Enhancing Your Financial Success with Expert Tools and Strategies

Embark on a thrilling journey into the world of option trading, where calculated risks can unlock extraordinary rewards. As an esteemed blogger navigating the dynamic financial landscape, I’ve witnessed firsthand the profound impact of finding a reliable platform for option trading. And today, I’m eager to share my insights and guide you towards the transformative power of a platform that caters to your every need.

Image: kongashare.com

Delve into the intricacies of option trading and master the art of managing risk while maximizing potential returns. A well-designed platform will empower you with a comprehensive suite of features, real-time market data, and expert analysis to elevate your decision-making and maximize your chances of success.

Choosing the Right Platform: A Keystone to Success

Selecting the ideal platform for option trading is a crucial step in your journey. Consider these key factors:

- User Interface: Intuitiveness is paramount for seamless navigation and rapid decision-making.

- Trading Tools: Seek a platform that provides advanced trading tools, such as charting and technical analysis capabilities.

- Execution Speed: Minimize slippage and optimize profits with a platform that offers lightning-fast execution speeds.

- Educational Resources: Knowledge is power. Choose a platform that offers educational resources and support to enhance your skills.

- Customer Service: Prompt and responsive customer support can make all the difference when navigating market complexities.

Remember, the right platform will align with your unique trading style and empower you to achieve your financial aspirations.

Mastering the Art of Option Trading

Option trading presents a unique blend of risk and reward. Dive into the foundational concepts:

- Options: Options are contracts that grant you the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain time frame.

- Call Options: These options give you the right to buy an underlying asset at the strike price on or before the expiration date.

- Put Options: Put options grant you the right to sell an underlying asset at the strike price on or before the expiration date.

- Strike Price: This is the predetermined price at which you can buy or sell the underlying asset using the option.

- Expiration Date: The specific date on which the option contract expires and becomes worthless.

Options provide traders with a versatile tool to speculate on market movements, hedge against risk, or enhance their returns.

Tips and Expert Advice for Option Trading Success

Elevate your option trading strategies with these invaluable tips and expert advice:

- Embrace Risk Management: Implement proper risk management techniques to minimize potential losses and protect your capital.

- Leverage Technical Analysis: Enhance your trading decisions by incorporating technical analysis tools that identify trends and patterns in market data.

- Stay Informed: Continuously monitor market news, economic data, and industry trends to inform your trading decisions.

- Trade with Discipline: Adhere to a structured trading plan to avoid emotional decision-making and maximize consistency.

- Seek Professional Guidance: Consult with experienced traders, mentors, or financial advisors to gain invaluable insights and avoid costly mistakes.

Remember, success in option trading requires a combination of knowledge, skill, and discipline. Embrace these principles and watch your trading journey transform.

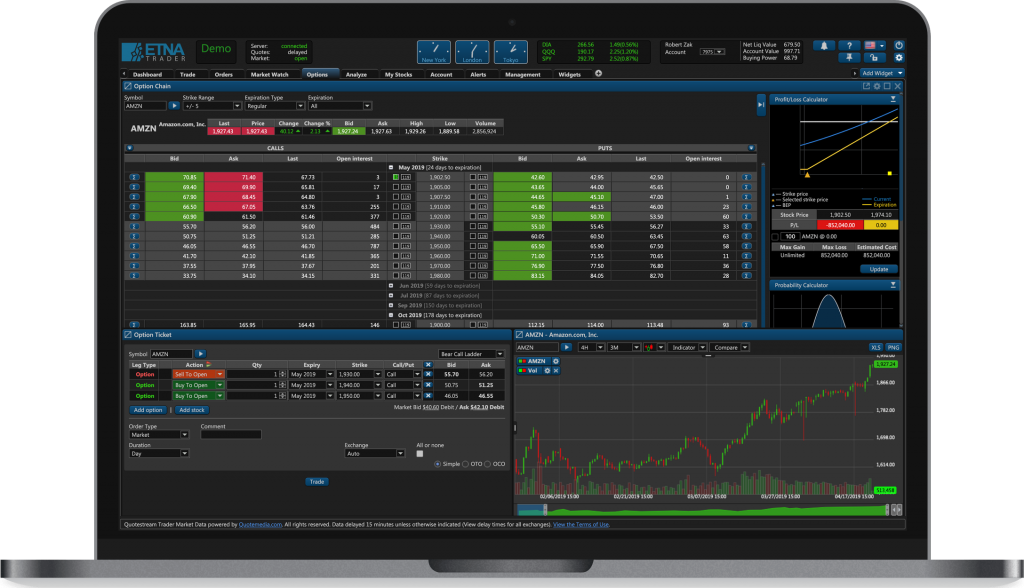

Image: www.etnasoft.com

FAQs: Unleashing the Potential of Option Trading

Q: What are the key advantages of option trading?

A: Options trading offers various benefits, including the potential for high returns, hedging against risk, and income generation through premiums.

Q: How do I get started with option trading?

A: Begin by educating yourself, selecting a reliable platform, and starting with a small amount of capital until you gain confidence.

Q: What are some common trading strategies for options?

A: Popular strategies include covered calls, cash-secured puts, and bull or bear spreads.

Q: How do I manage risk in option trading?

A: Implement risk management techniques such as stop-loss orders, position sizing, and diversification.

Q: Can I trade options without a broker?

A: While it’s possible, using a reputable broker provides access to resources, support, and lower fees.

Platform For Option Trading

Image: purepowerpicks.com

Conclusion

Exploring the world of option trading through a reliable platform empowers you with boundless opportunities for financial growth. Remember, knowledge is your greatest asset. Embrace continuous learning, implement effective strategies, and stay disciplined in your approach. With the right platform and a commitment to excellence, the path to option trading success awaits.

Are you ready to embark on this exhilarating journey? Share your thoughts and experiences in the comments section below and let’s ignite a conversation about the transformative power of option trading.