Image: speedtrader.com

In the realm of investing, where uncertainty reigns and fortunes are sculpted, quantified options trading strategies stand out as a beacon of precision and profit potential. By harnessing the power of mathematics and statistical models, these strategies seek to navigate the turbulent waters of the options market, empowering investors with a structured approach to maximize returns.

Options, financial instruments that convey the right but not the obligation to buy (in the case of calls) or sell (in the case of puts) an underlying asset at a specified price within a predefined time frame, are a versatile tool for investors looking to hedge risk, enhance portfolio returns, and potentially generate substantial profits. Quantified options trading strategies take this complexity a step further, utilizing advanced mathematical techniques and historical data analysis to identify high-probability trading opportunities.

Delving into the Dynamics of Quantified Options Strategies

At the heart of quantified options trading strategies lies the premise of seeking statistical patterns and deviations in the behavior of underlying assets and options prices. By leveraging historical data, machine learning algorithms, and sophisticated mathematical models, these strategies strive to capture anomalies and exploit inefficiencies in the market.

One widely employed technique involves identifying trends and patterns in the underlying asset’s price movements. Statistical models, such as autoregressive integrated moving average (ARIMA), are often used to forecast future prices and predict market direction. Once a trend is established, traders can employ options strategies to capitalize on the anticipated price action, such as buying call options to profit from upward momentum or buying put options to hedge against potential declines.

Another approach revolves around volatility analysis, which attempts to gauge the degree of fluctuation in an underlying asset’s price. Implied volatility, a key parameter in options pricing, indicates market expectations of future price movements. By comparing implied volatility to realized volatility (the actual historical price fluctuations), traders can identify discrepancies and capitalize on perceived mispricings. For instance, when implied volatility is significantly higher than realized volatility, it may suggest an overestimation of market uncertainty, presenting an opportunity to sell options premiums at inflated prices.

Harnessing Expert Insights and Practical Applications

To demystify the complexities of quantified options trading strategies, it is imperative to tap into the wisdom of experts in the field. Renowned quantitative analysts, such as Emanuel Derman, Nassim Nicholas Taleb, and Kevin Der, have dedicated their careers to advancing the understanding and application of quantitative trading techniques. Their insights and research provide invaluable guidance for investors looking to navigate the complexities of the options market.

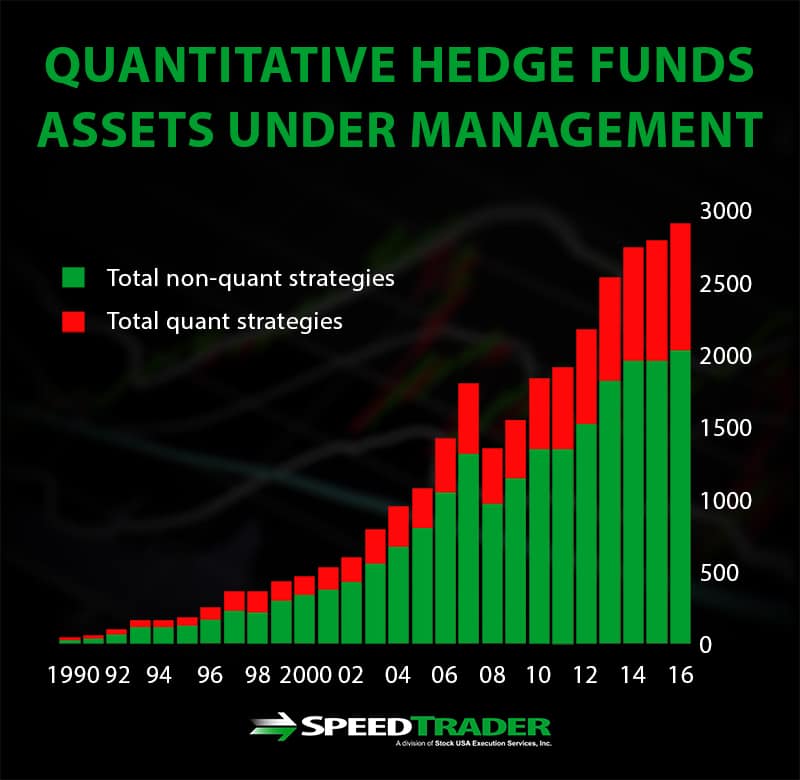

In practice, many thriving investment firms leverage quantified options trading strategies to generate consistent returns. Renaissance Technologies, the legendary quantitative hedge fund, employs complex statistical models and advanced machine learning algorithms to identify trading opportunities across various asset classes, including options. Bridgewater Associates, another prominent investment firm, utilizes sophisticated quantitative methods to analyze global markets and allocate capital efficiently.

Embracing the Promise of Quantified Options Trading

Quantified options trading strategies present a compelling opportunity for investors seeking a systematic and data-driven approach to market participation. By embracing these strategies, armed with a deep understanding of statistical concepts and the guidance of industry experts, investors can unlock the potential for enhanced profitability and risk management. However, it is crucial to approach this domain with caution, acknowledging the inherent risks and complexities involved.

As with any investment strategy, diversification remains a cornerstone principle. While quantified options trading strategies offer the potential for substantial returns, it is prudent to complement them with other investment approaches to mitigate overall risk. Furthermore, investors should allocate only a portion of their portfolio to options trading, commensurate with their individual risk tolerance and financial objectives.

To succeed in the world of quantified options trading strategies, a relentless pursuit of knowledge and continuous refinement is paramount. Regularly engaging with cutting-edge research, attending industry conferences, and seeking mentorship from experienced professionals can empower investors to stay abreast of evolving market dynamics and enhance their trading acumen. By embracing the principles of quantified trading, investors can unlock a world of informed decision-making and potentially reap the rewards of consistent financial success.

Image: speedtrader.com

Quantified Options Trading Strategies

Image: www.quantifiedstrategies.com