In the captivating world of options trading, understanding the intricacies of different option characteristics is paramount to making informed decisions. One such characteristic that serves as an instrumental indicator is the delta of an option. In this comprehensive guide, we will delve into the concept of high delta, exploring its significance and how it impacts the dynamics of options trading.

Image: www.rockwelltrading.com

The Essence of High Delta

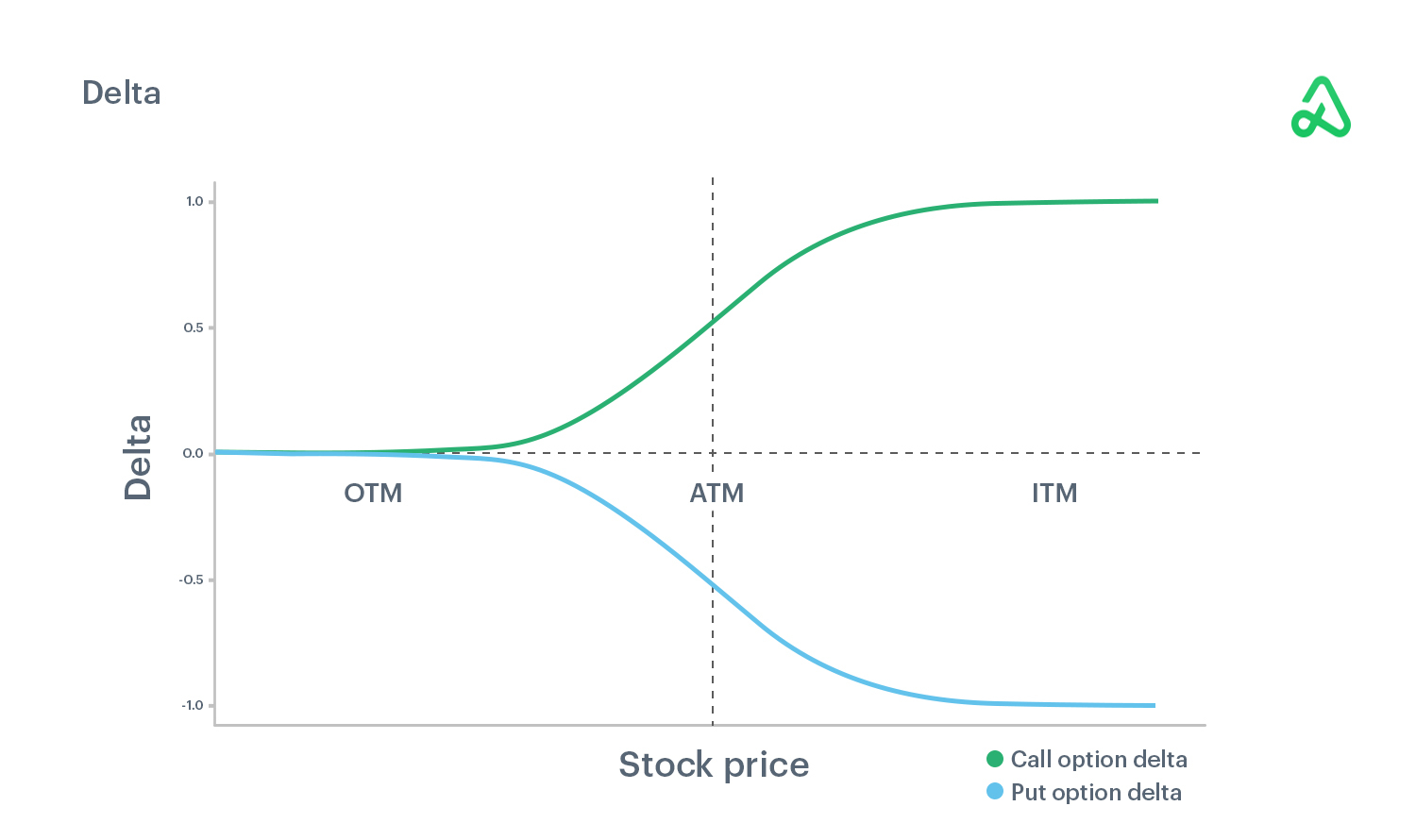

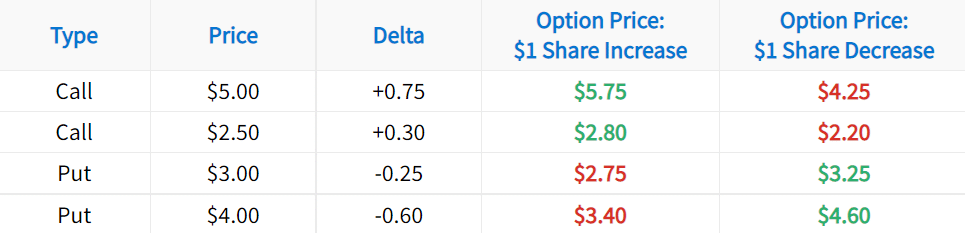

Delta refers to the rate at which the price of an option changes in relation to the underlying asset. A high delta option exhibits a high degree of sensitivity to price movements, meaning that its price tends to follow the price of the underlying asset closely. For instance, if the underlying asset increases in value by $1, a high delta option may increase by $0.90 or more.

Impact on Options Trading

The elevated sensitivity of high delta options makes them suitable for various trading strategies. One common strategy involves buying high delta call options when traders anticipate a significant increase in the underlying asset’s price. Conversely, selling high delta put options can be employed when traders expect a decrease.

Moreover, high delta options are highly responsive to changes in implied volatility, which measures the market’s expectation of future price fluctuations. In a high implied volatility environment, high delta options can exhibit exaggerated price movements. Traders need to be cognizant of this volatility to mitigate potential risks associated with high delta options.

How to Identify High Delta Options

Identifying options with high deltas is relatively straightforward. Most options trading platforms will display the delta of an option in the option chain. Options with delta values closer to 1 (for call options) or -1 (for put options) are considered high delta options.

Alternatively, traders can use option calculators to calculate the delta of a particular option based on its underlying asset price, strike price, time to expiration, and implied volatility.

Image: optionalpha.com

Advanced Applications

High delta options offer advanced trading techniques for seasoned traders. One such technique is delta hedging, which involves adjusting the number of options held to maintain a desired delta exposure. This strategy allows traders to fine-tune their exposure to price fluctuations.

High delta options can also be employed in complex trading strategies such as butterfly spreads and calendar spreads, enabling traders to potentially generate income from sideways or neutral price movements.

Conclusion

Delving into the nuances of high delta options empowers traders to make informed decisions in the options market. By understanding the sensitivity of these options to underlying asset price movements, traders can strategically position themselves to optimize their potential returns. However, it’s essential to remember that high delta options come with inherent risks due to their exaggerated price movements in response to volatility. Traders should exercise caution and meticulously analyze the market conditions before incorporating high delta options into their trading strategies.

Would you like to pursue further knowledge about options trading and the significance of delta? Join our vibrant community of options traders where you can connect with experts, exchange insights, and refine your trading strategies.

Options Trading What Is A Higg Delta

Image: www.projectfinance.com

FAQs

-

Q: What determines the delta of an option?

A: Delta is influenced by several factors, including the underlying asset price, strike price, time to expiration, and implied volatility.

-

Q: When should I use high delta options?

A: High delta options can be effective when traders anticipate significant price movements and aim to maximize their exposure to those movements.

-

Q: Are high delta options risky?

A: Due to their high sensitivity to price changes, high delta options can amplify both profits and losses, increasing the associated risks.