Navigating the Deep Sea of Option Markets

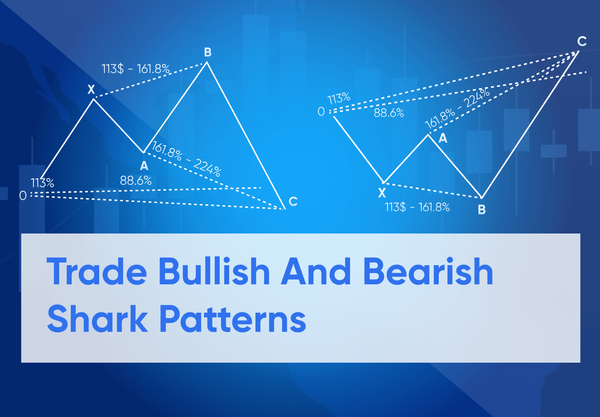

Image: margex.com

In the tumultuous waters of financial markets, option trading offers traders the potential to land lucrative returns while navigating the risks. Among the many option trading strategies available, the shark option trading strategy stands out as a powerful tool for seasoned traders seeking aggressive profit opportunities. This strategy draws inspiration from apex predators, mirroring their prowess in identifying and capitalizing on market vulnerabilities.

Unveiling the Shark Option Trading Strategy

The essence of the shark option trading strategy lies in identifying underlying assets with high volatility and elevated premiums. By purchasing deep out-of-the-money call or put options with long expirations, traders take an aggressive stance, betting on significant price movements. The allure of this strategy resides in the potential for exponential returns, exponentially amplifying profits if the market aligns with the trader’s predictions.

Executing the Shark Attack

Harnessing the power of the shark option trading strategy necessitates careful execution. Traders should meticulously research potential underlying assets, scrutinizing their historical price behavior, volatility, and macroeconomic factors influencing their market dynamics.

Once an opportunity emerges, traders purchase deep out-of-the-money options, meaning options with strike prices significantly higher (for call options) or lower (for put options) than the current market price. The extended expiration dates afford ample time for market movements to unfold, potentially leading to substantial profit potential.

Managing Risks in the Financial Jungle

While the allure of high returns is undeniable, the shark option trading strategy is not without its inherent risks. Traders must remain cognizant of the possibility of substantial losses should the underlying asset’s price not move as anticipated. Moreover, the extended durations of these options can expose traders to prolonged periods of uncertainty, demanding significant patience and risk tolerance.

To mitigate these risks, traders should employ sound risk management practices, such as maintaining appropriate position sizing, utilizing stop-loss orders to limit potential losses, and diversifying their option trades across different underlying assets.

Hunting Down Alpha: Advanced Techniques

Seasoned shark option traders often employ advanced techniques to enhance their returns. These include:

- Scalping: Utilizing short-term price fluctuations to profit from rapid market movements.

- Iron Condors: A sophisticated strategy involving simultaneously buying and selling call and put options at different strike prices.

- Delta Neutral: Maintaining a position in which the sum of the deltas of the options held is approximately zero, reducing exposure to market volatility.

Conclusion

The shark option trading strategy offers bold traders the opportunity to bag substantial profits while embracing the inherent risks associated with this aggressive approach. By carefully selecting underlying assets with high volatility and long expiration dates, traders can mimic the apex predator’s instincts, patiently waiting for the opportune moment to strike and capitalize on market vulnerabilities. However, it is crucial to remember that this strategy is not for the faint of heart and requires a deep understanding of option mechanics, market dynamics, and strategic risk management.

Image: www.youtube.com

Shark Option Trading Strategy

Image: finakademie.cz