Introduction

In the labyrinthine world of finance, where fortunes are forged and lost in the ceaseless ebb and flow of the markets, volatility reigns supreme. It is a double-edged sword that can both inflate and decimate portfolios, wielding immense power over the minds and hearts of investors. Harnessing its enigmatic nature is a skill that separates the astute from the uninitiated. Enter the realm of options volatility trading—an intricate dance where risk and reward intertwine, promising vast profits to those who can navigate its complexities.

Options, financial instruments that derive their value from underlying assets, offer traders a powerful tool to speculate on the future direction of markets. By skillfully utilizing these contracts, traders can hedge against risk, generate income, and amplify their returns. However, mastering the art of options trading requires a deep comprehension of the intricate concepts that govern it, particularly the enigmatic force known as volatility.

Image: optionstradingiq.com

Deciphering the Enigma of Volatility

Volatility, a measure of an asset’s price fluctuations, is a crucial factor in options pricing. It plays a pivotal role in determining the premium, or price, that traders pay to acquire options contracts. Understanding volatility is akin to unlocking the secrets of a hidden treasure—it empowers traders to make informed decisions, minimize risk, and maximize profits.

Historical volatility, a statistical measure of an asset’s past price movements, provides valuable insights into its future behavior. By analyzing historical volatility data, traders can gauge the potential range of price swings and the likelihood of extreme market movements. However, it’s crucial to remember that historical volatility is merely a guide, and the future is inherently unpredictable.

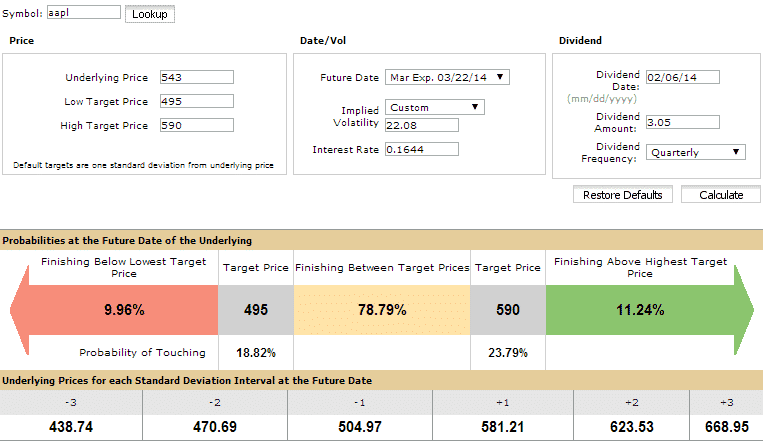

Implied volatility, on the other hand, is a forward-looking metric that reflects market expectations of future volatility. It encompasses not only historical volatility but also incorporates current market sentiment, supply and demand dynamics, and geopolitical events. Implied volatility is a crucial indicator of market expectations and can help traders determine whether an option is overpriced or underpriced.

Navigating the Options Landscape

Options come in various forms, each with its own unique characteristics and risks. Calls, which grant buyers the right but not the obligation to buy an underlying asset at a predetermined price, are often employed when bullish market sentiments prevail. Puts, conversely, provide the right to sell an asset at a specific price, offering protection against market downturns.

Traders can further refine their strategies by employing advanced options strategies such as spreads, straddles, and strangles. These techniques involve combining multiple options contracts to create customized risk profiles and enhance potential returns. However, it’s essential to approach these strategies with a deep understanding of their intricacies and the risks associated with them.

Market Dynamics and Volatility

Volatility is not a constant; it ebbs and flows in response to a myriad of factors. Economic news, geopolitical events, and corporate earnings can all trigger significant market swings, leading to rapid shifts in volatility. Traders must constantly monitor these external forces to anticipate changes in volatility and adjust their strategies accordingly.

Periods of high volatility can be both lucrative and perilous for options traders. While increased volatility can amplify profits, it also magnifies potential losses. Understanding the causes of volatility and its impact on options pricing is crucial for managing risk and maximizing returns. Conversely, periods of low volatility can present challenges, as options premiums tend to be lower, offering less profit potential.

Image: www.youtube.com

Trading Volatility

Trading volatility directly, without the use of options, is another avenue for profiting from market uncertainty. Volatility indices, such as the VIX, provide an indirect way to speculate on market volatility. These indices measure implied volatility of the underlying stock market and can be traded through various financial instruments, including futures, options, and exchange-traded funds.

Trading volatility indices allows investors to capitalize on market swings without the direct exposure to underlying assets. However, it’s important to recognize that these instruments can be complex and require a thorough understanding of their underlying mechanisms before engaging in trades.

Options Volatility Trading Book

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Image: www.ainfosolutions.com

Conclusion

Options volatility trading is an intricate and potentially lucrative arena that requires a deep understanding of volatility, options pricing, and risk management. By mastering the concepts outlined in this comprehensive guide, aspiring traders can harness the power of volatility to enhance their returns and navigate the ever-changing financial landscape with confidence. Remember, the journey to options mastery is an ongoing pursuit, and continuous learning and refinement are the keys to unlocking the full potential of this dynamic and rewarding field.