Imagine yourself, a passionate investor, venturing into the unknown realm of options trading, eager to decipher its complexities. The allure of exponential returns and the power to tailor tailored strategies is enthralling, yet the path ahead is veiled in uncertainty.

Image: www.interactivebrokers.com.hk

Fear not, intrepid trader, for this comprehensive guide will serve as your beacon, illuminating the intricacies of this captivating financial instrument. Join us as we embark on a journey to conquer the world of options trading, unlocking hidden opportunities and empowering you to make informed decisions.

What is Options Trading?

Options trading is a sophisticated investment strategy that grants you the option, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. This flexible instrument allows you to speculate on the future price movements of assets, catering to a wide range of investment objectives and risk tolerances.

Unraveling the Mechanics

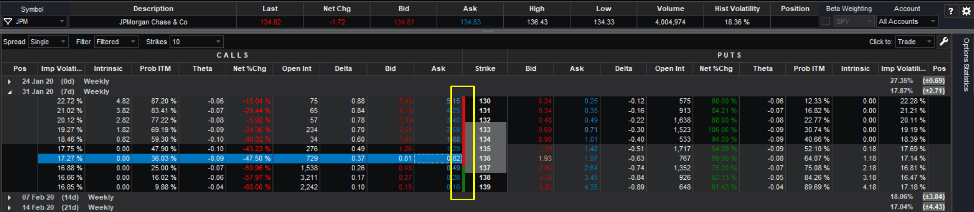

At the core of options trading lies the concept of calls and puts. A call option provides you with the right, not the obligation, to buy an underlying asset at a predetermined price (the strike price) on or before a specified expiration date. On the flip side, a put option grants you the right to sell an underlying asset at the strike price within the stipulated time frame.

The premium you pay for an option reflects the market’s assessment of the likelihood of the option expiring in the money (ITM), meaning the price of the underlying asset is favorable for exercising the option. Factors such as the volatility of the underlying asset, interest rates, and time to expiration influence the premium.

Empowering Investors with Flexibility

Options trading empowers investors with remarkable flexibility, enabling them to:

- Speculate on Market Movements: Options allow you to profit from correctly predicting the future price direction of an asset, regardless of whether it is rising or falling.

- Hedge Risk: Options can serve as protective instruments, mitigating potential losses on other investments during market downturns.

- Enhance Returns: Options offer the potential to generate outsized returns, albeit with higher risk levels than traditional investments.

Image: patternswizard.com

Navigating the Evolving Landscape

As markets evolve, so too do the strategies and instruments available in options trading. One notable trend is the rise of exchange-traded funds (ETFs) that track options indices, providing investors with diversified exposure to the options market.

In addition, advancements in technology have spurred the development of sophisticated trading platforms that empower investors with real-time market data, analytical tools, and customized options strategies. These tools can significantly enhance the efficiency and effectiveness of options trading.

Tips and Expert Insights

To maximize your success in options trading, heed the following tips and expert advice:

- Start with Small Positions: As a beginner, it is prudent to trade small positions until you gain a firm understanding of the market dynamics.

- Focus on Education: Dedicate time to studying options trading strategies, risk management techniques, and market analysis.

- Manage Your Risk: Options trading can be a high-risk endeavor, so establish clear risk management parameters before initiating any trades.

Frequently Asked Questions (FAQs)

To clarify lingering queries, here are answers to commonly asked questions about options trading:

- Q: What is the difference between an option and a stock?

A: Unlike stocks, options do not represent ownership in an underlying asset. Instead, they convey the right to buy (call) or sell (put) the underlying asset at a predetermined price within a specified time frame. - Q: How much money can I make from options trading?

A: The potential returns from options trading are uncapped, but so are the risks. Your earning potential is influenced by the accuracy of your market predictions and your risk management strategies. - Q: Is options trading suitable for all investors?

A: Options trading is not without its risks and complexities. It is advisable to have a solid understanding of financial markets, risk management, and investment strategies before embarking on this type of trading.

Options Trading Platform Blog

Image: www.tradestation.io

Embark on Your Options Trading Journey

The world of options trading awaits your exploration. With informed decisions, calculated risk-taking, and a relentless pursuit of knowledge, you can navigate this dynamic landscape and unlock the potential for significant returns. Embrace the learning curve, refine your strategies over time, and conquer the world of options trading.

Are you ready to embark on this captivating journey? Let your passion for financial markets guide you as you set sail into the uncharted waters of options trading.