Have you ever dreamt of multiplying your investments with a dash of calculated risk? Welcome to the world of options trading, a potent financial tool that can empower you to seize market opportunities and potentially turbocharge your portfolio’s growth. If you’re a novice in this realm, this comprehensive guide will serve as your trusty roadmap, laying out the basics of option trading in a clear and captivating manner. Get ready to delve into the dynamic world of options and ignite your financial potential.

Image: tradingfuel.com

Understanding the ABCs of Options Trading

In the labyrinth of financial instruments, options stand out as contracts that grant the holder the “option” – but not the obligation – to buy (in the case of “calls”) or sell (in the case of “puts”) an underlying asset at a predetermined strike price on or before a specified expiration date. Imagine them as lottery tickets, granting you the right to buy or sell an asset at a fixed price, whether the market favors you or not.

Now, let’s break down the key players in the options trading arena:

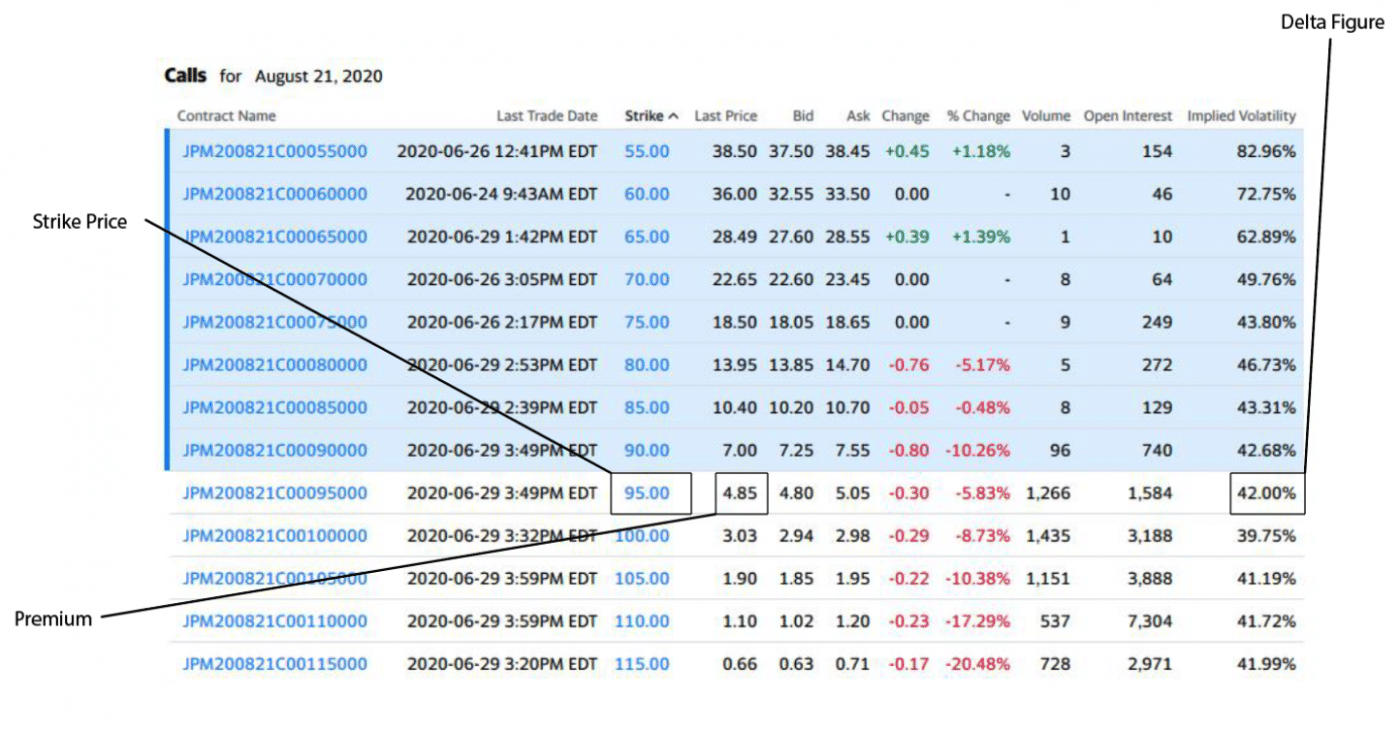

- Premiums: The price you pay to enter into an options contract. Think of it as the admission fee to the options trading game.

