Thinkorswim, a comprehensive trading platform, has transformed option trading with its advanced features and user-friendly interface. Harnessing the potential of thinkorswim can empower investors with refined option trading strategies, maximizing their returns while mitigating risks.

Image: www.youtube.com

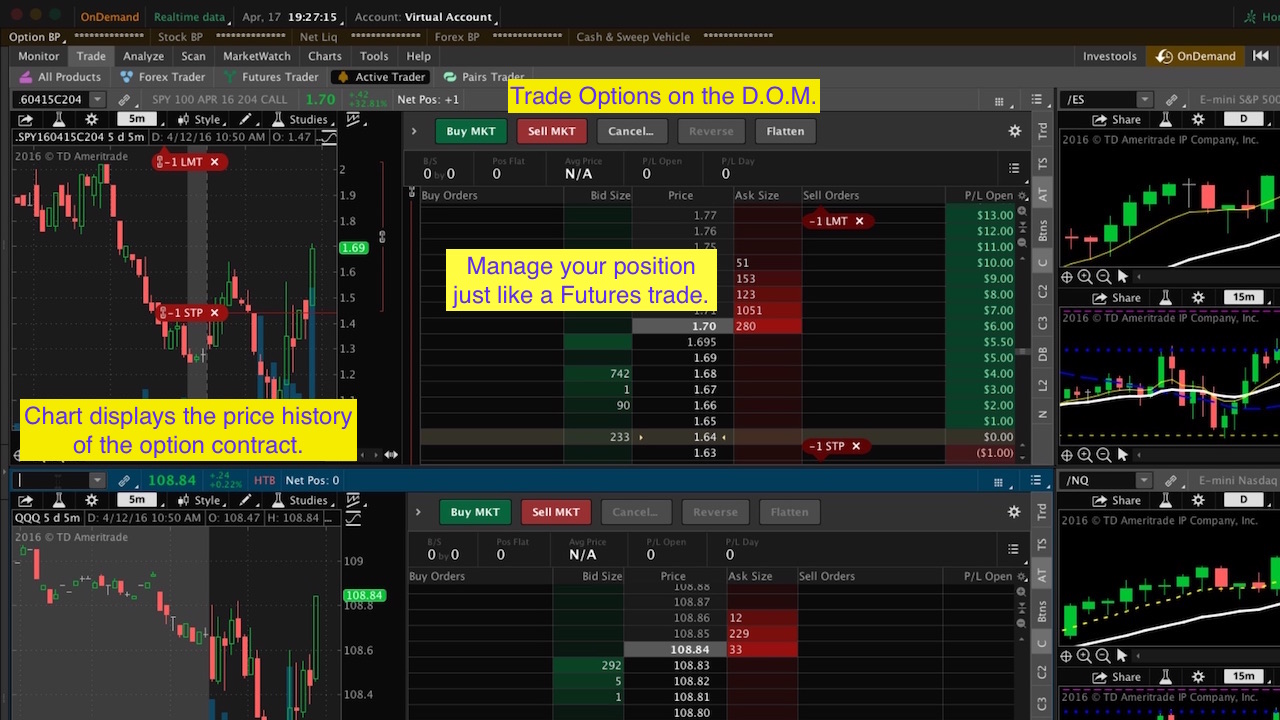

Dive into the World of thinkorswim Option Trading

Option trading involves the buying and selling of contracts that grant the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a specified price and date. thinkorswim offers a tailored platform for option traders, equipping them with a suite of robust tools and intuitive visualizations. From contract exploration to strategy analysis, thinkorswim empowers traders to make informed decisions and capitalize on market opportunities.

Uncovering the Strategies You’ve Been Missing

The Credit Spreads Arsenal

Credit spreads leverage the concept of time decay, aiming to profit from the decrease in option premiums as expiration nears. By simultaneously buying and selling options at different strike prices, traders use credit spreads to generate income. The bull call spread, for instance, involves buying a lower-priced call and simultaneously selling a higher-priced call with the same expiration date. This strategy benefits from a gradual increase in the underlying asset’s price.

Image: impulsa.oticasimet.cl

Embracing the Iron Condor

The iron condor, a more conservative strategy, establishes a defined range of prices within which the trade aims to profit. This strategy involves selling a call spread and simultaneously buying a wider call spread at a higher strike price while also selling and buying put spreads at a lower strike price. The structure of the iron condor is resemblant of a butterfly with long wings.

Unveiling the Butterfly Spread’s Delicacy

Butterfly spreads, consisting of three options with different strike prices, are characterized by their sensitivity to price movements within a narrow range. Traders employ the butterfly spread when they anticipate a relatively stable or slightly upward price trend. Buying or selling two options at the same middle strike while selling a single option at each higher and lower strike constructs the spread.

Navigating the Strangle’s Potential

Straddle and strangle strategies involve buying or selling options with different strike prices but with the same expiration date. Straddles involve buying both a call and a put at the same strike price, while strangles maintain a gap between the strike prices of the call and put, creating a wider range for price fluctuations.

Exploring the Wheel of Time: Covered Calls and Cash-Secured Puts

Covered calls and cash-secured puts harness the benefits of option selling while maintaining the underlying asset. With a covered call, traders own the underlying stock and simultaneously sell a call option on that stock, profiting from the premium paid by the option buyer. Cash-secured puts grant the investor the ability to sell a put option, giving the buyer the right to sell the underlying stock to them, with the funds serving as collateral securing the option sale.

Thinkorswim Option Trading Strategies

Image: www.hahn-tech.com

Conclusion: Empowering Your Option Trading Journey with thinkorswim

Navigating the world of option trading requires an understanding of fundamental strategies and a platform that empowers informed decision-making. thinkorswim unlocks the potential for investors and traders alike, providing a comprehensive and powerful toolkit for option trading. Embracing these strategies and leveraging thinkorswim’s functionalities can propel your option trading endeavors to new heights, maximizing returns and minimizing risks.