In the realm of financial markets, there exists a versatile instrument known as an option—a contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a particular date. This intricate mechanism opens doors to a wide array of investment strategies, empowering traders to navigate market volatility and pursue both protection and profit.

:max_bytes(150000):strip_icc()/StockOption_source-7a5ecb0c22a04d759e283596e7e64905.jpg)

Image: www.investopedia.com

Comprehending the nuances of options trading requires an understanding of their fundamental mechanics. Simply put, options involve two parties: the buyer, who acquires the right to execute the contract, and the seller, who assumes the obligation (albeit not the guarantee) to fulfill the contract if the buyer chooses to exercise it. The buyer pays a premium to the seller in exchange for this granted right.

The underlying asset in an options contract can take various forms, encompassing stocks, bonds, commodities, currencies, and even indices. The predetermined price at which the buyer can execute the contract is referred to as the strike price. The date on which the contract expires, marking the final opportunity for the buyer to exercise their right, is known as the expiration date.

Options trading presents a spectrum of opportunities for both seasoned investors and those seeking a nuanced approach to market participation. For instance, buying a call option (a contract granting the right to buy) allows traders to capitalize on the potential upside of an underlying asset, while selling a call option provides income if the asset’s price remains below the strike price. Conversely, buying a put option (a contract granting the right to sell) hedges against potential losses or enables investors to speculate on an asset’s price decline, while selling a put option generates income if the asset’s price holds firm or ascends.

In conclusion, options trading unveils a sophisticated and potent instrument for harnessing market dynamics and pursuing diverse investment objectives. Through their inherent flexibility, options empower traders to refine their strategies, manage risk, and unlock the potential for both protection and profit. Whether seeking to enhance returns, mitigate risks, or simply explore new avenues in the financial markets, options trading beckons investors with a world of possibilities and empowers them to navigate the ever-evolving complexities of modern finance.

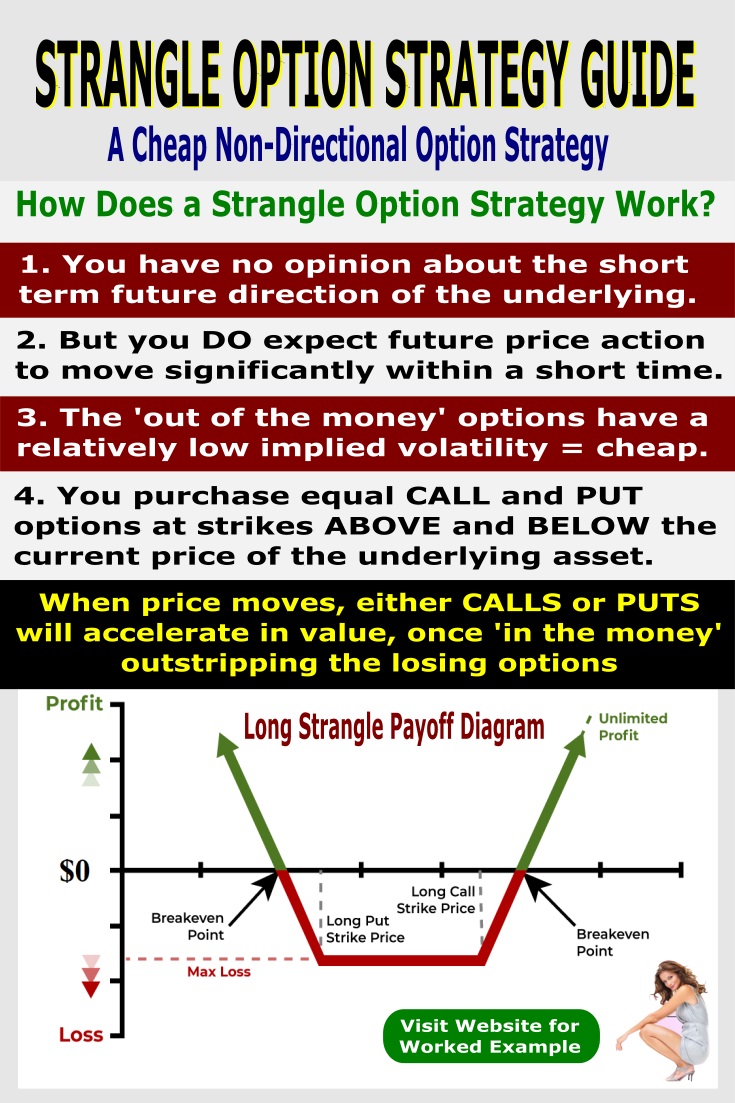

Image: www.options-trading-mastery.com

Options Trading Def

Image: www.tradethetechnicals.com