Introduction

Embark on the enigmatic world of options trading in California, where savvy investors leverage contracts to navigate the complexities of the financial markets. Options, financial instruments that grant the right but not the obligation to buy or sell an underlying asset at a specified price, empower traders with unparalleled flexibility and potential rewards. This comprehensive guide unravels the intricacies of options trading, equipping you with a foundation to harness its power.

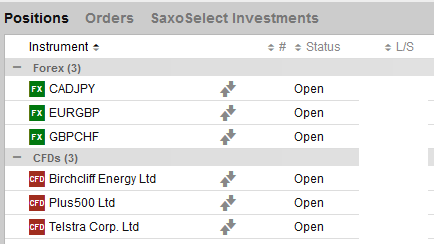

Image: www.fxstreet.com

California, a hub of innovation and venture capital, presents an ideal backdrop for options trading. With its proximity to major financial centers and a thriving startup ecosystem, the state offers a fertile environment for investors seeking to unlock new avenues of wealth creation. Dive into the world of options and unlock the potential to elevate your financial game.

Understanding Options Basics

Options trading involves two primary types of contracts: calls and puts. Calls give the holder the option to buy an underlying asset (e.g., a stock) at a specific price (the strike price) on or before a set date (the expiration date). Puts, on the other hand, grant the holder the right to sell an underlying asset at the strike price. Whether you choose to buy or sell an option, you pay a premium, a fee that entitles you to exercise this right.

The value of an option is influenced by several factors, including the price movement of the underlying asset, time remaining until expiration, interest rates, and volatility (a measure of price fluctuations). Understanding these factors is crucial for making informed trading decisions.

Types of Options Strategies

Options offer a vast array of strategies tailored to different investment goals and risk appetites. Covered calls, for example, involve selling a call option while owning the underlying asset, generating premium income and potentially limiting downside risk. Naked calls, on the other hand, involve selling a call option without holding the underlying asset, amplifying both potential profits and risks.

Traders may also employ spreads, which involve buying and selling options with different strike prices or expiration dates. Spreads can be crafted to limit risk and enhance precision in targeting specific market outcomes.

Options Trading in Action

To illustrate options trading, consider a scenario where a trader anticipates a stock’s rise in value. They could buy a call option with a strike price slightly above the current stock price. If the stock price rises beyond the strike price by the expiration date, the trader can exercise the option to buy the stock at the favorable strike price, realizing a profit.

<pConversely, if a trader expects a stock’s decline, they could purchase a put option with a strike price below the current stock price. If the stock price falls, the trader can exercise the option to sell the stock at the higher strike price, mitigating losses.

Image: www.angelone.in

Risk Management in Options Trading

While options trading presents opportunities for substantial returns, it is imperative to recognize the risks involved. Careful risk management is paramount to safeguarding your capital. Always define clear entry and exit points for each trade, and never invest more than you can afford to lose.

Implied volatility, a crucial indicator of expected price fluctuations, should be carefully assessed before entering an option position. Higher volatility generally leads to higher option premiums and amplified potential profits, but it also magnifies the risk of significant losses.

Finding the Right Broker

Selecting a reputable broker is crucial for a successful options trading journey. Look for a broker that offers a user-friendly platform, comprehensive trading tools, and competitive commissions. Consider the broker’s experience in options trading and their ability to provide guidance and support.

Regulations in California, overseen by the Department of Financial Protection and Innovation, ensure investor protection and fair play in options trading. Always verify a broker’s compliance with these regulations for peace of mind.

Education and Resources

Embracing continuous education is essential for success in options trading. Attend workshops, read books, and engage with online forums to deepen your understanding of market dynamics and trading strategies. Numerous reputable resources provide valuable insights and educational materials to enhance your knowledge.

Engage with experienced professionals, seek mentorship opportunities, and stay abreast of the latest market news and trends. Continuous learning fuels your growth and enables you to adapt to evolving market conditions.

Options Trading California

Image: utahpulse.com

Conclusion

Options trading in California empowers investors with a versatile tool to amplify returns and navigate financial markets. By grasping the fundamentals, embracing risk management, and seeking continuous education, you can unlock the potential of this dynamic investment strategy. Remember, success in options trading requires discipline, a keen understanding of market dynamics, and unwavering pursuit of knowledge. Embrace the journey, trade wisely, and seize the opportunities presented by this captivating world of financial exploration.