In the realm of investing, knowledge is power, and when it comes to options trading, understanding tax implications is crucial. Amidst the complexities of taxation, the tax audit limit reigns supreme, determining the potential financial consequences of an IRS investigation. For discerning traders, navigating this enigmatic terrain is essential to protect their hard-earned gains.

Image: www.gao.gov

Let’s unravel the intricate tapestry of tax audit limits and embark on a journey to demystify its implications for options traders.

Enter the IRS: Unveiling the Tax Audit Limbo

The Internal Revenue Service (IRS) serves as the gatekeeper of tax compliance, wielding the power to scrutinize financial records and determine whether all taxes have been faithfully paid. The tax audit limit represents a crucial threshold beyond which the IRS reserves the right to conduct a thorough examination of an individual’s tax returns, leaving no stone unturned in the pursuit of potential discrepancies.

Understanding this limit becomes paramount for options traders, as it directly influences the potential risks associated with their trading activities. Complying with tax laws and adhering to the tax audit limit safeguards traders from costly fines and penalties, ensuring peace of mind.

Navigating the Labyrinth: Unveiling the Tax Audit Limit

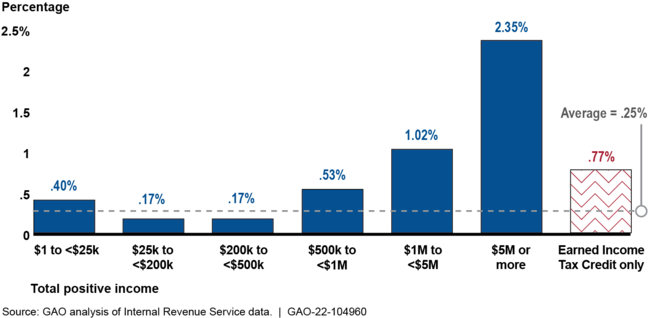

The tax audit limit for individuals varies based on several factors, including income, filing status, and the type of tax return filed. Typically, the audit rate for taxpayers with adjusted gross incomes (AGIs) below $100,000 hovers at a modest 1%. However, as incomes rise, so does the likelihood of an IRS audit.

Furthermore, traders engaged in option trading may raise red flags for the IRS. Frequent trades, large discrepancies between reported income and expenses, and the use of complex trading strategies can all pique the agency’s interest. Consequently, options traders must exercise meticulous diligence in record-keeping and tax reporting to minimize their exposure to audit risks.

Delving into the Tax Audit Process

Navigating a tax audit can be a daunting experience. Should the IRS decide to initiate an audit, traders must respond promptly to the agency’s request for documentation and prepare for potential interviews or hearings. During this process, transparent and accurate record-keeping becomes imperative to support claims and minimize potential tax liabilities.

![[FAQs] Due Date & Process to File Tax Audit Report | A.Y. 2023-24](https://www.taxmann.com/post/wp-content/uploads/2022/01/3-1-scaled.jpg)

Image: www.taxmann.com

Harnessing the Power of Expert Guidance

Unveiling the intricacies of tax audits requires expertise that goes beyond the grasp of most individuals. Enlisting the services of qualified tax professionals, such as certified public accountants (CPAs), enrolled agents (EAs), or tax attorneys, can prove invaluable. These professionals possess a deep understanding of tax laws and audit procedures, providing strategic advice and representation to mitigate risks.

Their expertise can be indispensable in evaluating tax liability, identifying potential areas of concern, and crafting a comprehensive defense strategy. By partnering with experts, options traders gain invaluable guidance and peace of mind throughout the audit process.

Frequently Asked Questions: Unveiling the Enigma of Tax Audits

To further illuminate the topic of tax audit limits for options traders, let’s delve into a series of frequently asked questions and their succinct answers:

- **What is the likelihood of facing an IRS audit as an options trader?**

- **What key documents should I gather to prepare for a potential audit?**

- **How long does a typical tax audit take to complete?**

- **What are the potential consequences of failing an IRS audit?**

The probability of an audit varies depending on individual income, filing status, and trading activities. Options traders should maintain meticulous records and adhere to tax laws to mitigate audit risks.

Compile all relevant tax returns, brokerage statements, trading records, and supporting documentation to substantiate your income and expenses during the audit period.

Audit timelines vary based on the complexity of the case. Simple audits may conclude within a few months, while complex audits involving multiple years and extensive documentation may take longer.

Unfavorable audit outcomes may result in additional tax liabilities, penalties, and interest charges. In severe cases, criminal charges may also be brought against the taxpayer.

Tax Audit Limit For Options Trading

Image: www.indiafilings.com

In Closing: Embracing Tax Transparency and Accountability

Navigating the complexities of tax audit limits for options trading demands a proactive approach, where traders embrace meticulous record-keeping, seek expert advice when needed, and maintain a commitment to tax compliance. By safeguarding their financial interests and understanding the nuances of tax regulations, options traders can trade with confidence, knowing that they are well-positioned to address any potential audit with clarity and accuracy.

To further engage with this intriguing topic, we invite you to share your insights and questions. Your valuable contributions will enrich the collective understanding of tax audit limits and empower fellow traders in the pursuit of financial success.