In the fast-paced, adrenaline-pumping world of day trading, the ability to make quick and informed decisions can make all the difference between profit and loss. The financial markets are an ever-evolving jungle, where constant noise and volatility can cloud your judgment. That’s where the wisdom of experienced option traders comes in – offering you a beacon of guidance through the market’s maze.

Image: forexrobotnation.com

Option traders possess an intimate understanding of the nuances of price movements. They analyze the underlying fundamentals, technical indicators, and market sentiment to discern potential trading opportunities. These traders often employ sophisticated models and algorithms to identify option trades with a high probability of success. By tapping into this wealth of knowledge and expertise, day traders can gain a significant edge in the market.

The Signals That Steer Your Trading Compass

Option traders’ signals are not mere suggestions but calculated insights based on thorough analysis. They provide actionable information, including:

- Entry and exit points for specific trades

- The underlying asset and expiration date of the option

- Recommended trade size and risk parameters

These signals are typically communicated through dedicated trading platforms or subscription services. By subscribing to these services, day traders can receive real-time updates on potential trading opportunities, empowering them to respond swiftly to market movements.

Navigating the Market with Confidence

Using option trader signals in your day trading strategy offers a multitude of benefits:

- Objectivity: These signals are derived from data-driven analysis, eliminating the emotional biases that can cloud your own trading decisions.

- Time-Saving: Signals provide quick and convenient information, sparing you the time-consuming task of conducting your own research.

- Enhanced Accuracy: Option traders have a deep understanding of the market dynamics and can identify trading opportunities with higher accuracy than many retail traders.

- Improved Risk Management: Signals often come with recommended risk parameters, helping you manage your downside and preserve your capital.

Harnessing the Power Responsibly

While option trader signals can be a valuable asset, it’s crucial to use them responsibly. They should not be blindly followed but rather considered as part of your overall trading strategy. Here are some guidelines for using signals wisely:

-

Diversify your Sources: Subscribe to multiple signal providers to get varying perspectives on the market.

-

Backtest the Signals: Test the historical performance of the signals to assess their consistency and profitability.

-

Understand the Underlying Rationale: Seek insights into the methodology and analysis behind the signals to make informed decisions.

-

Manage Your Risk: Never trade with more capital than you can afford to lose.

Empowering Your Trading Journey

Getting day trading signals from option traders is akin to having a seasoned navigator guiding you through treacherous waters. These signals provide invaluable insights, helping you make more informed trading decisions and potentially enhancing your profitability. By leveraging this powerful tool responsibly, you can unlock the potential for greater success in the dynamic world of day trading.

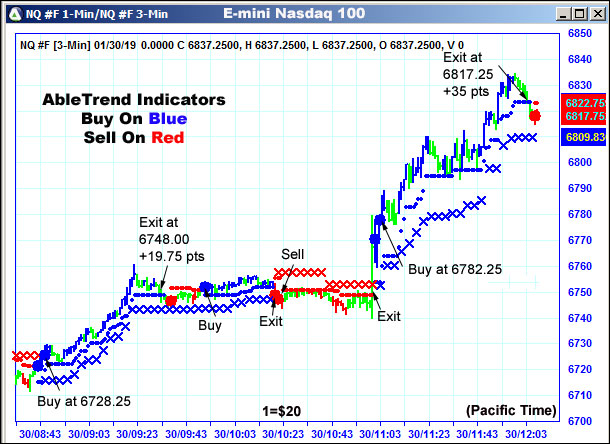

Image: www.wintick.com

Getting Day Trading Signals From Option Traders

Image: tradersunion.com