Embark on a Lucrative Journey with Options Trading

Options trading, a sophisticated financial strategy, offers traders the potential for substantial profits. Whether you’re a seasoned veteran or a novice eager to delve into this intriguing realm, this comprehensive workbook is your indispensable guide. Immerse yourself in the complexities of options trading, mastering the skills and strategies necessary for success.

Image: www.pinterest.com

Unveiling the Options Trading Landscape

Options, essentially contracts that confer the right but not the obligation to buy or sell an underlying asset at a predetermined price (strike price), empower traders to capitalize on market movements. This highly versatile instrument empowers traders to hedge against potential losses, enhance portfolio returns, and navigate market volatility.

A Comprehensive Framework for Success

Our meticulously crafted workbook provides a comprehensive roadmap for options trading, covering:

- Definition and History of Options: Delve into the origins and evolution of options, understanding their role in the financial markets

- Types of Options: Explore the different types of options available, including calls, puts, and their respective characteristics

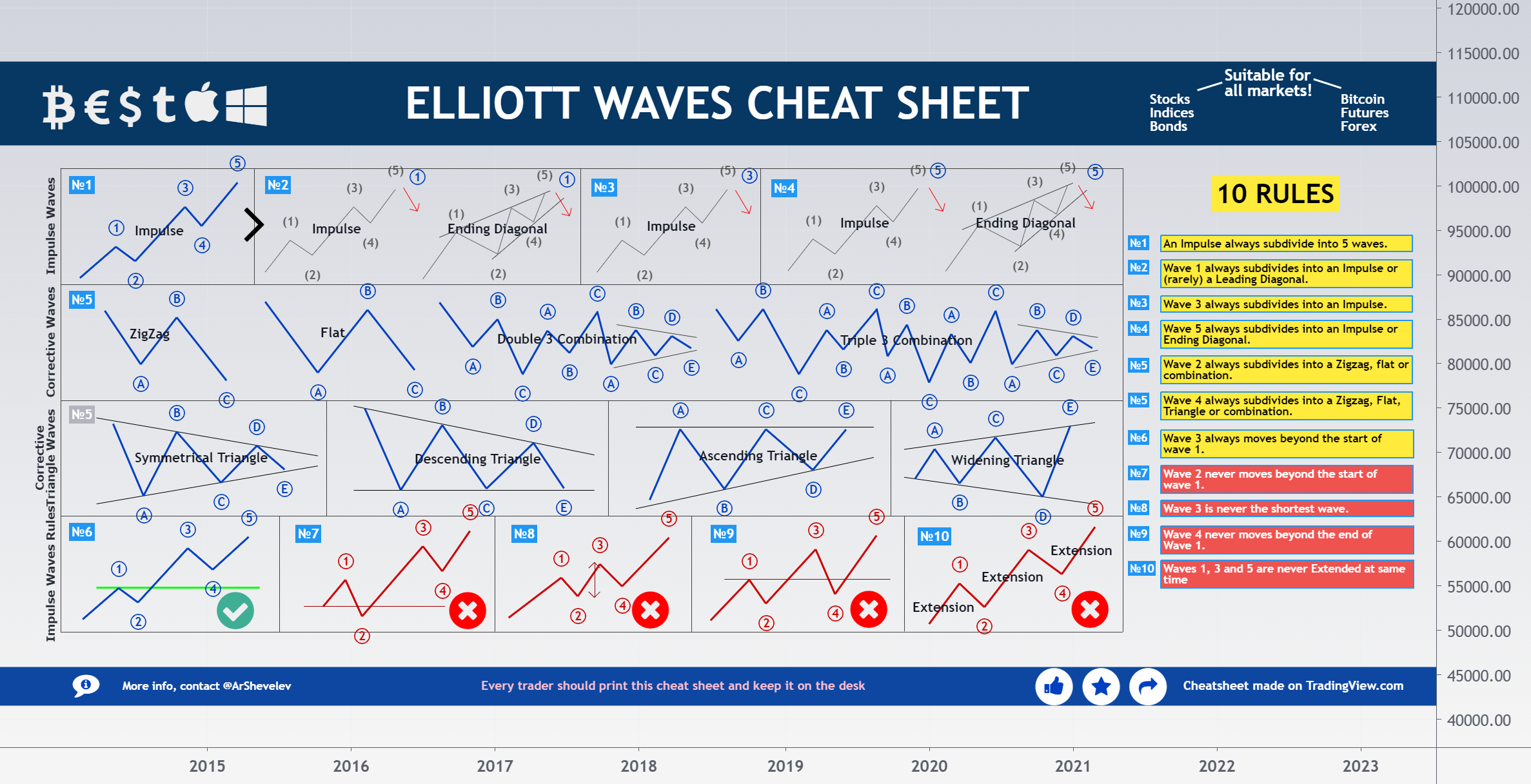

- Trading Strategies: Master a range of options trading strategies, delving into their mechanics, risk-reward profiles, and suitability for various market conditions

- Managing Options Positions: Learn how to manage open options positions effectively, including adjusting strike prices, adjusting expiration dates, and closing out positions

- Advanced Concepts: Uncover advanced options trading concepts such as volatility, delta hedging, and margin requirements

Latest Trends and Insights

To remain abreast of the ever-evolving options trading landscape, this workbook draws upon the latest industry updates, news sources, and insights from experts and analysts. Stay informed about cutting-edge strategies, regulatory changes, and market trends that shape the options trading ecosystem.

