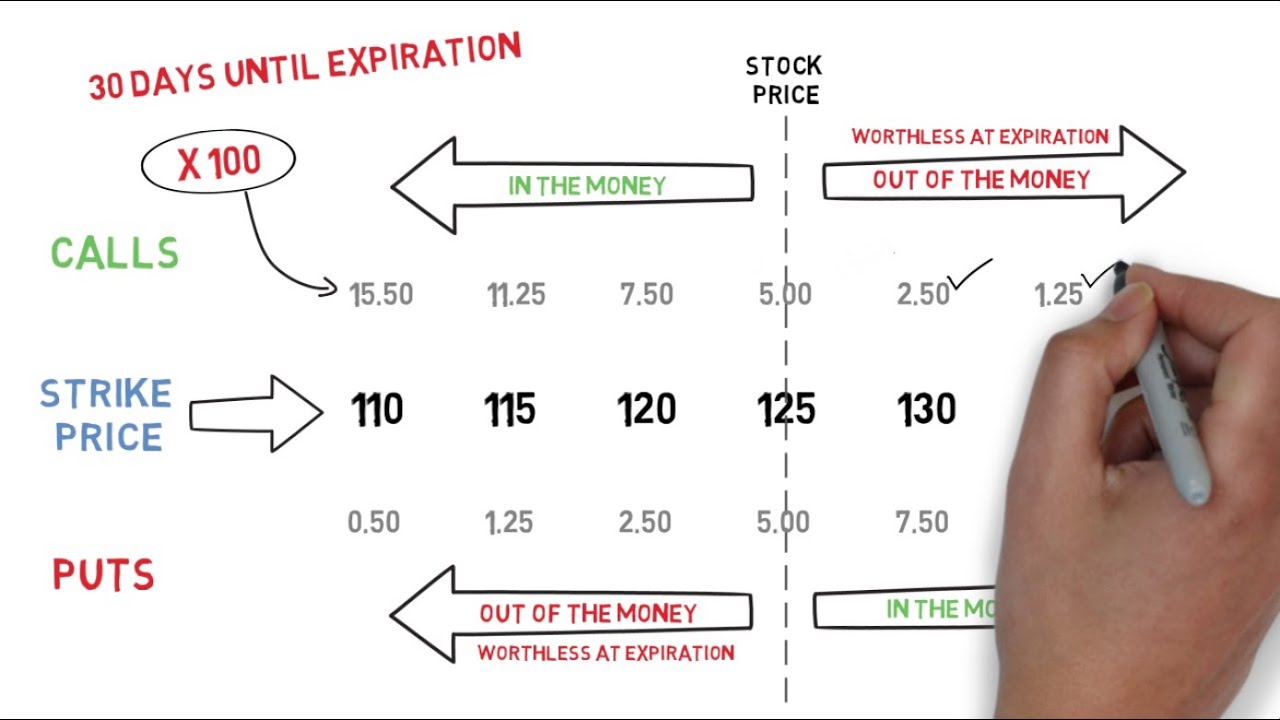

Image: www.youtube.com

As an experienced trader, I’ve witnessed firsthand the unique advantages and drawbacks of each instrument. In this comprehensive guide, I’ll delve into the intricacies of futures vs. options trading, providing insights to help you make informed decisions about these complex and potentially rewarding financial tools.

