Navigating the Labyrinth of Options Trading Fees

The allure of commission-free options trading has ignited a chorus of debate among aspiring traders. While the prospect of eliminating trading fees may inflate profits, it’s crucial to untangle the intricacies and potential pitfalls before taking the plunge. This article delves into the nuances of commission-free options trading, exploring both its enticing benefits and underlying risks to empower savvy traders.

Image: medium.com

The Allure of Free Trading: Lowering Entry Barriers

Commission-free options trading has emerged as a revolutionary force in the financial landscape, promising to obliterate the financial hurdles that traditionally barred access to this high-stakes market. Traditional brokers imposed exorbitant fees on every trade, often eating into potential profits. By eliminating this hefty expense, commission-free platforms open the floodgates for aspiring traders who once dwelled on the sidelines.

Reduced trading costs can foster a more active and dynamic trading approach, enabling traders to fine-tune their strategies and seize fleeting market opportunities without the fear of hefty commission charges. For new traders yearning to dip their toes into the options market, commission-free trading can serve as a launchpad, offering a cost-effective gateway to hone their skills and navigate the complex world of options derivatives.

Unveiling the Hidden Costs: Beyond the Price Tag

While commission-free trading may cloak itself as a costless sanctuary, a deeper examination reveals hidden expenses lurking beneath the surface. Commission may vanish from transaction slips, but alternative costs might emerge to fill the void. One prevalent concern is the wider bid-ask spreads often associated with commission-free platforms.

Traders must sharpen their vigilance, as wider bid-ask spreads can translate into higher transaction costs. The spread represents the chasm between the highest price a buyer is willing to pay for an option contract and the lowest price a seller is prepared to accept. Commission-free platforms may resort to broader spreads to compensate for the revenue lost from eliminated trading fees.

Another potential Achilles’ heel of commission-free trading lies in the realm of order execution. Some platforms may resort to inferior execution practices, resulting in traders receiving less favorable prices for their trades. This can lead to a slow erosion of profits, chipping away at the intended savings conferred by the absence of commissions.

Furthermore, traders must meticulously scrutinize the account minimums and other trading restrictions that often accompany commission-free platforms. These platforms may impose higher account minimums, potentially excluding traders with limited capital from accessing their services. Moreover, trading constraints, such as limited order types or trading hour restrictions, may impinge on traders’ ability to execute their strategies effectively.

Unveiling the Pitfalls: A Deeper Dive into Potential Risks

The litany of potential risks associated with commission-free options trading demands careful consideration. One inherent pitfall lies in the compromised quality of trade executions. Some platforms trade options on their own market or internalize orders, which may lead to less favorable prices for traders.

The absence of commissions can also lure traders into a false sense of security, potentially leading to excessive trading. Traders must maintain a disciplined approach and avoid succumbing to the temptation to trade more frequently solely to capitalize on the absence of trading fees. Excessive trading can exacerbate losses and erode the potential benefits of commission-free trading.

Image: www.tradingview.com

A Symphony of Factors: Orchestrating a Sound Decision

The choice of whether or not to enable commission-free options trading weaves together a symphony of factors. Traders must carefully consider their individual circumstances, trading style, and risk tolerance.

For novice traders seeking a low-cost entry into options trading, commission-free platforms can lower the financial barrier to entry. However, seasoned traders with sophisticated strategies that demand lightning-fast order execution may find it prudent to opt for traditional brokerages despite their higher trading commissions.

Should I Enable Commission Free Options Trading

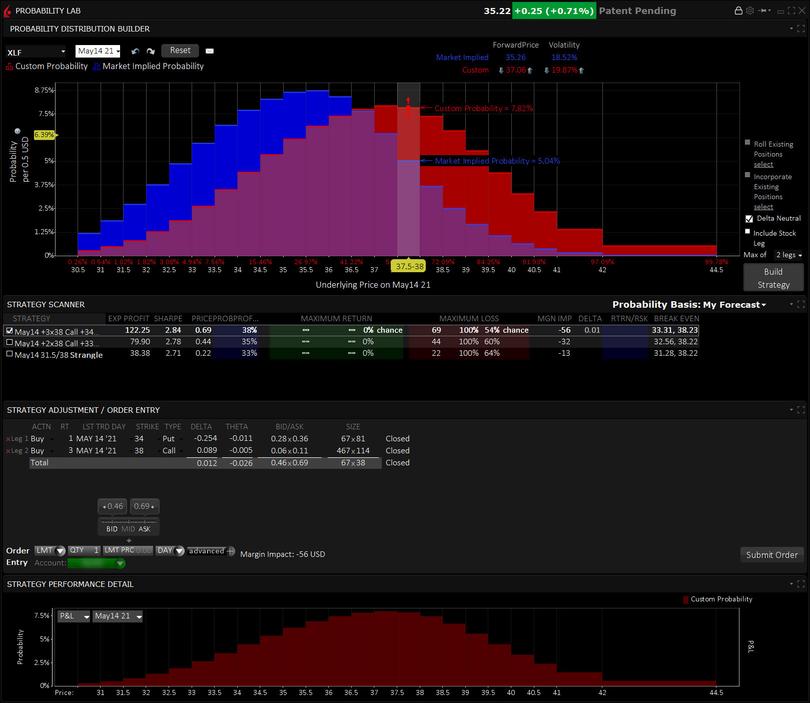

Image: www.interactivebrokers.com

Conclusion: Steering the Course with Confidence

The decision of whether or not to engage in commission-free options trading hinges on a careful evaluation of individual needs and circumstances. While the elimination of trading fees holds undeniable appeal, traders must remain vigilant to the potential hidden costs and risks that may accompany such platforms. With a discerning eye and a well-defined trading strategy, traders can navigate the labyrinth of commission-free options trading, maximizing the potential rewards while mitigating the inherent risks.