The Power of Inverse Volatility

Imagine a world where, instead of betting on the rise of stocks, you could profit from their volatility. That’s exactly what inverse volatility exchange-traded funds (ETFs) like SVXY offer. Designed to track the opposite of the VIX index, which measures stock market volatility, SVXY provides an opportunity to short volatility, meaning you can potentially make money when the market becomes less turbulent.

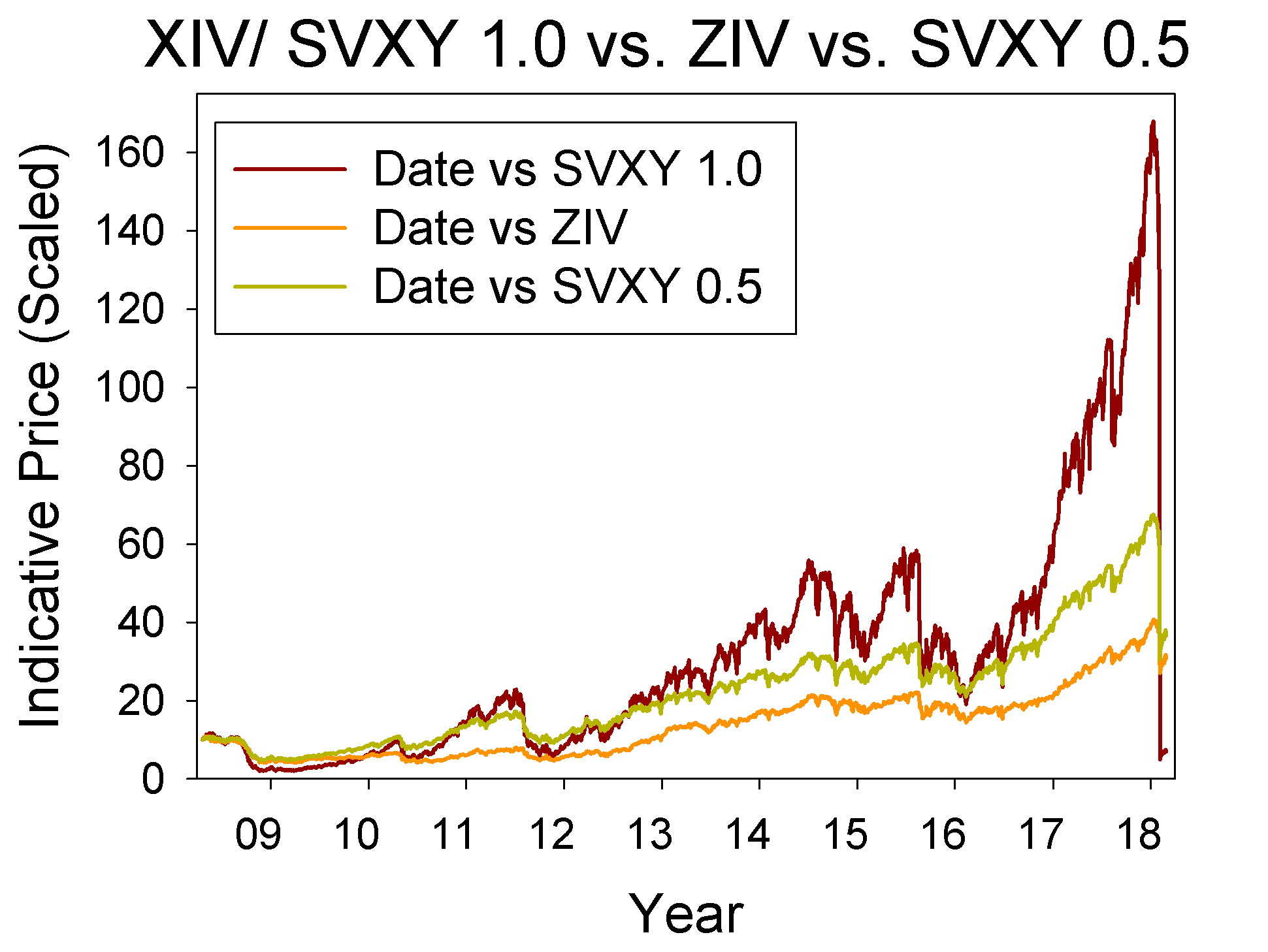

Image: seekingalpha.com

Anatomy of SVXY Options

SVXY, launched in 2011, seeks to inverse the daily performance of twice the VIX short-term futures index. By trading options on SVXY, you gain the flexibility to trade on the volatility of the volatility itself.

