Introduction:

In the dynamic world of financial markets, options trading has gained immense popularity as a powerful tool for potential profit and risk management. However, navigating the complexities of options strategies can be daunting for beginners and experienced traders alike. This comprehensive cheat sheet aims to demystify the options landscape, providing a clear roadmap to help you make informed decisions and maximize your trading potential.

Image: derivfx.com

Understanding Options Trading:

Options contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a certain date. Unlike stocks, where you own the underlying asset directly, options provide leverage and flexibility, allowing you to control large positions with relatively small investments.

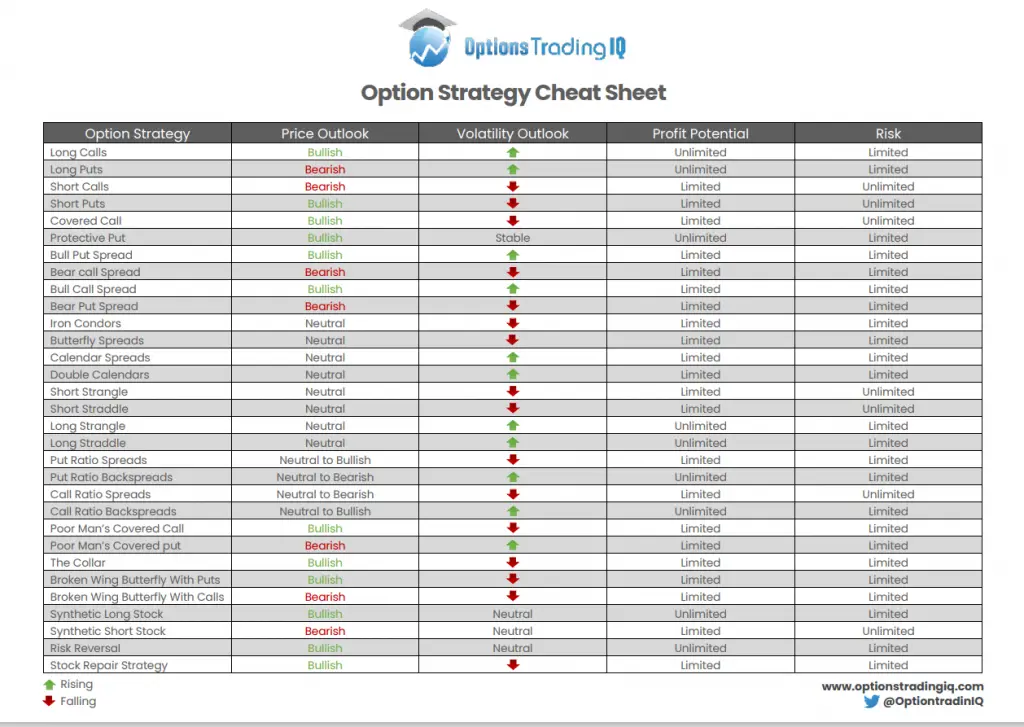

Types of Options Strategies:

The myriad of options strategies cater to diverse trading objectives. Here are some commonly employed approaches:

– Buy-and-Hold: This straightforward strategy involves acquiring an option expecting its value to appreciate over time.

– Covered Call: A popular income-generating strategy where the trader sells (writes) a call option against an existing stock position they own.

– Iron Condor: This neutral strategy involves selling a call spread and buying a put spread with the same expiration date and different strike prices.

– Straddle: A bullish strategy that involves simultaneously buying both a call and a put option with the same strike price and expiration date.

– Strangle: A broader version of Straddle, where the call and put options have different strike prices.

– Butterfly Spread: A multi-leg strategy that involves buying a call option at a lower strike price, selling two call options at a middle strike price, and buying another call option at a higher strike price.

Expert Insights and Actionable Tips:

– Risk Management: Before entering any options trade, thoroughly assess the potential risks involved and ensure you have adequate capital and risk tolerance.

– Volatility Impact: Options prices are highly sensitive to underlying asset volatility. Consider the market’s expected volatility when selecting options and adjusting strategies accordingly.

– Theta Decay: Options lose value (decay) over time, especially as they approach expiration. Monitor your positions closely to manage this factor effectively.

– Implied Volatility: Implied volatility (IV) is a key parameter that influences options pricing. Higher IV indicates higher expected volatility, which can impact your trading decisions.

Conclusion:

Understanding options trading strategies is crucial for unlocking the potential of this versatile financial tool. With careful consideration of your objectives, risk tolerance, and the intricacies of these strategies, you can navigate the options market with confidence and pursue your financial goals effectively. Remember, this cheat sheet is a valuable resource, but ongoing education and hands-on experience are essential for continuous growth as an options trader.

Image: www.newtraderu.com

Options Trading Strategies Cheat Sheet

Image: rubyowens.z21.web.core.windows.net