Options trading has emerged as a popular financial strategy, offering investors the potential for significant returns. However, navigating the complexities of taxation on options income can be daunting. This comprehensive guide aims to demystify the topic, providing a thorough understanding of the tax implications involved.

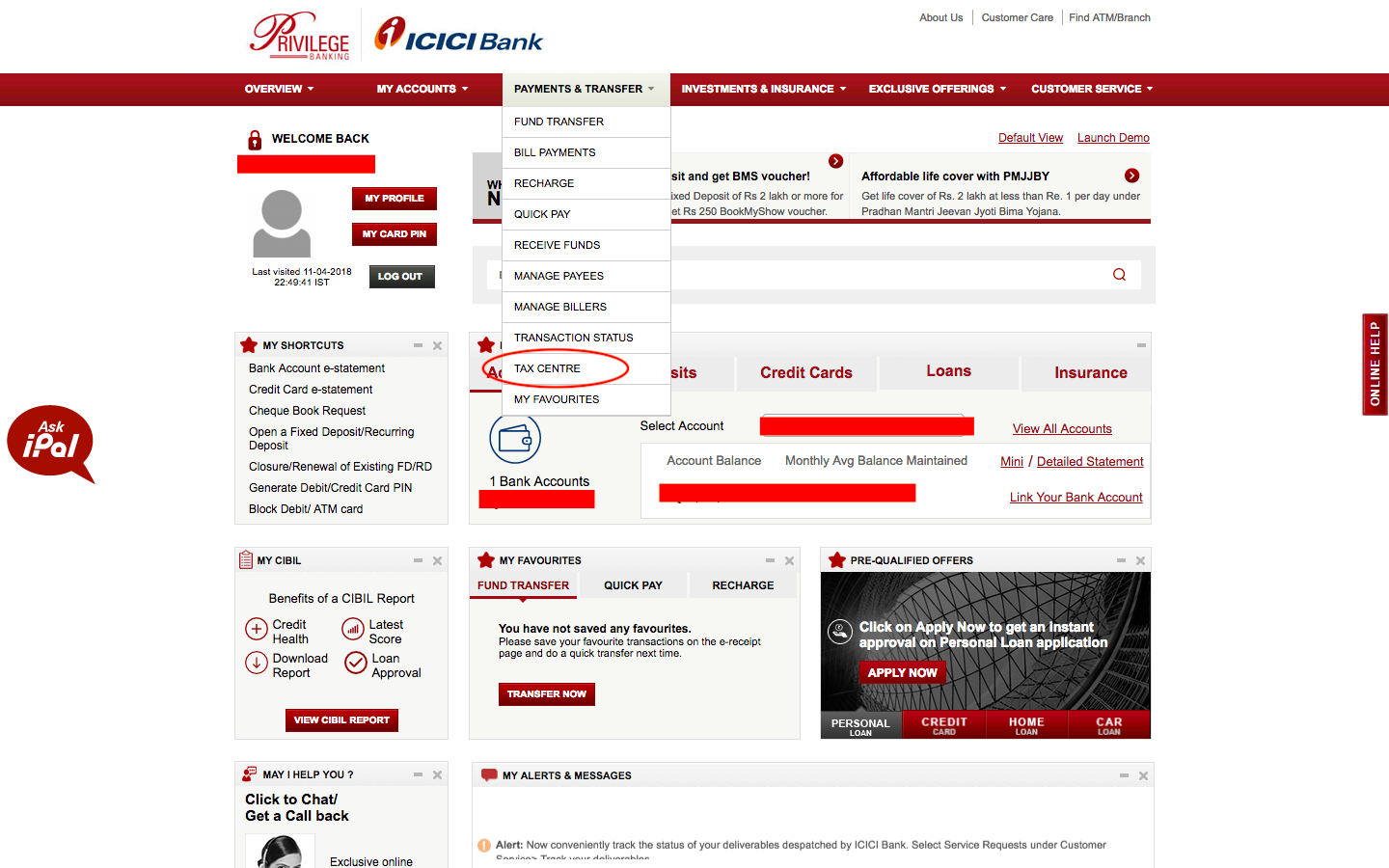

Image: www.fundsinn.com

Demystifying the Landscape of Options Taxation

Options are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price. When an options contract is exercised, the resulting capital gains or losses are subject to income tax. The tax treatment of options income depends on the type of option traded and the holding period.

Recognizing the Types of Options and Their Tax Implications

Options contracts come in two primary flavors: call options and put options. Call options give the holder the right to purchase an underlying asset, while put options provide the right to sell it. The tax treatment differs for each type of option.

-

Call Options: Gains from exercised call options are taxed as short-term capital gains if the option is held for one year or less, and as long-term capital gains if held for more than a year. Conversely, losses from call options can be deducted as ordinary losses.

-

Put Options: Gains from exercised put options are treated as short-term capital gains if the option is held for a year or less. However, losses from put options can only be deducted if the underlying asset is connected to the taxpayer’s trade or business.

Duration Matters: Understanding the Holding Period

The holding period of an options contract significantly influences its taxation. The holding period begins when the option is acquired and ends when it is exercised, sold, or expires. The treatment of capital gains or losses varies depending on whether the holding period exceeds one year.

-

Short-Term Capital Gains/Losses: If an option is exercised or expires within one year of its acquisition date, the resulting gain or loss is considered short-term. Short-term capital gains are taxed at the ordinary income tax rate. Short-term capital losses can offset short-term capital gains and up to $3,000 of ordinary income.

-

Long-Term Capital Gains/Losses: Options exercised or expiring more than a year after acquisition result in long-term capital gains or losses. Long-term capital gains are subject to preferential tax rates, typically lower than the ordinary income tax rate. Long-term capital losses can be used to offset long-term capital gains, and any excess can be deducted against up to $3,000 of ordinary income.

Image: www.youtube.com

Seeking Expert Insights: Navigating the Taxation Maze

Understanding the intricacies of options taxation can be complex. Consulting with a tax professional is highly recommended to ensure proper tax compliance and optimize your financial strategy. Tax professionals can provide personalized guidance tailored to your specific circumstances, helping you navigate the complex landscape of options taxation.

Income Tax On Options Trading

https://youtube.com/watch?v=g_4TmzND1ks

Conclusion: Empowered Decision-Making in Options Trading

Unraveling the intricacies of income tax on options trading equips you with the knowledge to make informed financial decisions. By understanding the tax implications, you can effectively plan your options trading strategies to maximize returns and minimize tax liability. Remember to seek professional advice to ensure complete comprehension of the complex tax rules governing options trading.