Patterns and Trends: A Journey into the World of Options on Futures

Options on futures (FOPs) have emerged as a powerful tool in the financial markets, offering traders the potential to enhance their returns while managing risk. Understanding the nuances of pattern day trading rules for FOPs is paramount for traders to navigate this complex landscape successfully.

Image: stockstotrade.com

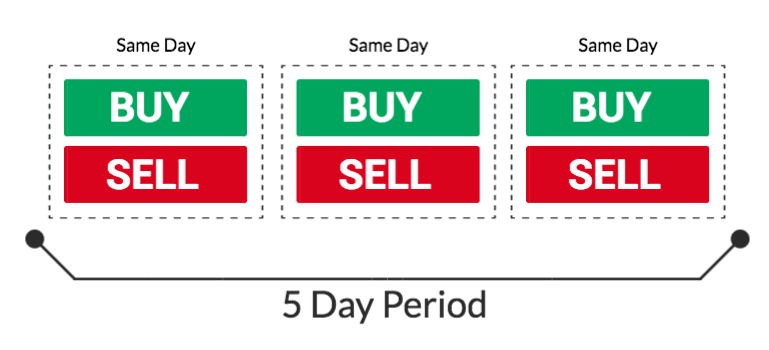

Pattern day trading, or PDT, is a regulatory requirement imposed by exchanges on certain types of accounts to prevent excessive intraday trading. Under PDT rules, accounts are subject to restrictions if they engage in four or more day trades within a rolling five-business-day period.

For FOPs, the Securities and Exchange Commission (SEC) has designated certain contract types as “bona fide” hedges, which are exempted from PDT rules. These hedges are designed to protect traders from potential price fluctuations in the underlying futures contracts.

Exploring the Bona Fide Hedge Exemption

To qualify for the bona fide hedge exemption, the FOP contract must meet specific criteria:

- The option must be purchased to hedge an existing position in the underlying futures contract.

- The option’s strike price and expiration must be reasonably related to the position being hedged.

- The option must not be used primarily to speculate on the price of the underlying futures contract.

Once a qualified hedge is established, the trader is exempt from PDT rules for the duration of the hedge, allowing them to engage in multiple day trades without triggering the restrictions.

Applying the Hedge Effectively

Utilizing the bona fide hedge exemption effectively requires a disciplined approach. Traders should carefully consider the following guidelines:

- Accurately identify the underlying futures contract being hedged.

- Choose an option contract with an appropriate strike price and expiration to match the risk profile of the hedge.

- Document the relationship between the option contract and the hedged position for compliance purposes.

By adhering to these guidelines, traders can leverage the bona fide hedge exemption while avoiding potential violations of PDT rules.

Harnessing Expert Insights for Success

Successful pattern day trading of FOPs requires in-depth knowledge and expert guidance. Here are some valuable insights from industry professionals:

Dr. Jeffrey Hirsch, Chief Market Analyst at Hirsch & Associates:

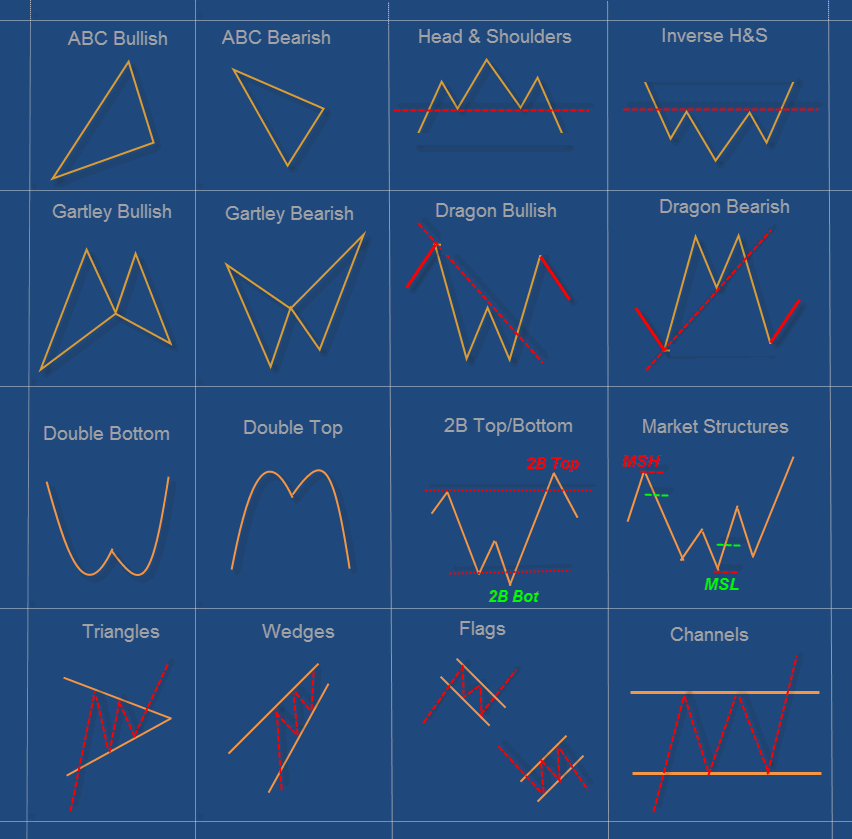

“The key to successful pattern day trading of FOPs lies in identifying repetitive price patterns that can provide insights into future market movements.”

Kent Smetters, Professor of Economics at the Wharton School:

“Traders should approach FOPs with a solid understanding of futures contracts and the principles of options trading.”

Image: www.themeetinghouse.net

Options On Futures Pattern Day Trading Rules

Image: www.mql5.com

Conclusion: Empowering Traders with Knowledge and Compliance

By embracing the concepts outlined in this article, traders can navigate the intricacies of options on futures pattern day trading rules effectively. The bona fide hedge exemption, expert insights, and actionable tips provide a roadmap for unlocking the potential of FOPs while ensuring compliance with industry regulations.

Remember, the financial markets are dynamic and constantly evolving. Traders must remain adaptable, continuously seeking knowledge and guidance to navigate the ever-changing landscape. By leveraging the resources and expertise available, traders can empower themselves to achieve their financial goals responsibly and strategically.