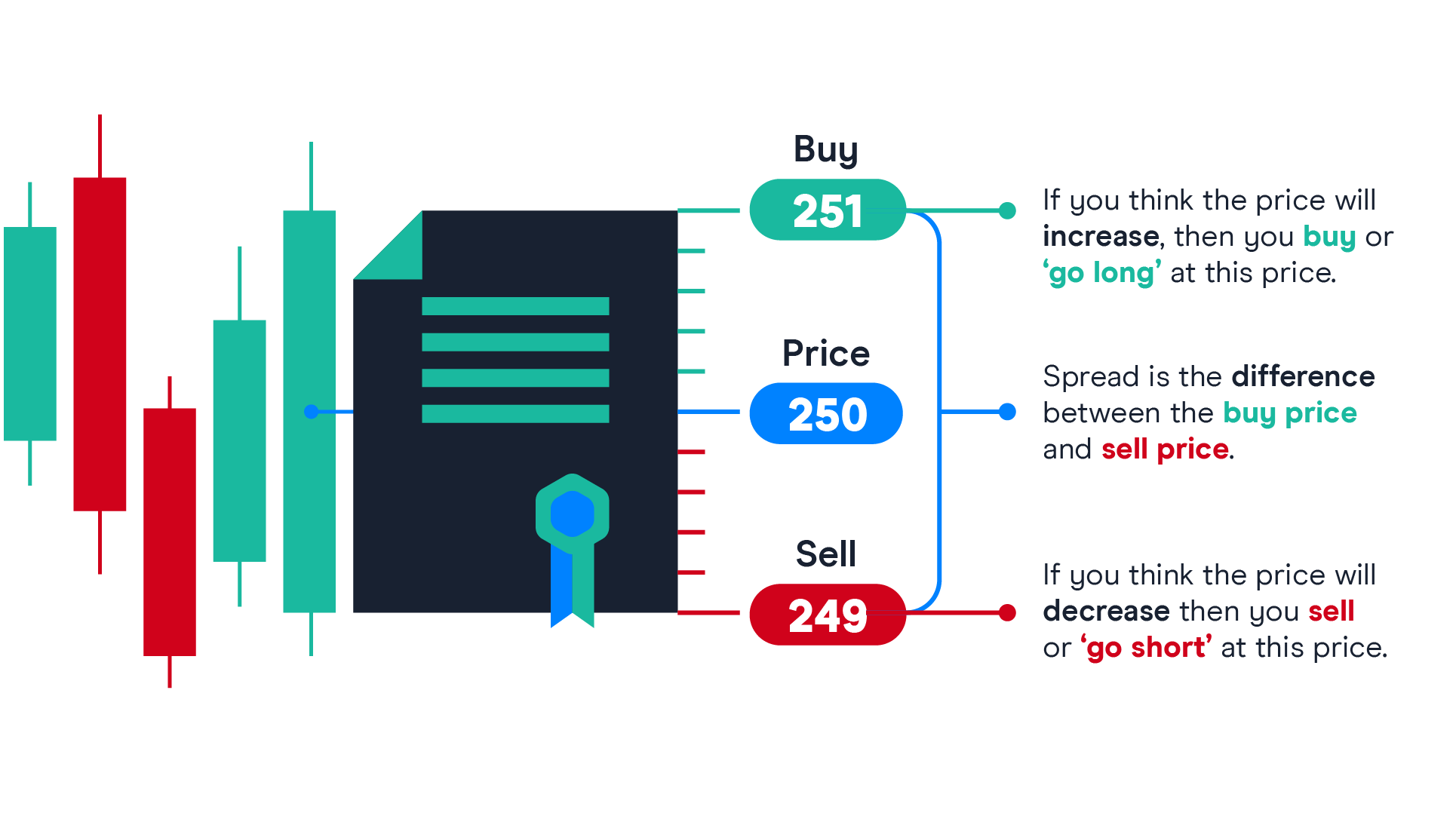

Options spandi ts of part of a profit making strategy for some traders. With options trading systems, you buy or sell regardless of your initial plan based on the trader’s execution system.

Image: www.cmcmarkets.com

Based on the market activity and user’s risk tolerance, the options spread trading system may either be bought or sold. This is based on their entry and exit points and is a versatile trading strategy. This is because they provide both limited risk as well as profit potential.

Understanding Exit Strategies

Exiting an Options Spread Trade

There is no magic bullet in spread trading but cutting your losses quickly is one of the key tenets of successful trading. It’s important to have a plan for exiting your options spread trades before you enter them. The two main types of exits are:

- Target Profit Exit:** This is where you sell your spread when it reaches a certain profit target.

- Stop-Loss Exit:** This is where you exit your trade when it reaches a certain loss limit.

Tips for Exiting Options Spread Trades

Here are a few tips for exiting your options spread trades effectively:

- Have a plan:** Before you enter a trade, you should have a clear idea of your profit target and stop-loss level. This will help you make rational decisions when the time comes to exit.

- Be disciplined:** It’s important to stick to your trading plan. Don’t let emotions get in the way of your decision-making.

- Use limit orders.** Limit orders can help you get the price you want when you exit your trade. This can help you reduce your risk and lock in your profits.

- Don’t be afraid to take small losses.** Cutting your losses quickly is one of the most important keys to successful options spread trading.

Image: www.optionsbro.com

FAQ on Options Spread Trading Exits

Q: What’s the best way to determine where to exit?**

A:** The best way to determine where to exit is to have a risk/reward trade strategy for each trade you enter.

Q: Can you edit or change the exits in your spread trading system?

A:** Yes, spread trades can be edited or exited early, but because of the complex calculations in their risk graphs, it is best to terminate and re-enter the system for a profitable exit.

Q: What is the most important thing to remember about spread trading exits?

A:** The most important thing to remember is to have a plan of entry and exit before you enter any trade.

Options Spread Trading System Exits

Image: topratedfirms.com

Conclusion

Exiting an options spread trade is an important decision that can impact your profitability. By following the tips above, you can improve your chances of successful exits.

Are you interested in learning more about options spread trading exits?