<!DOCTYPE html>

Image: forexposition.com

Introduction

The world of finance can be daunting, particularly for new traders venturing into the realm of currency options. However, with a clear understanding of the basics, trading currency options online can be an exciting and potentially lucrative opportunity.

In this comprehensive guide, we’ll embark on a journey into the world of currency options trading, exploring its intricacies and empowering you with the knowledge you need to make informed decisions. We’ll cover everything from the fundamentals to advanced strategies, so read on and discover the gateway to navigating the currency options market.

What Are Currency Options?

Currency options are contracts that grant you the right, not the obligation, to buy or sell a specified amount of a currency pair at a predetermined price (known as the strike price) on or before a specific date (known as the expiration date).

By investing in an option, you speculate on the direction of the underlying currency pair’s movement. If the market moves in your favor, your position can potentially yield significant returns. However, it’s important to note that options also carry risks, and it’s possible to lose your investment.

Understanding Option Terminology

Image: trendfx.ru

Call Options

Call options give you the right to buy the underlying currency pair. You expect the currency pair to increase in value and, if it does, you can exercise your right to purchase it at the agreed-upon strike price.

Put Options

Put options provide you with the right to sell the underlying currency pair. You anticipate that the currency pair’s value will decline, so you can sell it at the strike price to capitalize on the market movement.

Factors Influencing Currency Options Prices

Several key factors can influence the pricing of currency options:

- Underlying Currency Pair Value: The price of the currency pair directly impacts option premiums.

- Volatility: Higher volatility in the underlying currency pair generally results in higher option premiums.

- Time to Expiration: As the expiration date approaches, option premiums tend to decrease, as time decay reduces their intrinsic value.

- Interest Rates: Interest rate changes can affect the carrying costs of options, impacting their prices.

- Sentiment: Market sentiment can drive currency pair valuations, influencing option premiums.

Strategies for Trading Currency Options

Currency options offer a wide range of strategies for traders. Here are a few common approaches:

Covered Calls

Traders use covered calls to generate income from their existing position in a currency pair. By selling a call option with a higher strike price than the current spot price, traders can collect premiums while maintaining their position.

Protective Puts

Protective puts are used to hedge against potential losses on a long position in a currency pair. By purchasing a put option with a lower strike price than the current spot price, traders can limit their downside risk.

Expert Advice for Currency Options Trading

Seasoned traders offer the following tips for success in currency options trading:

- Manage Risk: Always carefully consider your risk tolerance and trade size accordingly.

- Conduct Thorough Research: Understand the underlying currency pairs and the macroeconomic factors affecting them.

- Choose the Right Strategy: Select a trading strategy that aligns with your risk profile and market outlook.

- Track Market Conditions: Monitor economic data, news events, and technical analysis to make informed trading decisions.

- Stay Disciplined: Stick to your trading plan and avoid making impulsive trades.

Frequently Asked Questions (FAQs)

Here are answers to some common questions related to currency options trading:

- What is the difference between a call and a put option?

Call options give you the right to buy, while put options give you the right to sell the underlying currency pair.

- What are the risks of trading currency options?

Options carry the risk of losing your investment if the market doesn’t move in your favor.

- How do I determine if an option is worth buying?

Consider Faktoren such as the strike price, time to expiration, and the current market conditions.

- Can I trade currency options without experience?

While it’s not advisable to trade without any knowledge, you can educate yourself through research and practice.

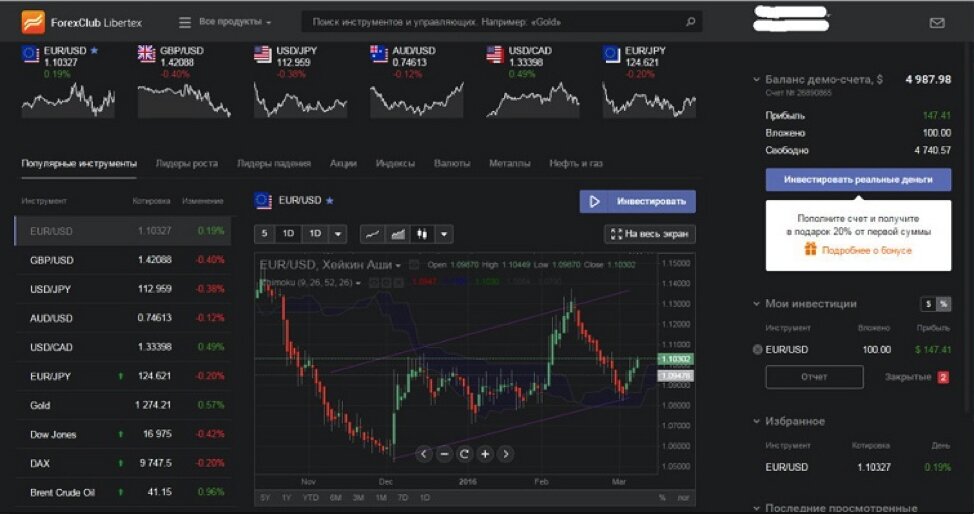

Trading Currency Options Online

Image: www.youtube.comConclusion

Trading currency options online can be a rewarding venture, but it requires careful consideration, knowledge, and a sound trading plan. By mastering the concepts outlined in this guide, you can create your path to success in the dynamic world of currency options trading.

Remember, navigating the financial markets is an ongoing journey. Stay curious, continue learning, and don’t hesitate to seek guidance from experienced traders.

Now, tell me, dear reader, are you ready to embark on the exciting journey of trading currency options online? The world of opportunities awaits you.

- What is the difference between a call and a put option?