**Definition and Overview**

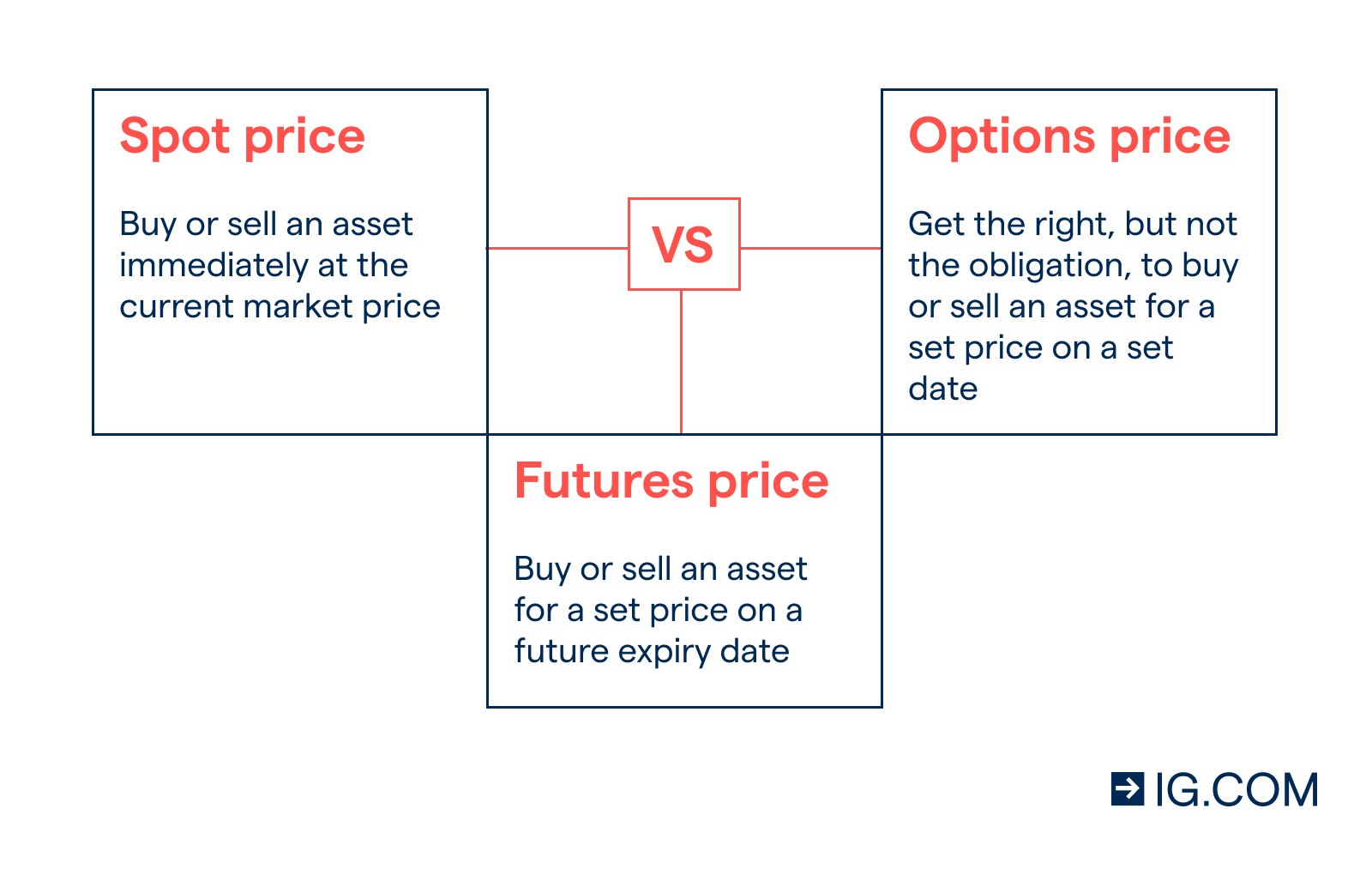

**Futures contracts** are standardized agreements to buy or sell a specific quantity of an underlying asset (e.g., corn, crude oil) on a predefined future date at a price agreed upon today. Futures contracts are traded on regulated exchanges and provide investors with leverage but also come with the obligation to fulfill the contract.

**Options contracts**, on the other hand, grant the buyer the right, but not the obligation, to buy or sell an underlying asset by a certain date at a predefined price (known as the strike price). Options contracts are also exchange-traded but offer more flexibility and limited potential loss compared to futures contracts.

**Similarities and Differences**

**Similarities:**

- Both futures and options are derivatives, meaning they derive their value from an underlying asset.

- Both are traded on regulated exchanges, ensuring transparency and liquidity.

- Both offer the potential for leverage, although the extent differs.

Image: www.ig.com

**Differences:**

| Feature | Futures Contracts | Options Contracts |

|---|---|---|

| Obligation | Obligation to fulfill the contract | Right, but not obligation, to fulfill |

| Leverage | Higher leverage potential | Limited leverage potential |

| Expiration | Fixed expiration date | Specified expiration date, but can be exercised before |

| Pricing | Priced at spot+ (or -), including the cost of carry | Priced based on various factors including time to expiration, volatility, and the underlying asset’s price |

**Applications and Strategies**

Futures:**

- Used for hedging price risk (e.g., by farmers or oil companies)

- For speculative trading to capitalize on price movements

- Provide exposure to commodities and currencies for investors without physical ownership

Options:**

- For speculative trading, such as buying call options (right to buy) or selling put options (right to sell)

- To enhance portfolio returns (e.g., using covered calls to generate income)

- As risk management tools (e.g., protective puts to limit potential losses)

**Expert Tips and Advice**

- Understand your risk appetite: Futures contracts carry a higher risk than options, so align your trades with your risk tolerance.

- Educate yourself thoroughly: Trading futures and options requires a deep understanding of underlying assets, market dynamics, and risk management techniques.

- Seek professional guidance: If uncertain, consult with a financial advisor or experienced trader for personalized guidance.

- Manage your emotions: Stay disciplined and avoid impulsive trading decisions based on emotions or fear of missing out (FOMO).

- Trade with a reputable broker: Choose brokers that offer safe and reliable trading platforms, competitive fees, and quality research.

**FAQ**

Q: Which is more profitable, futures or options trading?

A: Profitability depends on individual strategies, market conditions, and risk tolerance. Both futures and options can yield profits, but the potential risks and returns vary.

Q: Can I trade futures or options with small capital?

A: Options trading requires less capital compared to futures, as it offers limited potential loss. However, determining suitable strategies with small capital is crucial.

Q: What is the best way to learn about futures and options trading?

A: Attend workshops, study books, and connect with experienced traders. Additionally, demo accounts and paper trading can provide risk-free learning environments.

Trading Furtures Vs Options

Image: www.compsuite.com

**Conclusion**

Trading futures and options can be rewarding endeavors but also involve inherent risks. By understanding the intricacies of each instrument, applying the tips and advice shared, and approaching trading with a prudent mindset, you can increase your chances of success.

Are you interested in further exploring the world of futures and options trading? Let’s connect to delve deeper into this exciting field and unlock its potential together!