Call Options

When volatility rises, so does SVXY’s value, which can be advantageous when buying call options (the right to buy the ETF at a specified price). With call options, you can profit from increases in SVXY’s value above the strike price (the price at which you can purchase the ETF).

Put Options

On the other hand, when volatility falls, SVXY’s value decreases. Put options (the right to sell the ETF at a specified price) become profitable in this scenario. By buying put options, you can capitalize on SVXY’s value dropping below the strike price.

Image: www.sixfigureinvesting.com

Navigating SVXY Options Trading

Understanding SVXY options dynamics is crucial for successful trading. Consider these factors before you make a move:

- Market Volatility: Volatility is the key driver of SVXY’s performance. Monitor the VIX index to gauge market volatility and predict SVXY’s potential behavior.

- Historical Trends: Review SVXY’s historical performance to analyze how it reacts to market events and different levels of volatility.

- Time Decay: Options contracts lose value over time (time decay). Time decay is particularly relevant for SVXY options due to its leveraged design. Plan trades accordingly.

Expert Tips for Success

To enhance your SVXY options trading strategy, heed these knowledgeable insights:

- Establish Realistic Objectives: Set achievable profit targets and avoid overleveraging your positions.

- Manage Risk: Protect your capital by using stop-loss orders to limit potential losses.

- Monitor Execution Fees: Consider the trading fees associated with options orders, as they can impact profitability.

Frequently Asked Questions

Q: What is the best way to trade SVXY options?

A: Determine your trading horizon, assess market conditions, and employ proper risk management techniques.

Q: What are the risks associated with SVXY options trading?

A: SVXY options trading involves inherent risk, including volatility fluctuations and time decay.

Svxy Options Trading

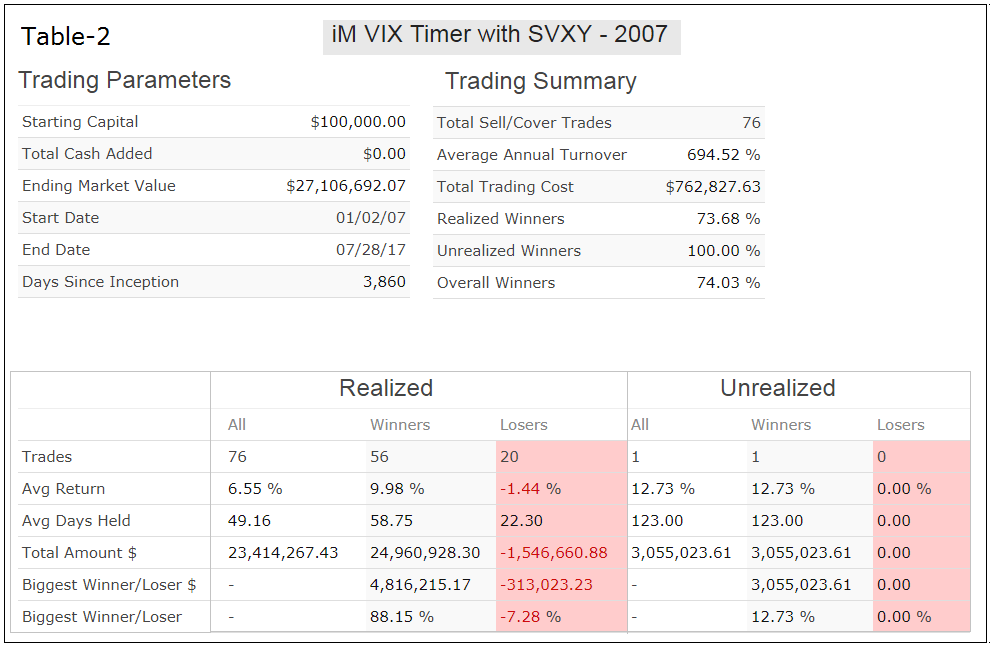

Image: imarketsignals.com

Conclusion

SVXY options offer a compelling way to harness the power of volatility. By understanding the mechanics, navigating the nuances, and implementing expert advice, you can enhance your chances of success in this intriguing market.

Are you ready to explore the world of SVXY options trading? Embark on this thrilling journey and discover the potential to profit from the ebb and flow of market volatility.