Navigating the Lucrative World of Precious Metals

Gold, a precious metal that has captivated traders and investors for centuries, continues to hold a prominent position in Austria’s financial landscape. Its allure stems from its intrinsic value, stability in times of uncertainty, and reputation as a safe haven asset. Whether novice or seasoned trader, comprehending the top gold trading options in Austria is essential for experiencing success in this rewarding but complex market.

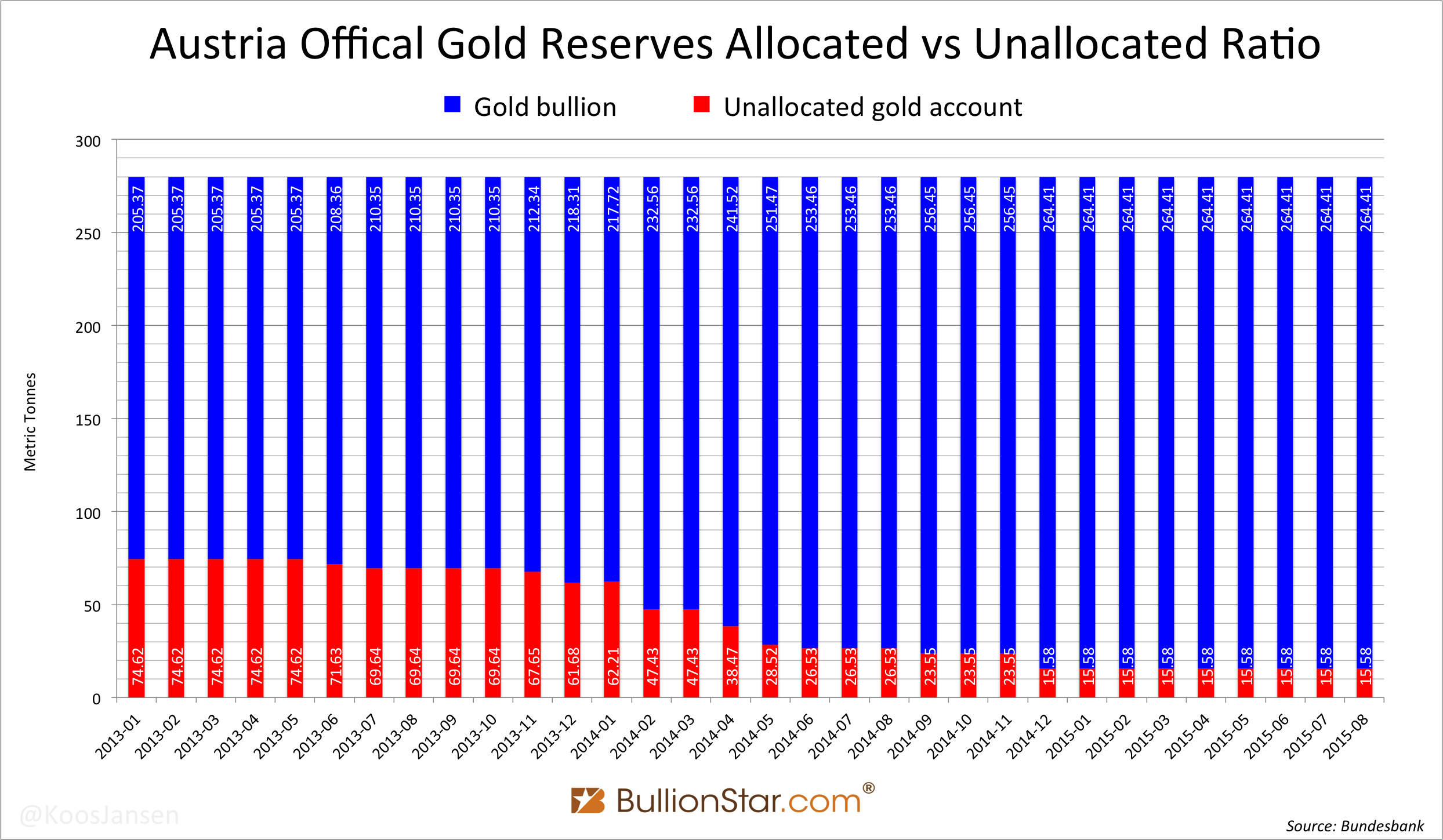

Image: www.bullionstar.com

1. Physical Gold

Physical gold, a tangible form of the precious metal, embodies the traditional method of gold investment. Acquiring physical gold entails purchasing bars, coins, or jewelry. While providing tangible ownership, physical gold necessitates secure storage and incurs storage costs, which can impact profitability.

