Exploring the Nuts and Bolts of Stock Options

Imagine if you could acquire shares of a thriving company at a predefined price, even when the market value soars higher. Stock options, financial instruments that grant such privileges, have become a game-changer for investors seeking long-term growth.

Image: www.pinterest.com

To navigate the intricacies of stock options trading, it’s crucial to possess a solid understanding of its underlying concepts. Prepare to test your knowledge with our comprehensive quiz that delves into everything from definitions and mechanics to strategies and current industry trends.

Deciphering Stock Options: A Comprehensive Guide

Stock options, in essence, are contracts that confer the right, but not the obligation, to buy (call option) or sell (put option) an underlying stock at a predetermined strike price on or before a specified date.

These instruments derive their value from various factors, including the underlying stock’s price, time until expiration, volatility, and interest rates. By skillfully leveraging these variables, traders aim to capitalize on potential price fluctuations and generate substantial returns.

Unveiling the Dynamics of Stock Options Trading

Call options convey the right to purchase the underlying asset, allowing investors to profit from bullish market sentiments. Conversely, put options grant the right to sell, enabling traders to capitalize on bearish trends.

The intricacies of stock options trading extend beyond grasping their mechanics; it encompasses formulating effective strategies. By employing techniques such as covered calls, married puts, and straddles, traders can enhance their risk-adjusted returns.

Navigating the Ever-Evolving Stock Options Landscape

The stock options market is constantly evolving, presenting both opportunities and challenges for traders. Recent trends, including the proliferation of retail investors and the rise of algorithmic trading, have reshaped market dynamics.

For savvy traders, keeping abreast of these developments and leveraging innovations such as exchange-traded funds (ETFs) that track stock options can significantly augment their performance.

Image: www.studocu.com

Expert Insights: Unlocking the Secrets of Success

Seasoned traders offer valuable advice for navigating the stock options market effectively.

a) Enforce Strict Discipline: Prudent traders adhere to a well-defined trading plan, setting clear entry and exit points to mitigate impulsive decisions and potential losses.

b) Manage Your Risk: Risk management lies at the core of successful trading. Traders employ strategies like hedging and diversification to minimize the impact of market volatility and protect their capital.

Frequently Asked Questions: Clarifying Common Doubts

Q: Are stock options risky?

Stock options conllevate a range of risks, including the potential for significant losses. However, proper risk management and knowledge can help traders mitigate these risks.

Q: What strategies should I adopt?

The choice of strategy depends on the trader’s risk tolerance and market conditions. Covered calls, married puts, straddles, and vertical spreads are popular strategies employed by stock options traders.

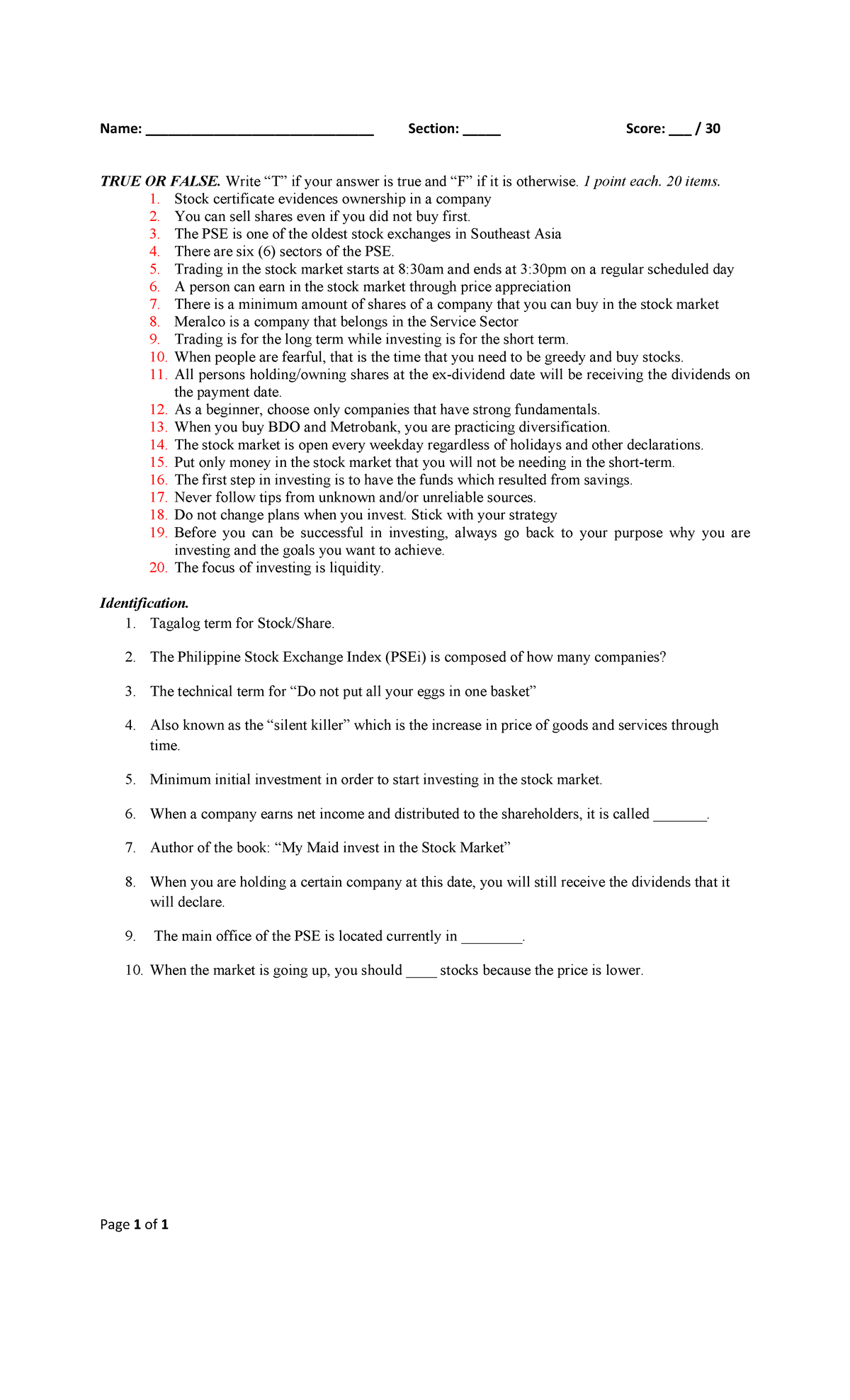

Stock Options Trading Test Questions

Image: blog.coincodecap.com

Conclusion: Embracing the World of Stock Options

Stock options trading offers a potent avenue for investors seeking to capitalize on market fluctuations and augment their portfolios. By understanding the fundamental principles, employing effective strategies, and staying abreast of industry developments, you can navigate this dynamic market with confidence.

Whether you’re a seasoned trader or an aspiring enthusiast, the stock options market presents a wealth of opportunities. Are you ready to test your skills and explore the world of stock options?