Introduction

Have you ever had a moment where you wished you could hedge against market volatility but found options to be too expensive? Enter the realm of spreads in option trading. These clever strategies allow you to mitigate risk and potentially enhance returns while tailoring your exposure to market movements.

Image: www.schwab.com

Understanding Spreads

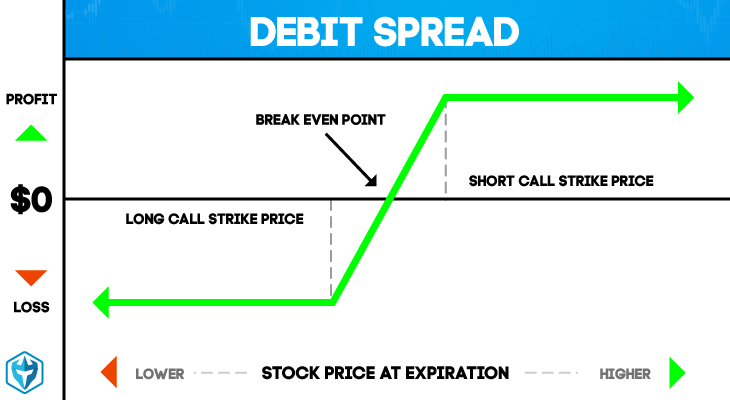

A spread in option trading combines two or more options with different strike prices and expiration dates into a single trade. By combining positions with differing risk and reward profiles, spreads provide flexibility and risk management. The difference between these strike prices is called the “spread,” and it represents the maximum potential profit or loss.

Types of Spreads

The world of spreads is vast, offering a wide range of strategies tailored to specific goals:

Bull Call Spreads

Suited for bullish outlooks, bull call spreads involve buying a lower-strike call option and simultaneously selling a higher-strike call option with the same expiration. You profit from the upward movement of the underlying security within a specific price range.

Image: www.warriortrading.com

Bear Put Spreads

Designed for bearish scenarios, bear put spreads involve buying a higher-strike put option and selling a lower-strike put option with the same expiration. You benefit from the downward movement of the underlying within a set price range.

Butterfly Spreads

Butterfly spreads create a “wings” effect by buying one call or put option at a middle strike price and selling two calls or puts at lower and higher strike prices. These spreads aim for limited profit potential with defined risk.

Condor Spreads

Condor spreads are a more advanced strategy that involves four options at two different strike prices and two different expiration dates. They seek to profit from sideways market movement or a slight upward or downward trend.

Latest Trends and Developments

The world of spreads is constantly evolving, with innovative strategies emerging to meet changing market conditions. Here are some notable trends:

-

Vertical spreads with longer expirations: Traders are employing longer expirations for vertical spreads to capitalize on extended market trends.

-

Multi-leg spreads: Sophisticated strategies involving three or more legs are gaining popularity, allowing traders to fine-tune risk and reward profiles.

-

Automated trading: The rise of algorithmic trading platforms enables traders to automate spread execution, capturing opportunities in real-time.

Tips and Expert Advice

Expert Tip 1: Choose the right type of spread.

Matching your spread strategy to your market outlook is crucial. Consider the direction, volatility, and expected price range of the underlying security.

Expert Tip 2: Manage risk effectively.

Spreads can limit risk compared to single options, but proper risk management is still essential. Set clear profit targets and stop-loss levels to protect your capital.

Frequently Asked Questions

Q: Are spreads always profitable?

A: No, spreads can also result in losses if the underlying security moves outside of the expected price range.

Q: What is the difference between a bull call spread and a bear call spread?

A: A bull call spread is used for bullish expectations, while a bear call spread is suitable for bearish outlooks.

Spreads In Option Trading

Image: www.mohitjakhotiablogspot.com

Conclusion

Spreads in option trading provide a powerful arsenal for traders seeking to mitigate risk and unlock profit potential. By understanding the different types of spreads, monitoring market trends, and employing expert tips, you can harness the power of these strategies to navigate uncertain markets and potentially enhance your trading outcomes.

Are you ready to embrace the world of spreads and elevate your option trading game? Explore your curiosity further and delve into the intricacies of spreads to empower your trading decisions.