Introduction

In today’s fast-paced financial landscape, investors are constantly seeking new strategies to enhance their portfolios and maximize returns. One such strategy that has gained significant traction in recent years is options trading. Options offer traders the opportunity to speculate on the future price movements of assets without having to purchase the underlying asset itself.

Image: www.pinterest.com

TD Ameritrade, a leading online broker, offers a robust suite of tools and services tailored specifically for options traders. From sophisticated order entry systems to educational resources, TD Ameritrade provides everything you need to navigate the complexities of options trading and pursue potential profits.

Understanding Options Basics

Options contracts are derivative instruments that give the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a pre-determined strike price on or before a specific expiration date. This flexibility offers traders the opportunity to speculate on market trends, hedge against risk, or generate additional income.

Types of Options

TD Ameritrade offers a wide range of options types to cater to different trading strategies. These include single-leg options (e.g., call or put options), and multi-leg options (e.g., spreads and combinations). Each type of option carries its own unique characteristics and risk profile, so it’s crucial to understand their differences before participating in options trading.

TD Ameritrade’s Options Trading Platform

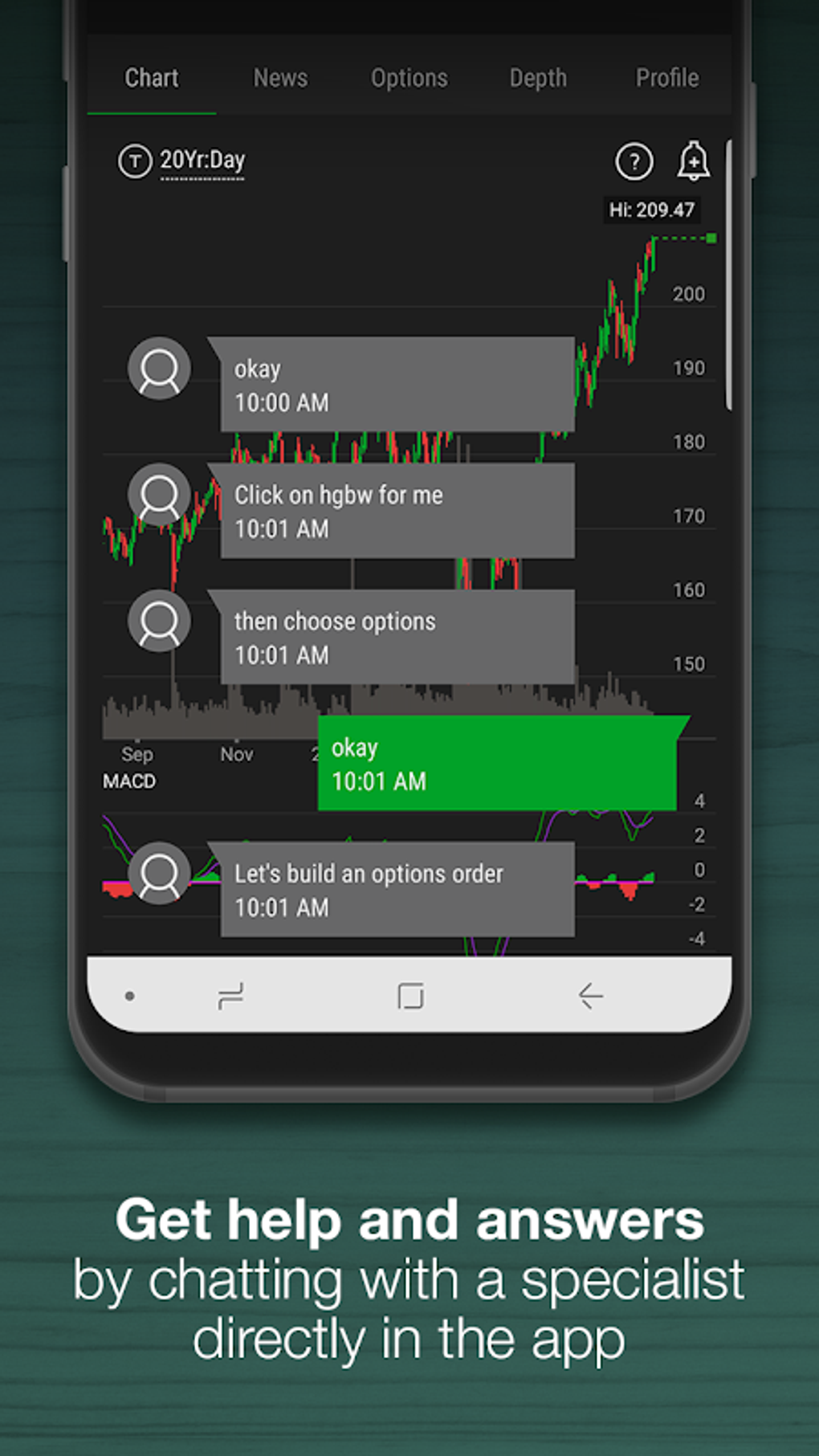

TD Ameritrade’s proprietary trading platform, thinkorswim®, is designed to provide options traders with an intuitive and powerful experience. The platform features advanced charting tools, real-time market data, and one-click order entry capabilities, empowering traders to make informed decisions and execute trades efficiently.

Image: td-ameritrade-mobile-trader.en.softonic.com

Benefits of Options Trading with TD Ameritrade

- Access to a wide range of options contracts: TD Ameritrade offers options on stocks, indices, ETFs, and futures, providing traders with ample opportunities to diversify their portfolios and pursue growth strategies.

- Margin trading capabilities: Margin trading allows traders to magnify their trading power by borrowing funds to enhance their trading capital. However, it’s important to use margin wisely, as it can also amplify potential losses.

- Educational resources and support: TD Ameritrade offers a comprehensive library of educational materials, webinars, and seminars to help traders of all experience levels master options trading concepts and strategies.

- Dedicated options specialists: Experienced options specialists are available to assist traders with any questions or concerns they may encounter throughout their trading journey.

Risks of Options Trading

It’s essential to acknowledge that options trading involves inherent risks that should be carefully considered before entering into any trades. The value of options contracts can fluctuate rapidly based on changes in underlying asset prices, time decay, and market volatility. Traders should thoroughly understand these risks and develop a risk management plan to mitigate potential losses.

Options Trading Td Ameritrade App

Image: slashtraders.com

Conclusion

Options trading can be a powerful tool for investors who seek to enhance their portfolio performance and navigate market movements. With TD Ameritrade’s state-of-the-art trading platform and comprehensive support offerings, you have the resources and guidance necessary to embark on your options trading journey with confidence. However, it’s crucial to remember that all trading activities involve risks, and investors should always approach options trading with a well-thought-out plan and a prudent understanding of the potential consequences.