Introduction

Imagine having a window into the future of the stock market, where you could anticipate market movements before the bell even rings. Options trading pre market offers just that – an opportunity to gain insights into the day’s trading session before the market officially opens. By understanding the unique dynamics of pre-market trading and employing effective strategies, traders can outsmart the competition and position themselves for success.

Image: margintradeab.blogspot.com

Options, financial instruments that give traders the right (but not the obligation) to buy or sell an underlying asset at a predetermined price, have become increasingly popular in recent times. The pre-market session, which typically runs from around 8:00 a.m. to 9:30 a.m. ET, provides a valuable opportunity to trade options before the full market opens at 9:30 a.m. ET.

Pre-Market Options Trading: What You Need to Know

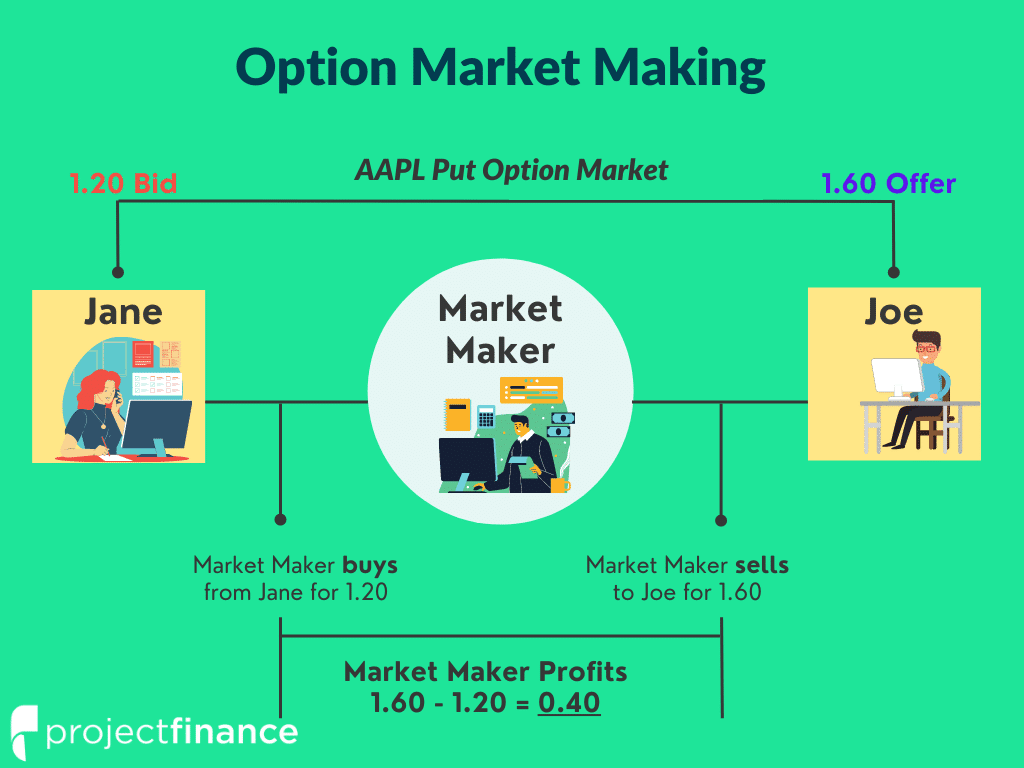

Pre-market trading differs significantly from regular market hours in several ways. First, only a limited number of market participants are active during this time, which can lead to less liquidity and wider bid-ask spreads. Second, the pre-market doesn’t reflect the full depth of the market, meaning there may be fewer orders available to execute at a given price.

Despite these differences, pre-market trading offers several advantages. It allows traders to react to overnight news and events, adjust positions, and potentially gain an edge over other market participants who wait for the regular market open.

Strategies for Pre-Market Options Trading

Traders can employ various strategies to capitalize on the pre-market session’s unique dynamics. One common strategy is to identify and trade stocks with strong earnings announcements. When earnings reports beat or miss expectations, stocks tend to experience significant price movements, and pre-market trading provides an opportunity to capitalize on these moves before the wider market reacts.

Another strategy involves trading options that have expiration dates on the same day. These options, known as “daily” or “intraday” options, tend to have higher volatility and can offer significant returns, especially in rapidly moving markets. However, these options also carry higher risk and require careful management.

Market Watchers and Technology Tools

To succeed in pre-market options trading, it’s crucial to stay well-informed about market news and events. Market watchers and technology tools can be invaluable in providing real-time updates and helping traders identify potential trading opportunities.

Market watchers provide ongoing analysis of market conditions, earnings announcements, and economic data. By following market watchers, traders can stay abreast of the latest market developments and respond quickly to changing conditions.

Technology tools, such as options trading platforms, offer a suite of features designed to enhance pre-market trading. These platforms provide real-time quotes, charting tools, and advanced analytics that help traders make informed decisions.

Image: www.projectfinance.com

Options Trading Pre Market

Image: www.hoteldarshanpor.com

Conclusion

Options trading pre market offers traders a unique opportunity to gain a competitive advantage by anticipating market movements before the regular market opens. By understanding the dynamics of pre-market trading and employing effective strategies, traders can increase their chances of success in this fast-paced and potentially rewarding market.