Introduction to ES Options

The Electronic Securities (ES) options contract, traded exclusively on the Chicago Mercantile Exchange (CME), serves as a powerful tool for traders seeking exposure to the price fluctuations of the S&P 500 index. ES options offer a unique blend of flexibility, leverage, and potential profit for investors of varying experience levels. In this comprehensive guide, we delve into the intricacies of ES options trading, exploring fundamental concepts, advanced strategies, and practical applications to empower you in navigating this dynamic market.

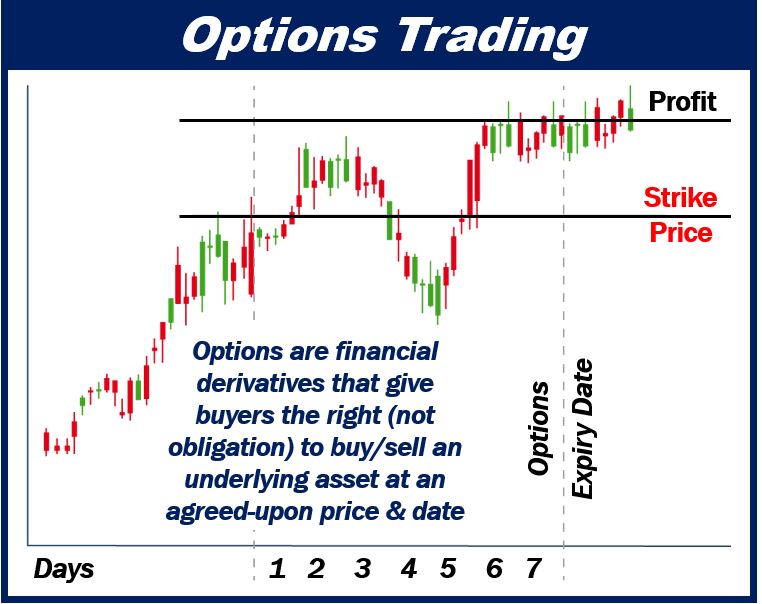

Image: www.angelone.in

Basics of ES Options Contracts

ES options contracts represent an agreement between two parties to exchange a predefined amount of S&P 500 futures, known as the underlying, at a specified price on a specific date. The buyer of the option acquires the right, but not the obligation, to exercise the option, while the seller agrees to fulfill the contract’s specifications if called upon to do so. Each ES option contract controls 500 multiplied by the index value of the underlying futures. This feature amplifies potential gains and losses.

Types of ES Options: Calls and Puts

There exist two primary types of ES options: call options and put options. Call options convey the right to buy the underlying futures at a specified price known as the strike price, while put options confer the right to sell the futures. The holder of a call option anticipates an increase in the S&P 500 index value, whereas the holder of a put option anticipates a decline.

Key Features of ES Options Trading

Leverage: ES options provide substantial leverage, allowing traders to control a significant underlying value with a relatively small capital outlay.

Flexibility: They facilitate multiple strategies, ranging from hedging risk to pursuing speculative opportunities.

Limited Risk: Unlike stock ownership, the potential loss of an options buyer is capped at the premium paid for the contract, reducing downside risk.

Image: medium.com

Strategies for Trading ES Options

Directional Trading Strategies:

- Long Call: This strategy involves buying a call option with the expectation that the S&P 500 index will rise.

- Short Put: Buying a put option with the expectation that the S&P 500 index will decline.

Volatility Trading Strategies:

- Long Straddle: Simultaneously buying a call and a put option at the same strike price. This strategy benefits from heightened volatility.

- Short Strangle: Selling a call and a put option at different strike prices captures premiums if volatility remains low.

Neutral Strategies:

- Iron Condor: A neutral strategy involving selling a put and a call option at a lower and higher strike price, respectively.

- Iron Butterfly: Selling an out-of-the-money call and put option, while simultaneously buying calls and puts at higher and lower strike prices.

Risk Management in ES Options Trading

Understanding the Underlying: Thoroughly research the S&P 500 index and its historical performance.

Position Sizing: Determine the appropriate number of contracts to trade based on available capital and risk tolerance.

Stop Losses: Establish clear exit points and use stop-loss orders to limit potential losses.

Monitor and Adjust Positions: Regularly monitor market conditions and adjust strategies as needed.

Trading /Es Options

Image: marketbusinessnews.com

Conclusion

Trading ES options offers a wide spectrum of possibilities for investors seeking to capitalize on the fluctuations of the S&P 500 index. By comprehending the fundamental principles, implementing effective strategies, and adhering to sound risk management practices, traders can unlock the potential of this dynamic market. Whether pursuing hedged investments or pursuing speculative gains, thorough preparation and informed decision-making are crucial for achieving success in ES options trading. Embark on this journey with confidence, and may your ventures bear profitable fruit.