Insights from the Trading Arena: Double Calendar Strategies Unveiled

In the dynamic world of options trading, strategy reigns supreme. The double calendar spread, a versatile strategy, has captivated seasoned traders with its multifaceted nature. Let’s embark on a journey to uncover the intricacies of this technique.

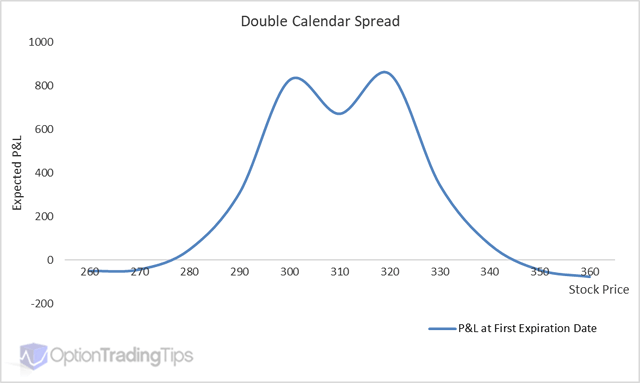

Image: www.optiontradingtips.com

Understanding the Double Calendar: A Comprehensive Overview

A double calendar involves simultaneously buying and selling calls and puts with different expiration dates while maintaining the same underlying asset and strike price. For instance, a trader may buy one call expiring in March and sell another call expiring in June, while simultaneously buying one put expiring in March and selling another put expiring in June.

The beauty of the double calendar lies in its nuanced approach, adjusting to market conditions. Traders can construct bullish, bearish, or neutral positions by altering the strike prices and expiration dates of their calls and puts. This strategic flexibility empowers traders to navigate market volatility and tailor their strategies to market movements.

Unveiling the Nuances: Crafting a Successful Double Calendar Strategy

Crafting a successful double calendar strategy requires meticulous planning and an in-depth understanding of market dynamics. Determining the appropriate strike prices based on implied volatility, trading around earnings announcements, and scrutinizing historical data patterns can significantly improve your chances of success.

For a bullish double calendar, traders seek to profit from an underlying asset’s rise in value. This involves buying calls at a lower strike price and selling calls at a higher strike price. Simultaneously, the trader buys puts at a lower strike price and sells puts at a higher strike price. This strategy benefits from the underlying asset’s price rising while mitigating risk through the sale of puts.

In contrast, a bearish double calendar strategy aims to capitalize on a decline in the underlying asset’s value. Here, traders buy puts at a higher strike price and sell puts at a lower strike price. They also buy calls at a lower strike price and sell calls at a higher strike price. This strategy profits from the underlying asset’s falling price and provides downside protection through the sale of calls.

Navigating the Market Pulse: Trends and Developments in Double Calendar Trading

The double calendar strategy has evolved alongside the ever-changing market landscape. Social media platforms and forums provide traders with real-time insights into market sentiment and technical analysis updates. These platforms foster a collaborative environment where traders share experiences, insights, and trading ideas.

Moreover, the advent of mobile trading apps has made it convenient to execute double calendar trades on the go, offering traders unparalleled flexibility and responsiveness to market fluctuations.

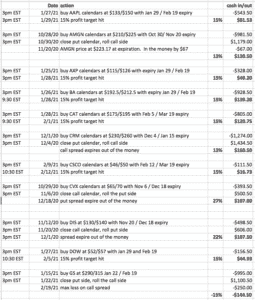

Image: www.pinterest.com

Expert Advice: Tips for Enhancing Your Double Calendar Strategy

1. Embrace Dynamic Adjustments: Market conditions are fluid; adapting your double calendar strategy accordingly is crucial. Monitor market movements closely and make adjustments as needed to optimize performance.

2. Master Trade Parameters: Define clear profit targets and stop-loss limits before executing any trade. This disciplined approach ensures responsible risk management.

Options Trading Double Calendar

Image: optionstradingiq.com

FAQ on Double Calendar Trading: Empowering Questions Answered

Q: Is a double calendar strategy suitable for both beginners and experienced traders?

A: While double calendar strategies offer flexibility, they require a solid understanding of options trading. Beginners are advised to gain experience and consult with experts before employing this strategy.

Q: What is the optimal holding period for a double calendar strategy?

A: The holding period varies based on the trader’s goals and market conditions. Generally, traders hold double calendar positions for a few weeks to several months.

Conclusion: Unleashing the Power of Double Calendar Strategies

The double calendar strategy has proven its worth in the realm of options trading. By harnessing its versatility and adaptability, traders can navigate market fluctuations and pursue profit opportunities. Whether you’re a seasoned trader or venturing into the world of options, consider incorporating this strategy to unlock its potential.

Do you find double calendar trading strategies intriguing? Are you eager to explore this technique further? Share your thoughts and experiences in the comments section below. Let’s continue the conversation and delve deeper into the exciting world of options trading.