Embark on a captivating journey into the world of options income engine trading, a revolutionary strategy designed to harness the immense profit potential of options contracts. Brace yourself for a comprehensive guide that unveils the art of consistent premium generation, empowering you to navigate market uncertainties with newfound confidence.

Image: wsolib.com

Unveiling Options Income Engine Trading: A Wealth-Building Blueprint

Options income engine trading stands as a sophisticated approach to generating consistent income from options premiums, regardless of market direction. Unlike conventional trading strategies that rely solely on directional bets, this technique focuses on the time decay of options to extract profits. By selling options strategically, traders can effectively harness the natural tendency of options to lose value over time.

Mastering Options Concepts: The Key to Success

To conquer the world of options income engine trading, a firm grasp of fundamental options concepts is crucial. Delve into the intricacies of call and put options, understanding their unique characteristics and the factors that influence their value. Familiarize yourself with option pricing models, including the renowned Black-Scholes model, to gain an edge in determining fair value.

Crafting a Bulletproof Trading Plan: Precision and Strategy

Discipline is paramount in options trading. Devise a robust trading plan that outlines your specific entry and exit strategies, risk management parameters, and trade management guidelines. Determine your preferred option types, whether covered calls, cash-secured puts, or premium-selling strategies, and establish clear criteria for trade selection.

Image: www.forexforum.co

Managing Risk: The Lifeline of Your Trading Journey

Risk management lies at the heart of successful options trading. Understand the myriad risks associated with options, ranging from volatility risk to tail risk. Implement prudent risk-mitigation strategies, such as position sizing, hedging, and diversification, to safeguard your capital. Embrace the concept of stop-loss orders and position limits to minimize potential losses.

Harnessing Volatility: The Power of Theta

Embrace volatility as your ally in options income engine trading. Theta, the Greek letter representing the time decay of options, plays a pivotal role in generating consistent profits. Selling options with shorter time to expiration allows you to capture theta decay, as the relentless march of time erodes the value of your contracts.

Monitoring and Adjusting: An Agile Approach

In the ever-evolving landscape of the financial markets, adaptability is key. Regularly monitor your options trades and make necessary adjustments to align with changing market conditions. Evaluate the performance of your strategies, identify areas for improvement, and continually refine your approach to maximize profitability.

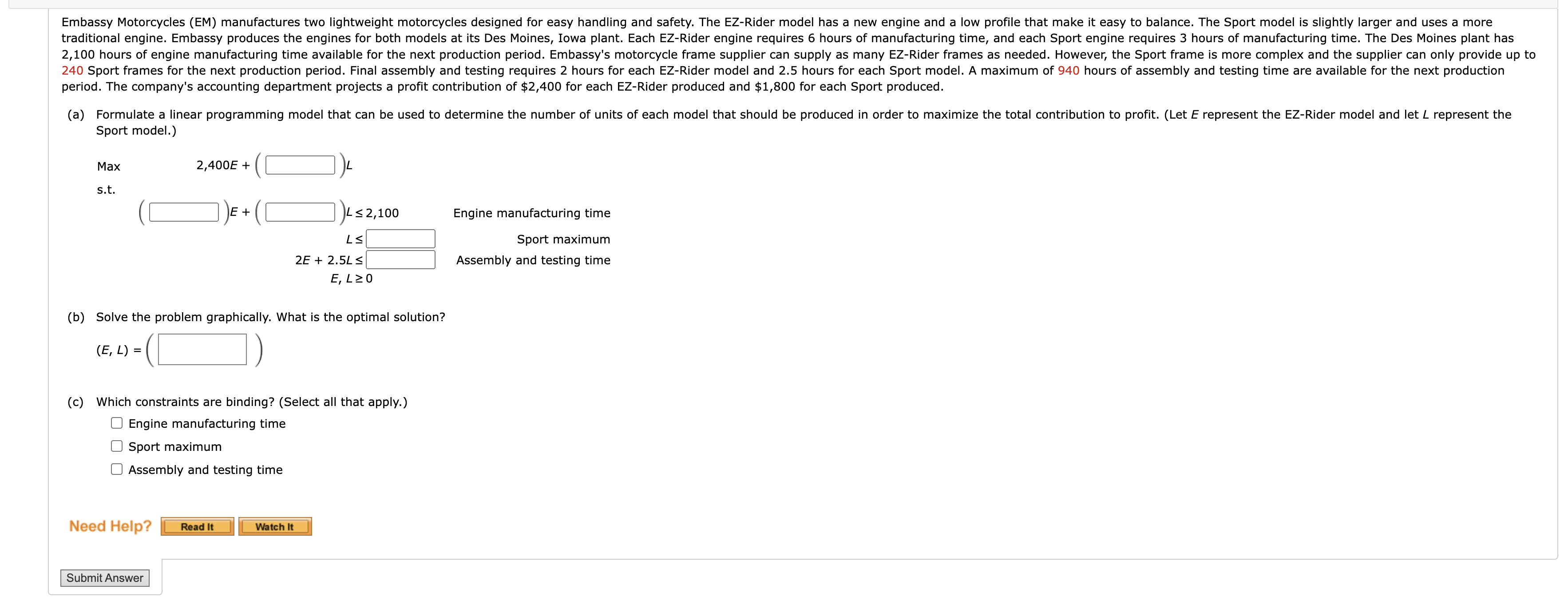

Options Income Engine Trading Rules Blueprint

Image: www.chegg.com

Conclusion: Unveiling the Path to Options Success

Embrace options income engine trading as a transformative tool to generate consistent premium profits. By mastering fundamental concepts, implementing a robust trading plan, managing risk effectively, harnessing volatility, and maintaining adaptability, you can unlock the boundless potential of this powerful strategy. Remember, knowledge is power, and the path to success lies in continuous learning and unwavering discipline. Embark on this journey with confidence, and the rewards of options income engine trading will unfold before your very eyes.