The advent of Software as a Service (SaaS) has revolutionized the way we conduct business across industries. In the realm of finance, SaaS has emerged as a game-changer, particularly in the dynamic field of options trading. By providing traders with access to sophisticated tools and data, SaaS empowers them to make informed decisions, execute trades seamlessly, and navigate the complexities of the market with greater confidence.

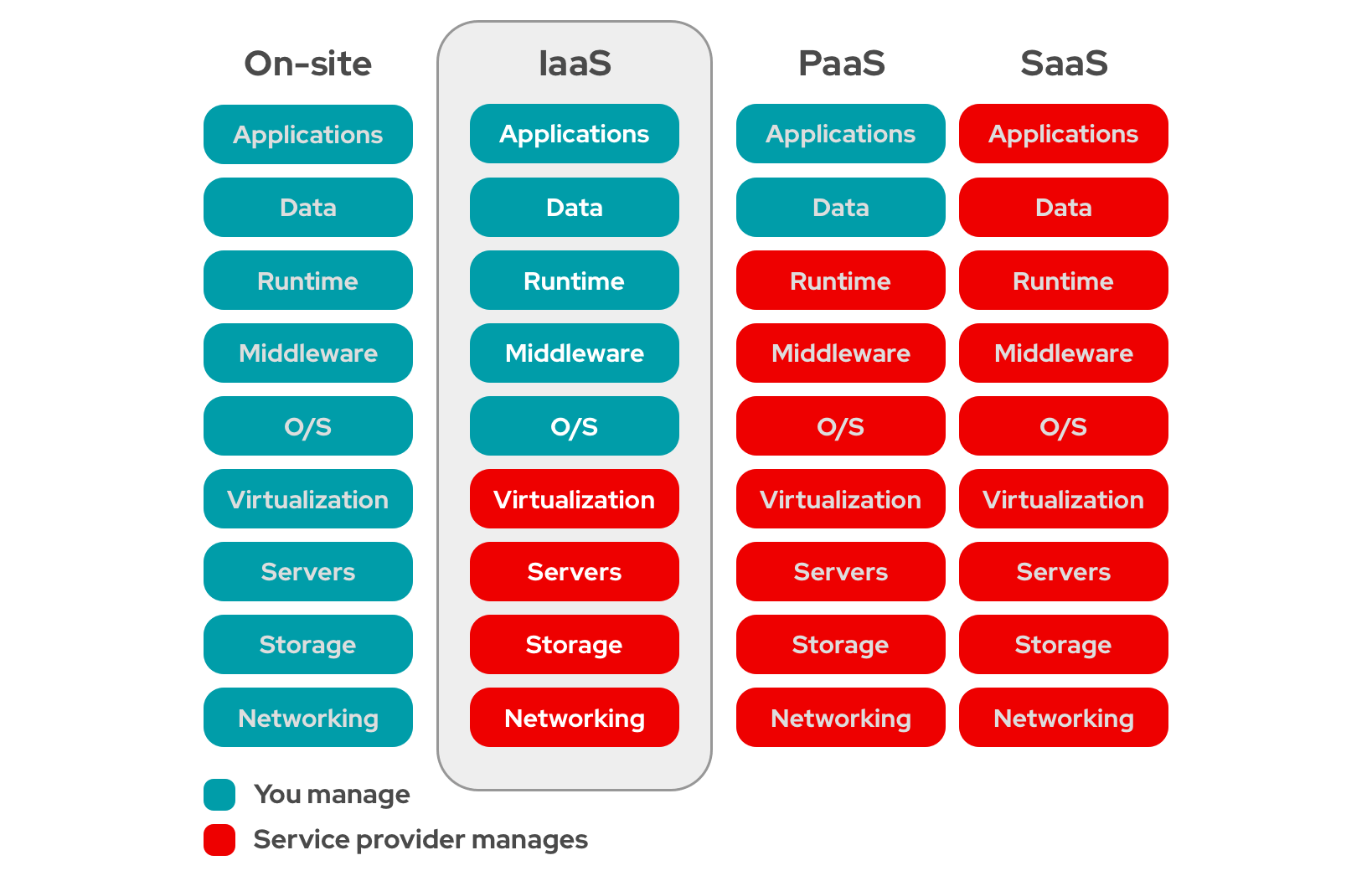

Image: www.redhat.com

SaaS platforms offer a comprehensive suite of features tailored to the specific needs of options traders. These features include:

Real-time Data and Analytics: SaaS platforms provide traders with live market data, technical analysis tools, and charting capabilities that enable them to monitor market movements in real-time. Traders can use these tools to identify trading opportunities, assess risk, and make quick adjustments to their strategies.

