Introduction: Embracing the Art of Option Stratagems

Venturing into the realm of options trading, I stumbled upon the enigmatic concept of straddle strategies. Intrigued by their paradoxical nature, I delved into a quest to unravel the secrets that lay within. Along the way, I discovered a world of strategic finesse and unparalleled potential.

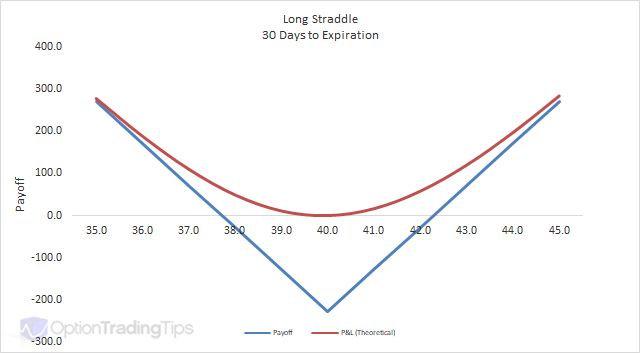

Image: www.optiontradingtips.com

Straddle strategies beckon option traders with a siren song, promising both the allure of profit and the thrill of calculated risk. By understanding the intricacies of this trading technique, traders can navigate the market waters with increased confidence and precision, seeking to harness its power for their own financial endeavors.

Understanding the Essence of Straddle Options

At its core, a straddle strategy involves the simultaneous purchase of both a call and a put option with the same strike price and expiration date. This dual approach provides the trader with the potential to profit regardless of the underlying asset’s price movement.

Consider the following scenario: an investor anticipates a stock’s future price to exhibit significant volatility leading up to an earnings report. A straddle strategy would allow them to capitalize on this uncertainty by simultaneously betting on both a potential rise and fall in the stock’s price.

Benefits of Utilizing Straddle Options

- Profit Potential in Varying Market Conditions: Straddle strategies present the opportunity to profit from various market scenarios, whether the underlying asset experiences an upward or downward price movement.

- Reduced Volatility Risk: By holding both a call and a put option, the trader mitigates the risk associated with price fluctuations.

- Increased Flexibility: Straddle strategies offer significant flexibility, enabling traders to tailor their positions based on their market outlook and risk tolerance.

Crafting Effective Straddle Option Strategies

- Determine the Underlying Asset: Choose an asset that you believe will experience substantial price volatility in the near future.

- Select the Strike Price: Identify the strike price that closely aligns with the current market price of the underlying asset.

- Set the Expiration Date: Consider the time frame within which you anticipate the price movement to occur.

- Calculate the Cost: Determine the total cost of the strategy, which includes the premiums paid for both the call and put options.

- Assess the Potential Profit and Loss: Evaluate the potential rewards and risks associated with the strategy based on different price scenarios.

Image: www.youtube.com

Expert Insight and Practical Tips

“Straddle strategies can be a valuable tool for managing risk and capitalizing on market volatility. However, it’s crucial to approach these strategies with caution and a thorough understanding of market conditions.” – Emily Jones, Senior Options Trader

To maximize the effectiveness of straddle option strategies, consider the following tips:

- Conduct Thorough Research: Make well-informed decisions by meticulously analyzing market trends, news events, and company fundamentals.

- Manage Risk: Employ proper risk management techniques, such as setting stop-loss orders and monitoring positions closely.

- Consider Implied Volatility: Implied volatility directly impacts the pricing of options. Understand how it affects the potential profitability of your strategy.

Frequently Asked Questions

Q: When should I consider using a straddle strategy?

A: Straddle strategies are well-suited for scenarios where you anticipate significant price volatility, but the direction of the movement is uncertain.

Q: What is the ideal holding period for a straddle strategy?

A: Holding periods typically range from a few days to several weeks, depending on the anticipated price action and the expiration date of the options.

Q: How do I calculate the potential profit of a straddle strategy?

A: The potential profit is equal to the difference between the underlying asset’s price movement and the net premium paid for the options.

Straddle Strategies Option Trading

Image: www.pinterest.com

Conclusion: Embarking on the Straddle Option Adventure

Straddle strategies can be a potent tool in the arsenal of options traders. Armed with a comprehensive understanding of their mechanisms, benefits, and risks, traders can navigate option markets with precision and poise, unlocking the potential for profitable outcomes. Whether you are a seasoned trader or a novice venturing into the world of options, I invite you to explore the intricacies of straddle strategies and embrace the opportunities they present.