Peloton, the iconic indoor cycling brand, has captivated fitness enthusiasts and investors alike. With its burgeoning stock, Peloton options trading has emerged as an intriguing opportunity for savvy traders seeking to capitalize on the company’s growth potential. This guide delves into the intricacies of Peloton options trading, empowering you to harness the market’s fluctuations and enhance your investment strategies.

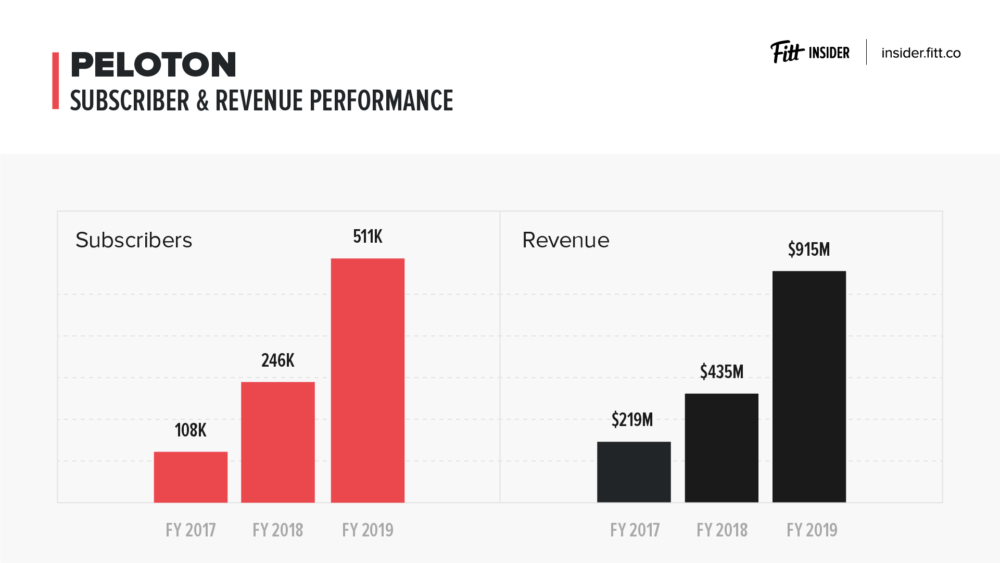

Image: insider.fitt.co

Unveiling the World of Options

Options are financial contracts that grant traders the right, but not the obligation, to buy or sell an underlying asset (in this case, Peloton stock) at a predetermined price (known as the strike price) on or before a specific date (expiration date). Traders can either exercise their options, thereby completing the transaction, or let them expire worthless. Understanding the mechanics of options is crucial for successful trading.

Unboxing the Anatomy of a Peloton Option

Peloton options come in two flavors: calls and puts. Call options convey the right to buy Peloton shares, while put options offer the option to sell. When trading Peloton options, traders select the strike price and expiration date that align with their market outlook and risk tolerance. These parameters determine the option’s premium, which is the price paid to acquire it.

Strategies for Savvy Peloton Traders

Peloton options trading presents a wide array of strategies, each catering to different market scenarios and trader risk appetites. Some prevalent strategies include:

-

Bullish Call Options: These options are ideal for traders who anticipate a rise in Peloton’s stock price. By acquiring a call option with a strike price below the current market price, traders can potentially profit from a sustained uptrend.

-

Bearish Put Options: These options are suitable for traders expecting a decline in Peloton’s stock price. Holding a put option with a strike price above the current market price can generate profits if the stock price falls.

-

Covered Calls: A less risky strategy that combines selling a call option while owning the underlying shares. This strategy generates income from the option premium while limiting potential losses from a stock decline.

-

Iron Condor: A more complex strategy that involves selling both a call and a put option at different strike prices simultaneously. Iron condors capitalize on low volatility and a sideways market trend.

