In the ever-evolving landscape of financial markets, investors seek innovative strategies to maximize returns while managing risk. Among these strategies, SPY weekly options trading has emerged as a compelling option, offering traders the potential for substantial gains within a short timeframe. SPY, the SPDR S&P 500 ETF, tracks the performance of the S&P 500 index, providing a broad market exposure. Its weekly options, with expiration dates every Friday, cater to traders seeking to capture market movements within a defined time frame. This article delves into the world of SPY weekly options trading, shedding light on its nuances, strategies, and potential rewards.

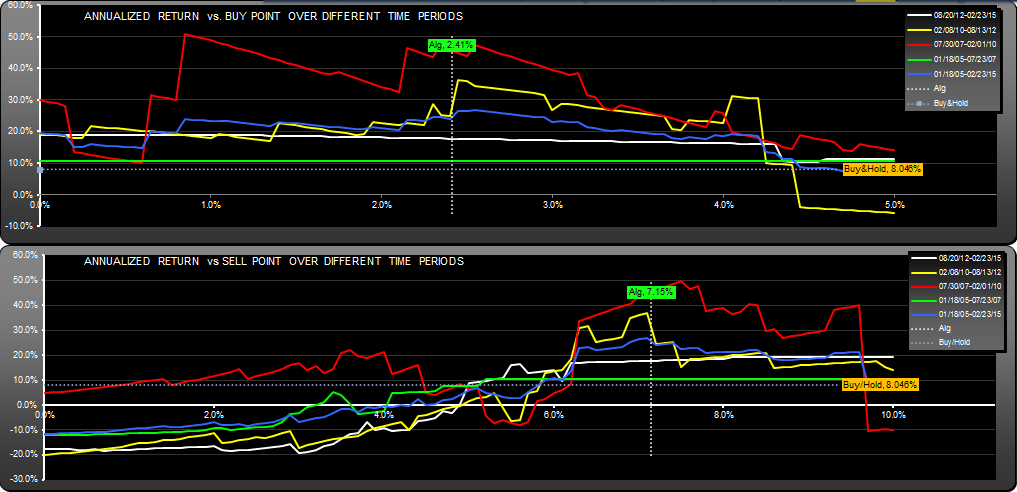

Image: www.signalsolver.com

What are Weekly SPY Options?

Weekly SPY options are short-term options contracts tied to the SPY ETF. Unlike traditional monthly options that expire on the third Friday of each month, weekly options expire every Friday, offering traders a shorter time frame for trading. This unique feature allows for flexibility in adjusting positions and capitalizing on short-term market fluctuations.

Trading Weekly SPY Options: Strategies for Success

Successful weekly SPY options trading hinges on meticulous strategy execution. The “buy-to-close” and “sell-to-open” strategies stand as two popular approaches. In a “buy-to-close” strategy, a trader purchases a weekly option with the intention of selling it at a higher price before expiration. Conversely, “sell-to-open” strategies involve selling a weekly option with the expectation that its value will decline before the expiration date.

Other strategies include covered calls, cash-secured puts, and various spreads, each with distinct risk and reward profiles. Selecting the most appropriate strategy depends on the trader’s risk tolerance, market outlook, and trading goals.

Market Analysis and Risk Management

Thorough market analysis is paramount in weekly SPY options trading. Technical and fundamental analysis techniques play a crucial role in identifying trading opportunities and managing risk. Monitoring economic indicators, geopolitical events, and industry trends can provide valuable insights into market direction. Additionally, technical analysis of price charts and indicators helps traders identify key support and resistance levels, trend reversals, and potential trading signals.

Risk management is equally critical. Establishing clear entry and exit points, setting stop-loss orders, and managing position size based on available capital are essential practices for mitigating potential losses. Regular monitoring of positions and adjusting the trading strategy as needed are also crucial for long-term success.

Image: www.tradingview.com

The Advantages of Weekly SPY Options Trading

Weekly SPY options trading offers several advantages to savvy traders:

-

Capital Efficiency: Weekly options offer increased capital efficiency compared to monthly options due to their shorter duration. Traders can enter and exit positions more frequently, allowing for better use of available capital.

-

Flexibility: Weekly options provide greater flexibility in adjusting positions to market changes. The ability to trade options with expirations every Friday empowers traders to adapt their strategy based on market fluctuations or new information.

-

Exploiting Short-Term Market Movements: Weekly options offer a unique opportunity to capitalize on short-term market movements within a defined time frame. This can be particularly advantageous in volatile market conditions where rapid price swings present trading opportunities.

Spy Weekly Options Trading

Image: www.fullyinformed.com

Overcoming Challenges and Conclusion

Like any trading strategy, weekly SPY options trading comes with its share of challenges. The shorter time frame and higher volatility associated with weekly options require traders to possess strong risk management skills, rapid decision-making abilities, and a deep understanding of technical analysis techniques. Additionally, understanding the unique characteristics of the SPY ETF and its underlying holdings is crucial for making informed trading decisions.

In conclusion, weekly SPY options trading presents an exciting opportunity for investors seeking to enhance their returns while navigating market fluctuations. Armed with a thorough understanding of the strategies, market analysis, and risk management techniques outlined above, traders can harness the power of weekly SPY options to unlock profitable opportunities and achieve their financial goals. Successful traders recognize the inherent volatility and risk associated with this strategy and approach it with meticulous planning, constant learning, and a disciplined trading mindset.