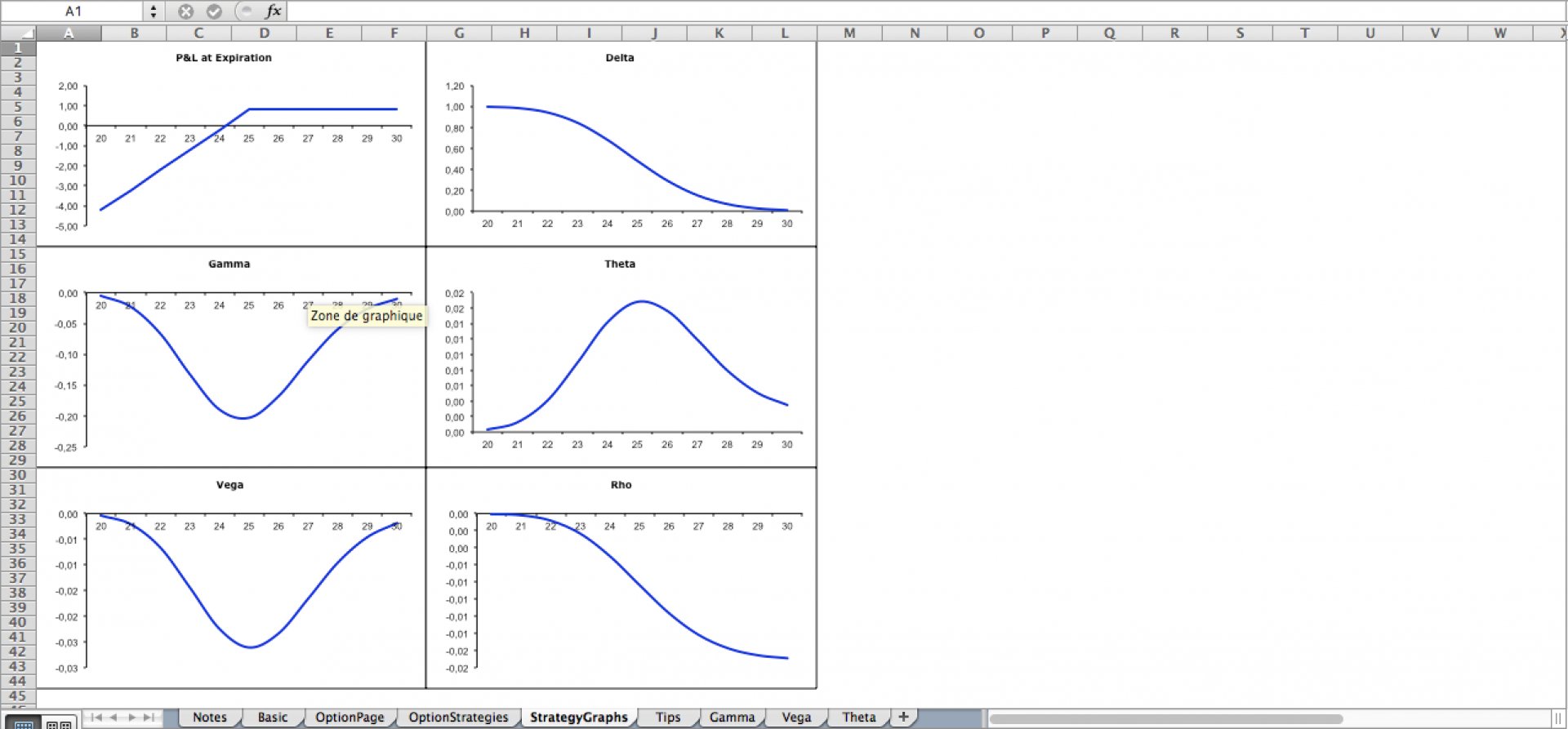

Image: www.eloquens.com

Expert Guidance and Proven Strategies

Benefit from the wisdom of seasoned options traders and industry professionals. Discover:

- Time-Tested Strategies: Gain valuable insights into time-tested options trading strategies that have consistently delivered positive results

- Risk Management Techniques: Learn robust risk management techniques to protect your capital and mitigate potential losses

Frequently Asked Questions (FAQs)

Q: What is the difference between a call and a put option?

A: A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset.

Q: How do I determine the strike price of an option?

A: The strike price is the price at which the underlying asset can be bought or sold. It is typically determined based on the current market price and the trader’s expectations of future price movements.

Q: What is the risk associated with options trading?

A: Options trading can be risky, and losses can exceed the initial investment. It is crucial to understand the risks involved and only trade with capital you can afford to lose.

Options Trading Workbook Pdf

Image: promo.pearlriverresort.com

Conclusion

Master the art of options trading with this meticulously curated workbook. Embark on a transformative journey, empowering yourself with the knowledge and skills necessary to navigate the complex world of options trading confidently. Whether you’re a seasoned professional or a budding enthusiast, this comprehensive guide will elevate your trading prowess, enabling you to reap the rewards that options trading has to offer.