Unleashing the Power of Options: A Personal Odyssey

The labyrinthine realm of options trading held me captive in its enigmatic web. Eager to unravel its mysteries, I embarked on an arduous journey to decipher the cryptic language of Greeks. Little did I know this pursuit would ignite a beacon of understanding, guiding my navigation through the tumultuous seas of volatility.

Image: tradeoptionswithme.com

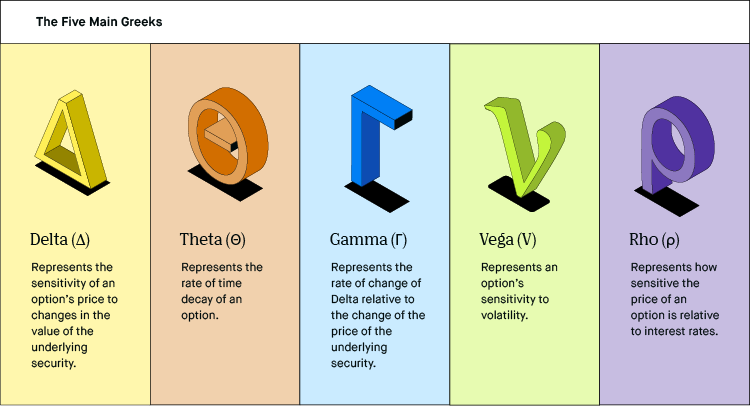

Understanding Greeks: The Gatekeepers of Option Valuations

Greeks, the enigmatic characters of the options universe, are intricate mathematical formulae that quantifies an option’s sensitivity to various market factors. Armed with this knowledge, I uncovered the hidden forces shaping option values, empowering me with unparalleled precision in market analysis and risk management.

Key Greeks: Unraveling the Greek Alphabet

- Delta: Representing the rate of change in option price for a given change in underlying asset price, Delta serves as a crucial parameter for determining price sensitivity.

- Gamma: Gauging the Delta’s rate of change in response to underlying movements, Gamma illuminates the curvature of the option’s price surface.

- Theta: A time-sensitive measure, Theta unveils the impact of time decay on option value as the clock tics relentlessly toward expiration.

- Vega: A measure of an option’s sensitivity to changes in implied volatility, Vega unlocks the potential impact of heightened market volatility on option pricing.

Masterpiece of Precision: Assessing Market Movements

Harnessing the power of Greeks, I parried the unpredictable nature of market swings. Delta, like a loyal compass, guided me in gauging the potential impact of asset price changes, empowering me with strategic choices for managing positions. Gamma’s intricate calculations revealed the dynamic relationship between Delta and underlying price movements, allowing me to craft tailored hedging strategies that stood the test of volatile waters.

Image: learn.robinhood.com

Contemporary Currents: Navigating the Ebb and Flow of Options

The relentless tides of the financial markets have witnessed the emergence of new strategies, such as volatility trading and delta-neutral hedging, that leverage the intricate interplay of Greeks. Volatility indices, gauges of market sentiment and uncertainty, now play a central role in risk assessment, empowering traders to adjust their sails to the prevailing wind.

Expert Guidance: Unraveling the Enigma

Seeking wisdom from seasoned traders, I gleaned invaluable insights and honed my understanding of Greeks. They emphasized the significance of dynamic hedging, where Greeks are continuously monitored and adjusted to maintain desired exposure, ensuring agility in a swiftly evolving market landscape.

Frequently Asked Questions: Illuminating the Shadows

Q: How do I calculate Greeks?

A: Greeks can be calculated using mathematical formulae or obtained from financial data providers. They are indispensable tools for evaluating option performance.

Q: Can Greeks predict option values with certainty?

A: While Greeks provide invaluable insights, they remain mathematical constructs subject to underlying assumptions and market dynamics, necessitating cautious interpretation.

Greeks In Option Trading

Conclusion

Greeks, the enigmatic gatekeepers of option valuations, have unveiled the secrets of volatility, empowering me with the precision to navigate the tumultuous seas of the markets. Their ability to quantify risk and uncover market sensitivities has transformed my trading journey, igniting a passion for continuous learning and refinement.

Are you ready to embark on your own odyssey of options mastery? Join me in unlocking the secrets of these financial alchemy, harnessing their power to conquer the challenges of the market landscape.