Understanding options trading can be a daunting task, but with the right guidance, it’s possible to embark on this journey successfully. Bill Johnson’s 2007 book, “Options Trading 101,” serves as a cornerstone for those seeking knowledge in this field. Join us as we explore the fundamentals of options trading, from theory to practical application, and delve into the insights shared by Bill Johnson.

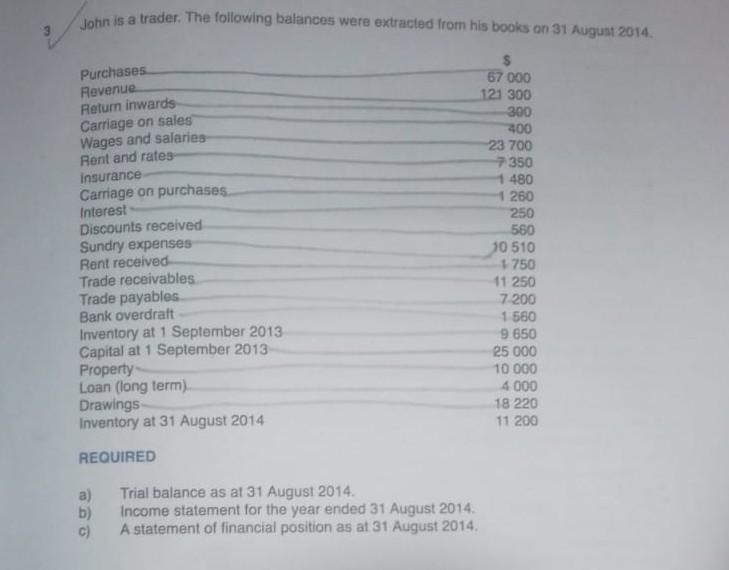

Image: www.chegg.com

Overview: Unveiling Options Trading

Options are financial instruments that provide the buyer the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a specific price (strike price) on or before a particular date (expiration date). These instruments offer flexibility and the potential for significant returns, but they also come with their own set of risks.

Historical Roots and Significance

Options trading has a rich history that dates back centuries. Merchants would engage in “options” on commodities to hedge against price fluctuations, ensuring a fair price for their goods. Over time, options evolved into standardized contracts traded on exchanges, providing a regulated platform for investors to manage risk and speculate on market movements.

The Power of Options

Options offer a versatile tool for investors with varying objectives. They enable individuals to:

- Manage Risk: Hedge against potential losses by purchasing put options or limit exposure to gains by selling call options.

- Speculate on Market Movements: Capitalize on predicted price changes by purchasing call options (expecting a rise in price) or put options (expecting a decline in price).

- Generate Income: Sell options and collect premiums to generate additional returns.

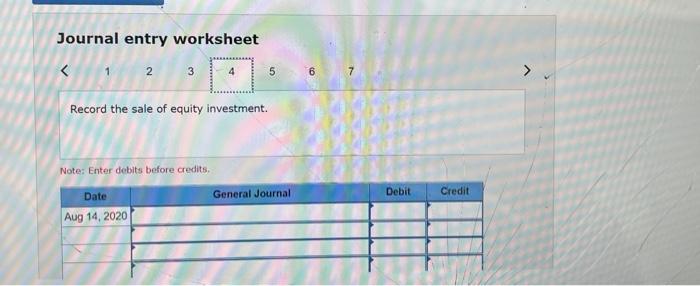

Image: www.chegg.com

Keys to Options Trading Success

Before venturing into options trading, it’s essential to grasp the fundamental concepts and strategies. Bill Johnson emphasizes the importance of understanding option pricing models, such as the Black-Scholes model, and using technical analysis to identify potential trading opportunities. Patience and discipline are also crucial, as options trading requires careful evaluation and risk management.

Decoding Option Jargon

Options trading can be a jungle of unfamiliar terms. Delve into the glossary below to master the lingo:

- Call Option: Gives the holder the right to buy the underlying asset at the strike price.

- Put Option: Grants the holder the right to sell the underlying asset at the strike price.

- Premium: The price paid to purchase an option contract.

- Strike Price: The predetermined price at which the underlying asset can be bought (call option) or sold (put option).

Trends Shaping the Options Market

Options trading is constantly evolving, driven by advancements in technology and changes in market dynamics. Analysing news updates, social media platforms, and market forums allows traders to stay abreast of the latest trends and developments, such as the rising popularity of Exchange-Traded Funds (ETFs) and the increasing use of algorithmic trading.

Expert Insights and Practical Advice

Bill Johnson’s expertise in options trading shines through in his book. He offers valuable insights and advice to enhance your trading acumen:

- Start Small: Begin with small trades and gradually increase the size as experience grows.

- Trade Options on Understandable Assets: Stick to underlying assets that are familiar and align with investment goals.

- Manage Risk: Prioritize risk management by using stop-loss orders and carefully calculating potential profit and loss.

Frequently Asked Questions

Q: What are the advantages of options trading?

A: Options provide flexibility, potential for high returns, and risk management tools.

Q: How do I get started with options trading?

A: Educating oneself through books and online resources, practicing with virtual trading simulators, and seeking guidance from experienced traders are recommended.

Q: Is options trading suitable for beginners?

A: While options offer various benefits, they do carry inherent risks. Beginners are advised to start with small trades, understand the underlying concepts, and seek professional guidance if needed.

Options Trading 101 From Theory To Applicationbill Johnson 2007

Image: www.walmart.com

Conclusion: Empowerment Through Options Knowledge

Navigating the complexities of options trading requires a thorough understanding of the fundamentals, prevailing trends, and expert advice. Bill Johnson’s book, “Options Trading 101,” serves as a comprehensive guide, empowering aspiring traders with the knowledge and insights necessary to embark on this journey. By embracing a structured approach, managing risk, and continuously seeking knowledge, individuals can unlock the potential of options trading to supplement their investment strategies.

Are you intrigued by the possibilities of options trading? Share your thoughts and questions in the comments below, and let’s explore the world of options together!