Introduction

Step into the intriguing world of options trading in foreign exchange (forex) and unlock a realm of opportunities where savvy traders navigate currency fluctuations to maximize gains. Options contracts offer a potent toolset, empowering traders with the flexibility to manage risk and potentially profit from both rising and falling markets.

Image: enrichest.com

In this comprehensive guide, we will delve into the intricacies of options trading in forex, exploring foundational concepts, strategies, and cutting-edge developments that will empower you to harness the strength of the options market in your trading endeavors.

Understanding Options Contracts

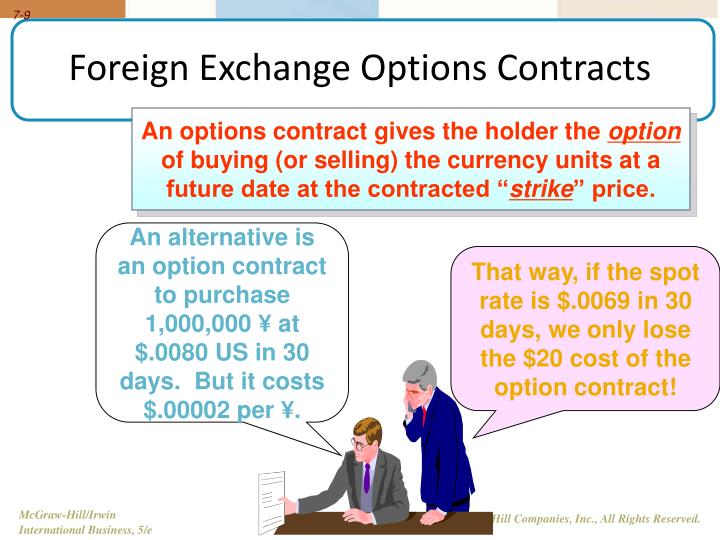

An options contract grants the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specified amount of an underlying asset at a predetermined price (known as the strike price) on or before a specified date (the expiration date).

In forex options trading, the underlying asset typically comprises a currency pair, such as EUR/USD or GBP/JPY. By purchasing an options contract, traders can gain exposure to currency movements without the need to own the underlying currency outright, providing greater flexibility and potential leverage.

Options Strategies and Applications

The versatility of options contracts allows for a wide range of trading strategies. Common strategies include:

- Covered Calls: Selling call options against underlying currency pairs already owned, generating additional income while limiting potential upside.

- Protective Puts: Buying put options to hedge against potential losses in volatile markets or to protect existing positions.

- Currency Straddles: Purchasing both call and put options at the same strike price and expiration date to capitalize on expected market volatility.

- Iron Condors: A combination of bull and bear strategies involving selling options at either end of a range and buying options closer to the middle, profiting from limited price movement.

Risk Management and Trade Execution

Risk management is paramount in options trading. Traders should carefully consider the potential risks, including time decay, volatility, and adverse price movements. Stop-loss orders and position-sizing strategies can help mitigate losses and protect trading capital.

Execution of options trades involves selecting the appropriate broker, determining the option premium (the price to purchase the contract), and managing the contract until expiration or closing.

Image: s3.amazonaws.com

Latest Developments and Market Trends

The forex options market is constantly evolving, with new strategies and technological advancements emerging. Notable trends include:

- Growth in Digital Options: The rise of binary and touch options, offering simpler trading mechanisms and potential for high returns.

- Increased Automation: The advent of sophisticated trading platforms that automate trade execution, risk management, and technical analysis.

- Emerging Markets: Expansion of options trading in non-traditional currency pairs, providing diversification and new opportunities.

Options Trading Foreign Exchange

Image: ykewobuzyjeca.web.fc2.com

Conclusion

The world of options trading in foreign exchange presents a vast and lucrative landscape for discerning traders. By equipping yourself with the knowledge, strategies, and risk management principles outlined in this article, you can navigate the complexities of forex markets and harness the power of options contracts to enhance your trading outcomes. Whether you seek income generation, hedging against risks, or exploiting market volatility, options trading offers an empowering set of tools.

Remember to continuously educate yourself on the latest trends, monitor market conditions, and trade responsibly. As with any investment, options trading carries inherent risks, but through careful planning and execution, you can seize the opportunities that lie within this dynamic and rewarding market.