Introduction

In today’s volatile market, it can be challenging to find opportunities for consistent returns. But by strategically using options contracts, you can potentially profit from both rising and falling stock prices. One particularly effective strategy is to buy put options on stocks that have been mentioned positively on CNBC. This approach leverages the network’s reputation for identifying potential winners and provides a defensive hedge against market downturns.

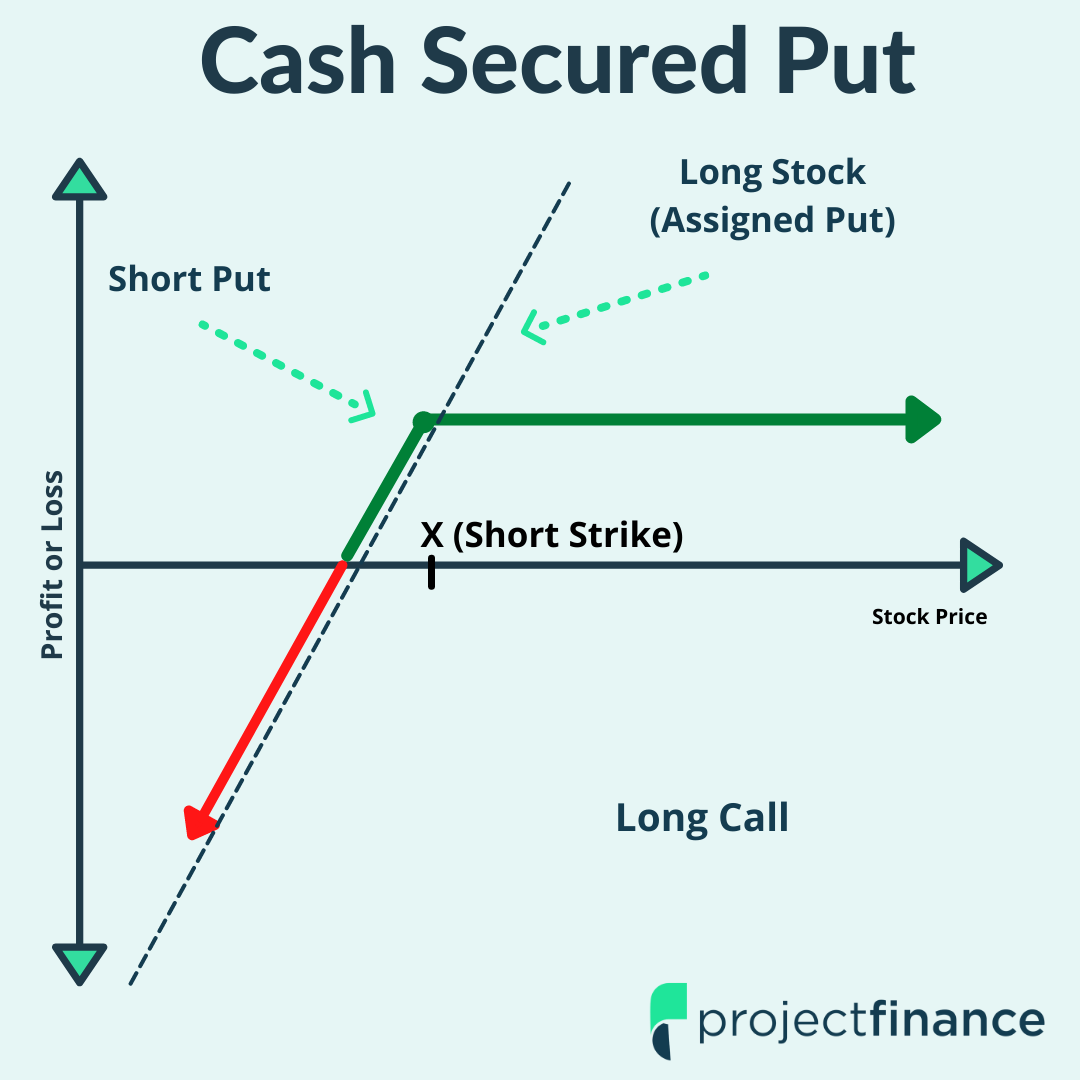

Image: www.projectfinance.com

Understanding Put Options

A put option grants the holder the right, but not the obligation, to sell a specific number of shares of a stock at a predetermined price (called the strike price) within a specified timeframe (the expiration date). When buying a put option, you expect the stock price to fall below the strike price by the expiration date. If it does, you can sell the stock at the higher strike price, realizing a profit.

Why CNBC-Mentioned Stocks?

CNBC is a leading financial news network with a reputation for insightful analysis and stock recommendations. When CNBC analysts highlight a company, it often translates into increased attention and potential price appreciation. By focusing on stocks that have received positive coverage, you can tap into this momentum while simultaneously mitigating risk with put options.

The Strategy

The options trading strategy involves purchasing put options on stocks that have been mentioned positively on CNBC. Here are the steps to follow:

- Research and Identify Stocks: Monitor CNBC’s business news and identify stocks that have been featured in favorable segments.

- Analyze the Stock: Conduct thorough research on the company’s financials, industry trends, and competitive landscape.

- Select Put Options: Choose put options with strike prices slightly below the current stock price and expiration dates that align with your projected holding period.

- Determine Position Size: Calculate the number of put options to purchase based on your desired profit potential and risk tolerance.

- Execute the Trade: Place your order through a reputable brokerage platform.

Image: www.markettradersdaily.com

Expert Insights

“Buying puts on CNBC-mentioned stocks can be an effective way to capitalize on the network’s research and analysis,” says financial analyst Mark Fisher. “However, it’s essential to exercise caution and conduct thorough due diligence before making any investment decision.”

“Options trading involves both potential rewards and risks,” cautions options trader Susan Lee. “Manage your risk carefully by understanding the mechanics of options contracts and setting realistic profit targets.”

Actionable Tips

- Consider using a screener to identify stocks that have received significant positive attention from CNBC.

- Seek guidance from experienced options traders or consult with a financial advisor.

- Practice risk management by diversifying your portfolio and setting stop-loss orders to limit potential losses.

- Stay informed on market trends and CNBC news coverage to adjust your strategy accordingly.

Options Trading Strategy Based On Puts On Cnbc Mentioned Stocks

Image: regpaq.com

Conclusion

Options trading can be a powerful tool for generating profits, especially when combined with strategies that leverage market insights. By purchasing put options on CNBC-mentioned stocks, you can potentially capture upside potential while mitigating downside risk. However, it’s crucial to approach options trading with a comprehensive understanding of the mechanics, risks, and rewards involved. By following these guidelines, you can navigate market volatility with confidence and increase your chances of financial success.