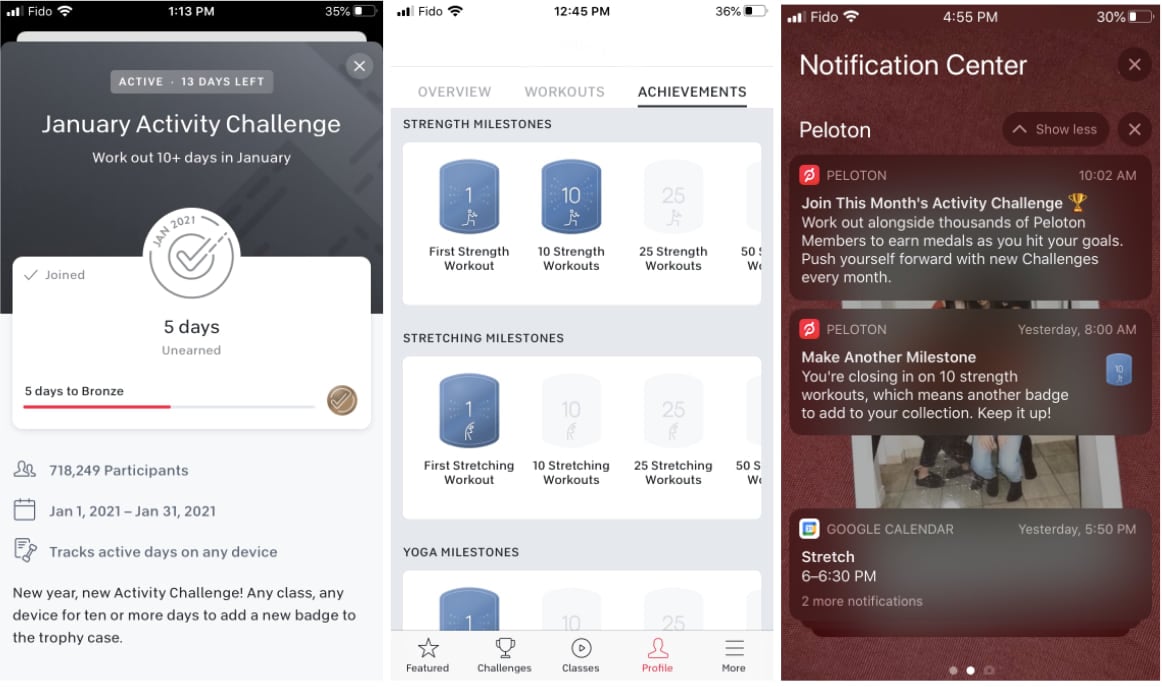

Image: taplytics.com

Navigating the Risks of Peloton Options Trading

While options trading offers significant upside potential, it also carries substantial risks that traders must acknowledge and manage diligently. Volatility, the extent to which an asset’s price fluctuates, is a crucial factor to consider. Significant price swings can swiftly erode option premiums, leading to losses.

Time decay is another risk, where options lose value as they approach expiration. Thus, it’s essential to assess the balance between time value and intrinsic value of an option before trading. Managing risk involves setting clear trading rules, utilizing appropriate position sizing, and avoiding excessive leverage.

Tips for Flourishing in Peloton Options Trading

To maximize your success in Peloton options trading, heed these valuable tips:

-

Master the Art of Market Analysis: Understand the factors driving Peloton’s stock performance, such as industry trends, competition, and economic conditions. Technical analysis can also provide insights into price patterns and potential trading opportunities.

-

Trade with a Clear Plan: Define your trading strategy, identify your profit targets, and establish risk management parameters before entering any trade. This disciplined approach enhances your chances of successful outcomes.

-

Monitor the Market Diligently: Regularly track the performance of Peloton stock, monitor news and announcements, and assess market sentiment. Staying informed enables you to adjust your trading strategy as needed.

-

Embrace Learning and Education: The world of options trading is constantly evolving. Enhance your knowledge by attending webinars, reading industry publications, and engaging with experienced traders. Continuous learning fosters consistent growth and improvement.

Peloton Options Trading

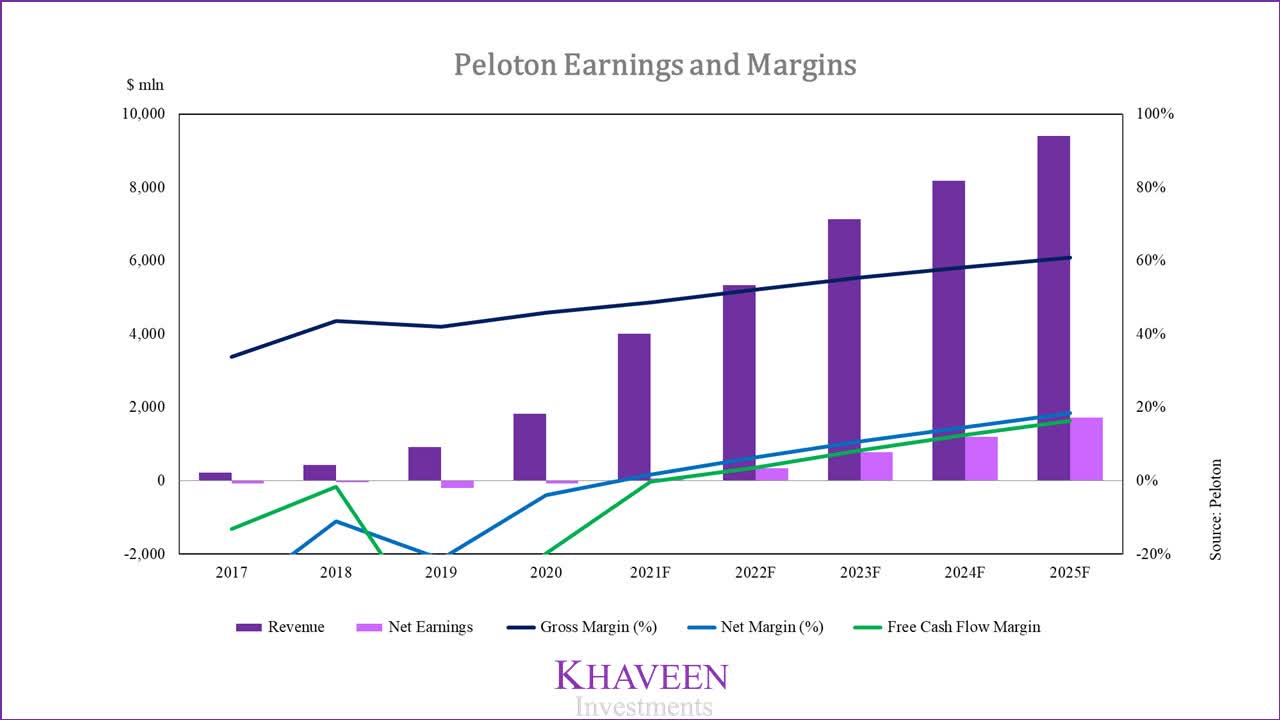

Image: seekingalpha.com

Conclusion

Peloton options trading unveils a plethora of opportunities for astute traders who embrace market knowledge, risk management, and strategic planning. By harnessing the potential of options, you can amplify your returns, diversify your portfolio, and navigate market fluctuations to your advantage. Remember, the road to investment success may have its complexities, but with dedication and a deep understanding, you can conquer the challenges and reap the rewards that Peloton options trading offers.