In the realm of finance, where risk and reward intertwine, options trading presents a fascinating avenue for investors to navigate market fluctuations and potentially reap substantial returns. By harnessing the computational prowess of Jupyter, a versatile open-source platform, traders can unlock a world of insights and empower their options trading strategies like never before.

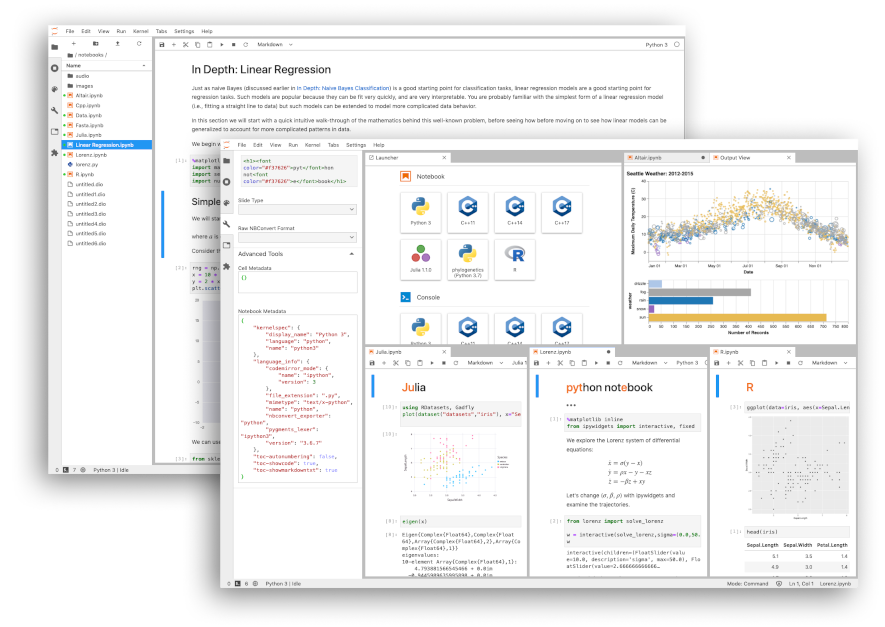

Image: jupyter.org

Jupyter, a notebook-based environment, has emerged as a game-changer in the field of data science and financial analysis. Its interactive nature allows users to seamlessly blend code, visualizations, and narrative text, fostering a collaborative and exploratory approach to data exploration and model development.

Delving into Options Trading Basics

Options trading involves the buying or selling of contracts that confer the right, but not the obligation, to purchase (call options) or sell (put options) an underlying asset, such as stocks, indices, or commodities, at a specified price (strike price) on or before a defined expiration date. Options provide traders with the flexibility to speculate on the future direction of an asset’s price without having to own it outright.

Leveraging Jupyter for Options Trading Analysis

Jupyter empowers options traders by enabling them to:

- Automate data acquisition: Gather real-time market data from sources like Yahoo Finance or Quandl, ensuring up-to-date information for analysis.

- Visualize complex data: Create interactive charts and dashboards to visualize historical price patterns, trading volume, implied volatility, and other key metrics, providing a comprehensive view of market dynamics.

- Develop and test trading strategies: Jupyter allows traders to implement sophisticated trading strategies, backtest them using historical data, and optimize their parameters to maximize profitability.

- Collaborate and share insights: Jupyter Notebooks are shareable, enabling traders to collaborate with colleagues, share ideas, and learn from each other’s experiences.

A Journey of Exploration and Discovery

With these powerful capabilities, Jupyter has transformed options trading into a data-driven endeavor, Opening new avenues for traders to refine their decision-making, mitigate risk, and potentially enhance their returns.

Here are some compelling applications of Jupyter in options trading:

- Implied volatility analysis: Model and visualize implied volatility surfaces to identify potential opportunities for trades based on market expectations.

- Option pricing models: Implement and compare different option pricing models, such as the Black-Scholes model, to determine fair value and assess potential profitability.

- Monte Carlo simulations: Run Monte Carlo simulations to simulate possible market scenarios and evaluate the performance of trading strategies under various conditions.

- Machine learning for options trading: Explore machine learning techniques, such as regression and classification, to identify patterns and predict future market movements.

Conclusion

Options trading with Jupyter is a transformative toolkit that arms traders with the power of data and computation. By seamlessly integrating data exploration, analysis, and visualization, Jupyter empowers traders to make informed decisions, adapt to dynamic market conditions, and achieve their financial goals. As the field of options trading continues to evolve, Jupyter will undoubtedly remain an indispensable tool, propelling traders to the forefront of innovation and success.

Image: capluky.blogspot.com

Options Trading Jupyter

Image: mathigon.org