Welcome to the fascinating realm of institutional options trading, where high stakes and strategic maneuvers intertwine. This in-depth exploration will guide you through the intricacies of this complex market, empowering you with the knowledge and insights needed to navigate its ever-evolving landscape. From fundamental principles to practical applications, we will unravel the secrets that drive institutional options trading, fostering a deeper understanding of its pivotal role in the financial markets.

Image: www.studocu.com

Defining Institutional Options Trading: The Powerhouse of Wall Street

Institutional options trading refers to the strategic buying and selling of options contracts by large financial institutions, hedge funds, and other sophisticated market participants. These entities harness the versatility of options to hedge risk, enhance returns, and capitalize on market volatility. Unlike retail traders, institutional players possess vast resources, analytical prowess, and access to specialized trading platforms, enabling them to execute intricate strategies with remarkable efficiency.

Decoding the Foundations of Options Trading: A Spectrum of Possibilities

Options, at their core, are financial instruments that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility offers a wide spectrum of possibilities, from leveraging market expectations to mitigating potential losses. Institutional traders actively leverage options to tailor strategies that align with their investment objectives.

Evolution of Institutional Options Trading: A Journey of Innovation

The world of institutional options trading has witnessed a remarkable evolution over the years, driven by technological advancements and regulatory changes. The advent of electronic trading platforms streamlined execution, while the introduction of complex options strategies expanded the toolkit available to traders. Today, institutional options trading stands as a highly sophisticated and dynamic market segment, continuously adapting to the ever-changing financial landscape.

Image: zeiiermantrading.com

Exploring the Role of Institutional Options Trading: Shaping Market Dynamics

Institutional options trading exerts a significant influence on the broader market dynamics. These large players often act as market makers, providing liquidity and facilitating trades for others. Their strategic positioning can shape price movements, impact implied volatility, and influence overall market sentiment. Moreover, institutional options trading serves as a barometer of market expectations, offering insights into the collective outlook of experienced investors.

Unlocking the Secrets of Institutional Options Strategies: A Symphony of Risk and Reward

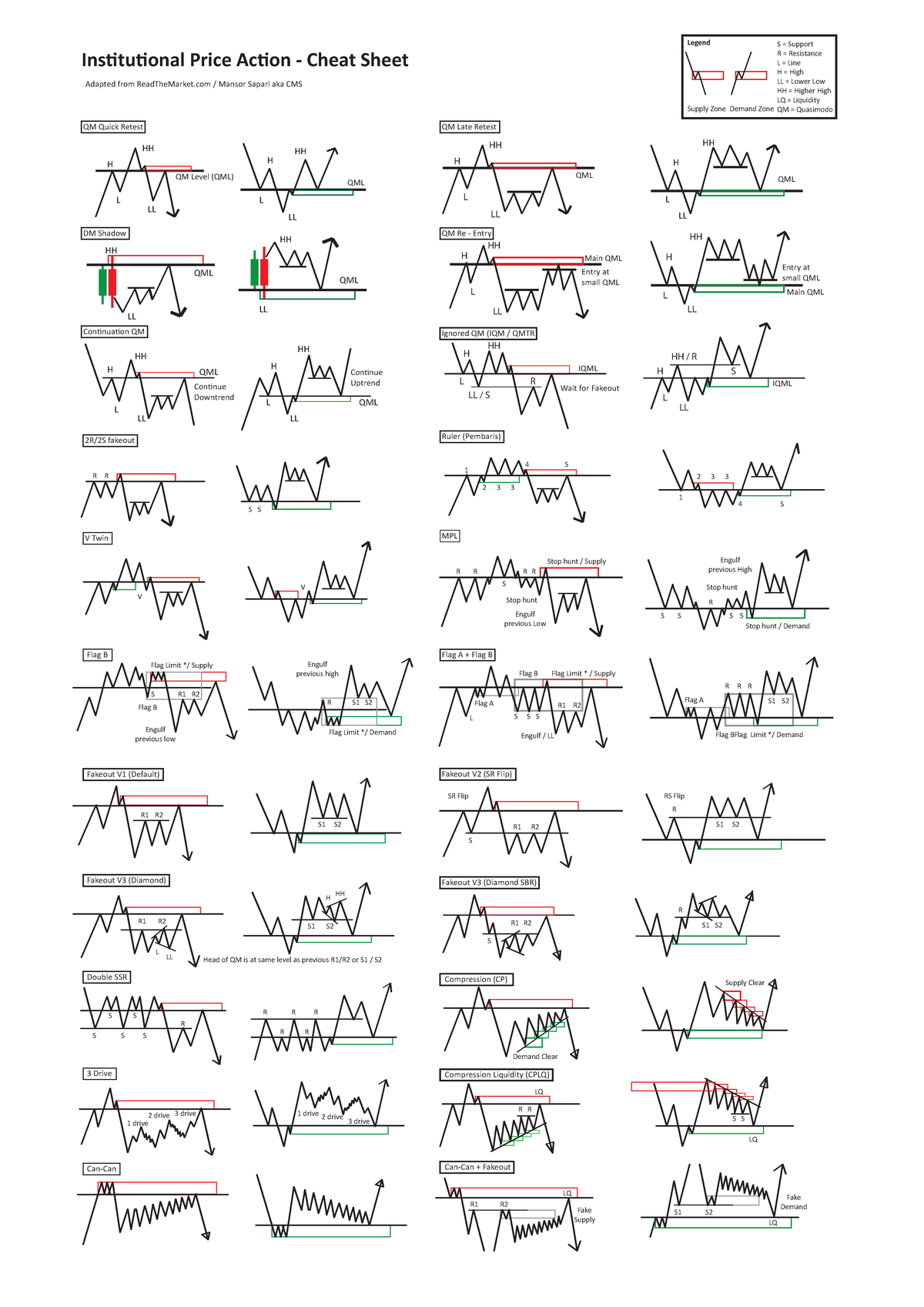

Institutional options traders employ a vast array of strategies, each meticulously crafted to achieve specific financial goals. These strategies run the gamut from basic hedging techniques to complex multi-leg structures. By understanding the risk-reward profiles associated with different strategies, investors can tailor their approach to their unique investment objectives.

Empowering Individuals with Insights from Institutional Trading: A Path to Informed Decisions

While institutional options trading may seem like an exclusive domain reserved for large-scale investors, the insights derived from their strategies can benefit individual investors as well. By understanding the principles that guide these sophisticated players, individuals can make more informed decisions in their own trading endeavors.

Harnessing the Power of Institutional Options Trading: Opportunities for Growth and Income

Options trading, when approached strategically, presents a wealth of opportunities for both growth and income generation. By incorporating options into their portfolios, investors can potentially enhance returns, reduce risk, and capitalize on market trends. However, it is crucial to proceed with caution, as options trading involves inherent risks that must be carefully managed.

Institutional Options Trading

Conclusion: Unveiling the Potential of Institutional Options Trading

The world of institutional options trading is a complex and ever-changing landscape, offering both opportunities and challenges for investors. By embracing a comprehensive understanding of the fundamental principles, strategies, and risk management practices involved, individuals can harness the power of options to elevate their investment strategies. Whether seeking to hedge against volatility, enhance returns, or capitalize on market trends, institutional options trading offers a versatile toolset for achieving financial goals.