Option Strategy Optimization: Many SaaS platforms offer advanced optimization tools that help traders identify the optimal option strategies based on their risk tolerance and financial goals. These tools analyze various option combinations, performance metrics, and historical data to provide traders with informed recommendations.

Automated Trading: Certain SaaS platforms incorporate automated trading capabilities, allowing traders to execute trades directly from the software. This feature eliminates the need for manual order entry, reducing the risk of human error and enabling traders to take advantage of fleeting market opportunities.

Mobile Accessibility: SaaS platforms often provide mobile applications, giving traders the flexibility to monitor their positions, execute trades, and access market data from anywhere with an internet connection. This mobile accessibility empowers traders to stay connected to the market even when away from their desktops.

The benefits of SaaS for options traders are numerous:

Enhanced Efficiency: By automating tasks and providing access to real-time data, SaaS platforms significantly improve a trader’s efficiency. This allows traders to focus on strategy development and market analysis, rather than spending time on administrative tasks.

Increased Accuracy: Automated trade execution and data analytics reduce the likelihood of errors, leading to more precise and profitable trades.

Improved Risk Management: SaaS platforms help traders identify and mitigate risk through advanced analytics and optimization tools. This enables traders to make informed decisions and adjust their strategies proactively.

Gaining an Edge: SaaS empowers traders with tools and data that were once only accessible to institutional investors. In the highly competitive options trading market, this edge can significantly increase their chances of success.

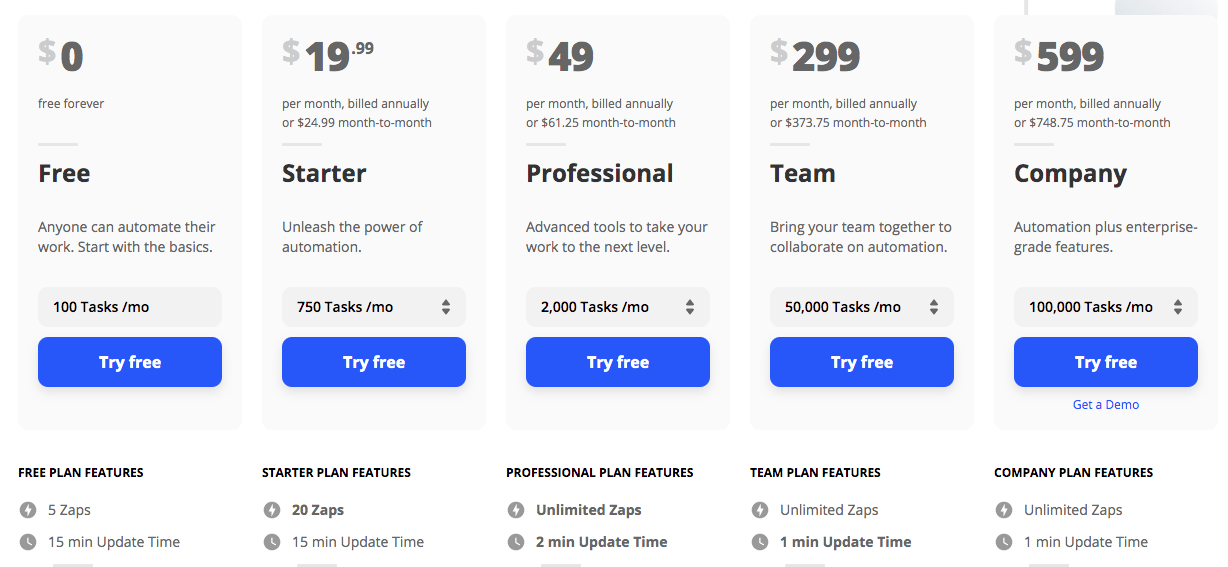

With a myriad of SaaS options trading platforms available, selecting the right one is crucial. Consider factors such as available features, user interface, cost, and the platform’s compatibility with your trading style. Explore different platforms, read reviews, and leverage trial periods to find the optimal SaaS solution for your trading needs.

Conclusion:

SaaS has undoubtedly transformed the landscape of options trading. By providing traders with access to advanced tools, data, and automated functionality, SaaS platforms have not only enhanced their efficiency and accuracy but also provided them with a competitive edge in the market. Those who embrace the power of SaaS are well-positioned to capitalize on market opportunities, mitigate risk, and achieve greater success in the dynamic world of options trading.

Image: investmentu.com

Saas Options Trading

Image: outcry.io