- Underlying asset: The financial instrument (stocks, bonds, indices, commodities) upon which the option is based. It’s like the main event you’re placing your bet on.

- Strike price: The predetermined price at which you can buy (for calls) or sell (for puts) the underlying asset using the option.

- Expiration date: The D-day when the option contract expires, rendering it worthless unless exercised.

Taming the Wild West of Option Strategies

Options trading offers a vast landscape of strategies, each tailored to distinct market sentiments and risk appetites. Let’s explore some of the most popular:

- Buying Calls: A bullish strategy, betting on the underlying asset’s price to rise. It’s like buying a ticket to a concert you believe will sell out.

- Selling Calls: A bearish strategy, wagering on the underlying asset’s price to fall. It’s like selling tickets to a concert you think will flop.

- Buying Puts: Another bearish strategy, speculating on the underlying asset’s price to drop. Think of it as buying insurance against a rainy day.

- Selling Puts: A bullish strategy, banking on the underlying asset’s price to climb. It’s like offering to buy tickets from someone who desperately wants to sell.

Empowering Insights from Market Gurus

“Options trading is not a magical wand that conjures profits out of thin air. It requires a deep understanding, disciplined risk management, and a healthy dose of patience,” advises renowned trader Mark Douglas, emphasizing the importance of educating oneself before venturing into the options market.

Echoing this sentiment, options expert Nassim Taleb cautions, “Options carry inherent risks, especially for the uninformed. Always remember: never bet more than you can afford to lose.”

Image: club.ino.com

Navigating the Ebb and Flow of Market Sentiment

The options market is an ever-shifting ocean, influenced by a myriad of factors, including economic indicators, geopolitical events, and the collective emotions of investors. Understanding market sentiment is pivotal in making informed trading decisions.

When optimism permeates the air, investors tend to buy call options, anticipating prices to surge. Conversely, during pessimistic times, investors flock to put options, hedging against potential downturns. It’s crucial to keep a keen eye on market trends and adjust your strategies accordingly.

Trading Psychology: The Art of Emotional Mastery

Options trading is not merely an intellectual exercise; it’s a battleground where emotions can wreak havoc. Fear of missing out (FOMO) and the allure of quick profits can cloud judgment, leading to impulsive decisions. Cultivating emotional discipline is paramount.

Adopt a calm and analytical approach, embracing a long-term perspective. Remember, Rome wasn’t built in a day, and neither are sustainable profits.

Unveiling the Option Trading PDF for Beginners

To further empower your options trading journey, we’ve meticulously crafted a comprehensive PDF guide, “Option Trading for Beginners: A Step-by-Step Blueprint.” This invaluable resource will guide you through the labyrinth of option trading, providing a solid foundation and essential insights to navigate the market confidently.

Within this guide, you’ll discover:

- In-depth explanations of key concepts and strategies, simplified for easy comprehension.

- Real-world examples to illustrate the practical application of options trading.

- Expert strategies from seasoned traders to enhance your trading acumen.

- Risk management techniques to safeguard your investments and minimize potential losses.

- Tips and tricks to maximize your chances of success in the options market.

Option Trading Pdf For Beginners

Unlocking the Promise of Option Trading

Options trading is a powerful tool that can amplify your investment returns and hedge against market fluctuations. However, it’s essential to approach it with knowledge, discipline, and emotional fortitude. Let this comprehensive guide serve as your beacon, illuminating the path to informed decision-making and empowering you to unlock the vast potential of option trading.

Remember, in the world of finance, knowledge is power. Embrace the opportunity to delve into the intricacies of option trading and emerge as a confident and capable investor. This guide is your key to unlocking financial freedom and seizing the opportunities that lie ahead.