It’s no secret that options trading can be a lucrative venture, but only if you have a solid plan in place. Without a well-thought-out strategy, you’re setting yourself up for failure. That’s where this options trading plan pdf comes in. This detailed guide will walk you through everything you need to know about options trading, from the basics to advanced strategies.

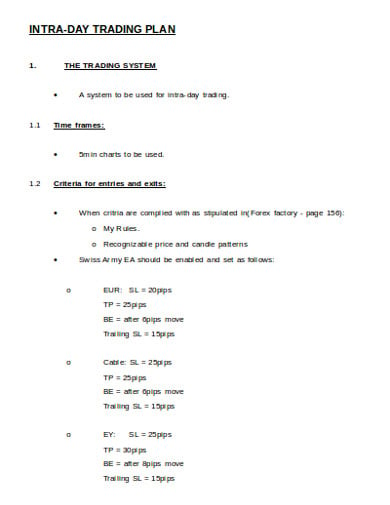

Image: www.template.net

Understanding Options Trading

Options trading is a complex but rewarding investment strategy that allows you to speculate on the future price of an underlying asset without having to buy or sell it outright. Options are contracts that give you the right (but not the obligation) to buy or sell a specific asset at a predetermined price within a certain time frame.

Types of Options

There are two main types of options: calls and puts. Call options give you the right to buy an asset at a specific price on or before a certain date. Put options, on the other hand, give you the right to sell an asset at a specific price on or before a certain date.

Options Trading Strategies

There are countless options trading strategies out there, each with its own risk and reward profile. Some of the most popular strategies include:

- Long Calls: Buying a call option gives you the right to buy an asset at a specific price in the future. If the asset’s price increases, you can exercise your option and buy the asset at a profit.

- Short Calls: Selling a call option gives you the obligation to sell an asset at a specific price in the future. If the asset’s price decreases, you can buy the asset at a lower price and fulfill your obligation without a loss.

- Long Puts: Buying a put option gives you the right to sell an asset at a specific price in the future. If the asset’s price decreases, you can exercise your option and sell the asset at a profit.

- Short Puts: Selling a put option gives you the obligation to buy an asset at a specific price in the future. If the asset’s price increases, you can sell the asset at a higher price and fulfill your obligation without a loss.

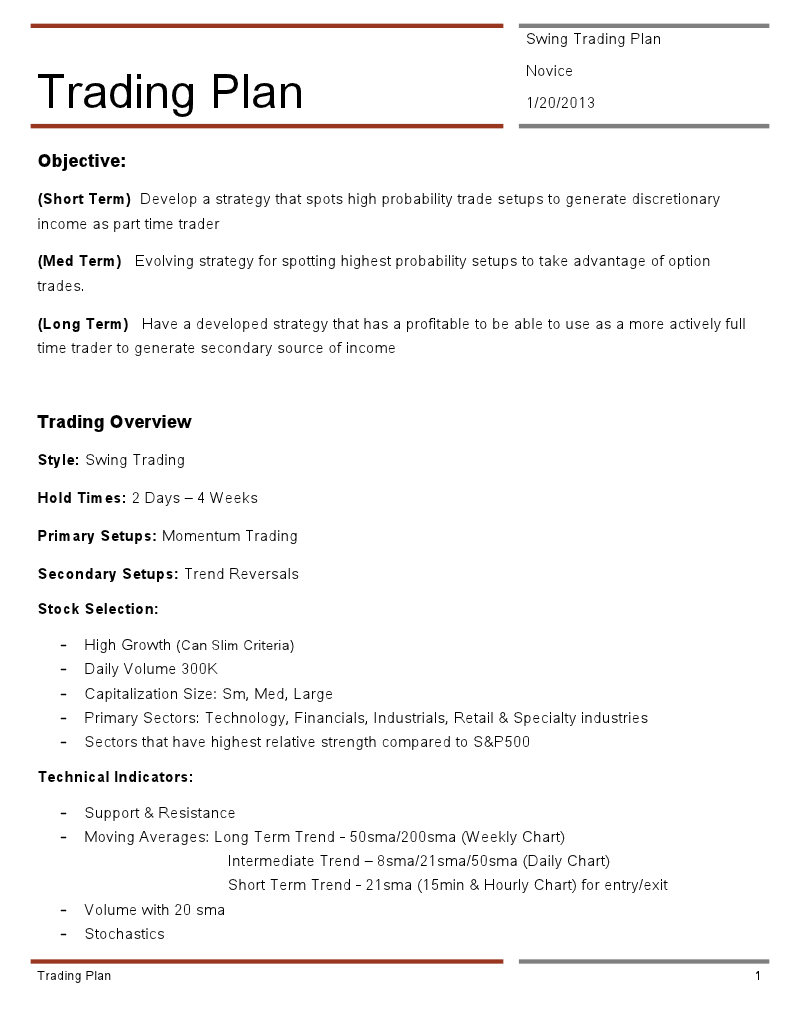

Options Trading Plan

Now that you have a basic understanding of options trading, it’s time to develop your own trading plan. A trading plan is a set of rules that you will follow when trading options. Your plan should include the following:

- Your goals: What do you hope to achieve with options trading? Are you looking to make a quick profit or build long-term wealth?

- Your risk tolerance: How much money are you willing to lose?

- Your trading strategy: Which options trading strategies will you use?

- Your trading discipline: How will you stick to your trading plan?

Conclusion

Options trading can be a great way to supplement your income or build long-term wealth. However, it’s important to remember that there is always risk involved. By following the advice in this options trading plan pdf, you can increase your chances of success and minimize your risk.

Additional Resources

Image: theimpatienttrader.blogspot.com

Options Trading Plan Pdf

Image: www.youtube.com