2. Gold Futures

Gold futures, standardized contracts traded on exchanges, enable traders to speculate on the future price of gold without physically owning the asset. Leveraging futures contracts amplifies profit potential, but requires a high level of risk tolerance due to their derivative nature.

3. Gold ETFs

Gold ETFs (exchange-traded funds) mirror physical gold’s performance without the inconvenience of physical ownership. These funds hold gold bars, aligning their value closely with the underlying metal. Gold ETFs offer liquidity and diversification benefits, catering to a broader range of investors.

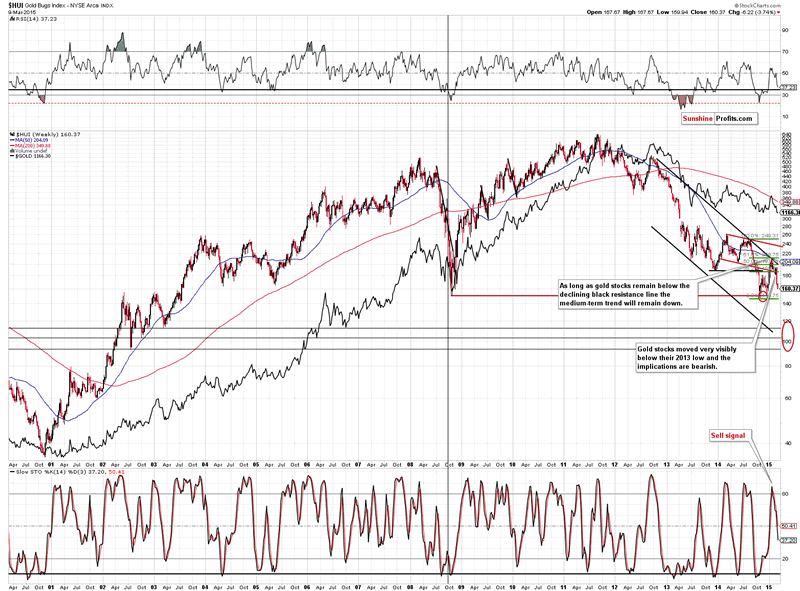

Image: umisifuy.web.fc2.com

4. Gold Mining Stocks

Gold mining stocks, representing ownership in gold-producing companies, provide an indirect exposure to gold price fluctuations. Mining stocks amplify price movements, offering higher potential returns and risks compared to physical gold. Monitoring individual companies’ financial performance is crucial to minimize investment uncertainty.

5. Online Gold Trading Platforms

Online gold trading platforms facilitate convenient and accessible gold trading anytime, anywhere. Utilizing these platforms eliminates the need for physical storage and allows for real-time market access. Comparing spreads, fees, and trading conditions across various platforms ensures cost-effective and user-friendly trading experiences.

Navigating Gold Trading Options

Choosing the optimal gold trading option hinges upon individual risk appetite and investment objectives. In essence:

- Physical gold suits risk-averse investors seeking tangible ownership.

- Gold futures appeal to experienced traders seeking high leverage and volatility.

- Gold ETFs offer a blend of liquidity, diversification, and correlation with gold prices.

- Gold mining stocks magnify profit potential but introduce company-specific risks.

- Online gold trading platforms simplify accessibility and empower traders with flexible market engagement.

Top Gold Trading Options In Austria

Image: www.gotradingasia.com

Conclusion

The Austrian gold market presents a diverse array of trading options catering to varying investment preferences. Whether seeking tangible ownership, speculative exposure, or diversified portfolios, understanding these options unlocks the opportunity to harness the enduring value of gold. Through diligent research, prudent risk management, and a well-informed approach, investors can navigate the Austrian gold market with confidence and reap the potential rewards it offers.