Unveiling the Murky World of Fraudulent Trading Platforms

Think or Swim (TOS), a renowned trading platform, has recently been embroiled in a web of controversy surrounding illegal trading options. The platform, once revered for its advanced tools and user-friendly interface, now stands accused of facilitating fraudulent practices that manipulate market prices and exploit unsuspecting investors.

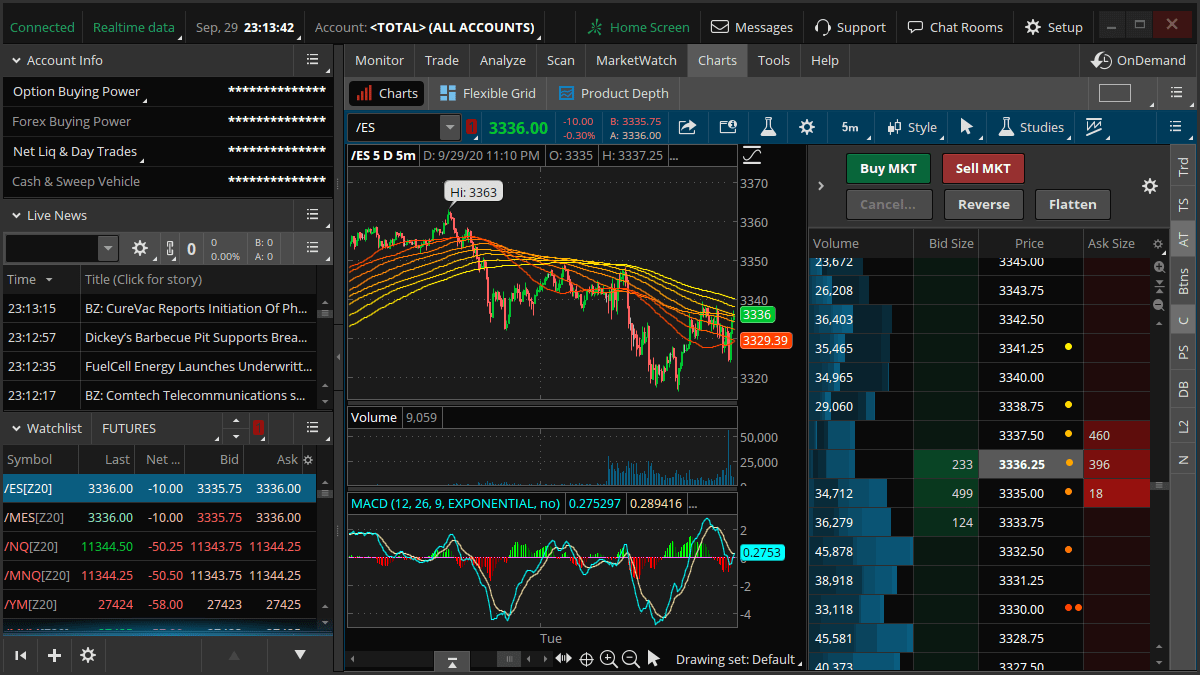

Image: haikhuu.com

The Allure of Illegal Trading Options

Illegal trading options involve leveraging platforms like TOS to execute manipulative trades that artificially inflate or deflate stock prices. By exploiting vulnerabilities in these platforms, traders can reap substantial profits at the expense of unsuspecting victims. Such practices undermine market integrity and erode investor confidence.

TOS: A Breeding Ground for Illicit Activities

TOS provides an ideal environment for illegal trading options due to its sophisticated algorithms and customizable features. Traders can create complex trading strategies that automate trades based on predetermined triggers. This level of automation allows for swift execution of manipulative orders, making it difficult for exchange regulators to detect and intervene in real-time.

A Tale of Manipulation: Case Studies Expose the Fraud

One prominent example involved a group of traders who utilized TOS to coordinate “pump-and-dump” schemes. These traders would identify undervalued stocks and purchase large quantities, artificially inflating their prices. Once the price reached a peak, they would sell their shares while naïve investors were lured in, causing the stock value to plummet, leaving them with substantial losses.

Image: decoqiw.web.fc2.com

Regulatory Crackdown: Enforcement Measures

In response to the rampant illegal trading options, financial regulators have taken swift action. The Securities and Exchange Commission (SEC) has launched multiple investigations and charged numerous individuals involved in these fraudulent activities. The SEC is committed to protecting investors and ensuring market stability.

Protecting Investors: Safeguarding Against Manipulation

It is crucial for investors to exercise vigilance and protect themselves from falling prey to illegal trading options. Thorough research of brokerage platforms, understanding trading strategies, and being wary of suspicious market movements are essential. Investors should seek guidance from trusted financial advisors and reputable trading platforms to minimize risks and safeguard their investments.

Reforming TOS: Addressing the Vulnerabilities

TOS, as a platform, has a responsibility to address the vulnerabilities that have enabled illegal trading options. Implementing stricter measures to curb manipulative activities, such as enhancing trade monitoring systems and limiting automated orders, is paramount. Additionally, TOS should increase transparency and cooperate with regulators to identify and prevent fraudulent trading practices.

Think Or Swim Illegal Trading Options

Image: www.wallstreetzen.com

Conclusion

The illegal trading options facilitated by Think or Swim have cast a dark shadow on the online brokerage industry. The allure of quick profits and the exploitation of platform vulnerabilities have fueled a culture of manipulation, eroding investor trust. While regulatory crackdowns are underway, investors must remain vigilant and protect themselves from such unethical practices. Ultimately, the onus is on platforms like TOS to address these issues and ensure market integrity. Only through robust enforcement measures and industry reforms can the dark side of illegal trading options be eliminated, restoring confidence and protecting investors in the digital financial landscape.