Embark on a riveting journey through the world of options for swing trading, where we delve into the profound insights of Thomsett, a master trader renowned for his exceptional strategies. Swing trading, an art form of the financial markets, empowers traders to capture short-term market swings and unlock lucrative opportunities. Options provide traders with a versatile tool to enhance their trading strategies, potentially maximizing returns. Prepare to immerse yourself in the intricacies of options for swing trading and unravel the secrets to successful market navigation.

Image: www.youtube.com

A Glimpse into Thomsett’s Approach: A Guiding Light for Traders

Thomsett’s approach to options for swing trading is a symphony of technical analysis and strategic option selection. By diligently studying market trends, price patterns, and volatility indicators, Thomsett identifies high-probability trading opportunities. He meticulously evaluates various option strategies, such as bull and bear spreads, calendar spreads, and iron condors, carefully tailoring each strategy to match the prevailing market conditions. By employing disciplined risk management techniques, Thomsett aims to minimize potential losses and maximize profit potential.

Mastering the Symphony of Options for Swing Trading

Options, akin to financial instruments, bestow upon traders the flexibility to amplify their trading potential. Bullish strategies, designed to profit from rising prices, involve buying call options or selling put options. Conversely, bearish strategies, crafted to capitalize on falling prices, encompass selling call options or buying put options. Mastering the nuances of these strategies enables traders to adapt nimbly to market dynamics, staying ahead of the ever-changing tides.

Spreads, a cornerstone of Thomsett’s approach, involve buying and selling options with different strike prices and expiration dates. By constructing these intricate webs, traders can potentially reduce risk and enhance profit potential. Calendar spreads exploit time decay to generate income, while iron condors seek to profit from low volatility. Thomsett’s expertise in crafting these sophisticated strategies empowers traders with the tools to navigate the financial labyrinth.

The Alchemy of Indicators: Discerning Market Sentiment

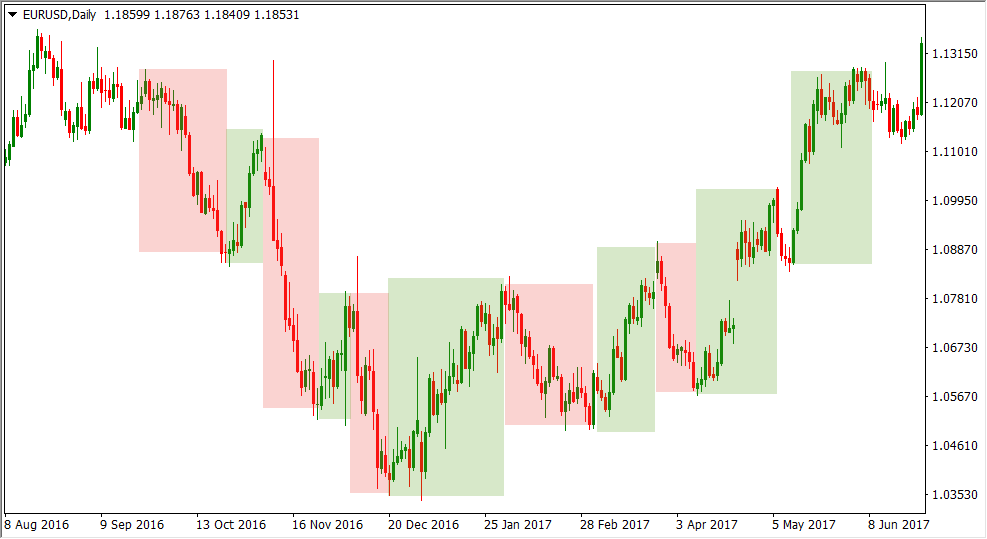

Technical indicators, the trader’s compass in the vast financial sea, provide invaluable insights into market sentiment and price movements. Relative Strength Index (RSI) gauges market momentum, identifying potential overbought or oversold conditions. Moving averages, like sleek lines tracing the market’s heartbeat, reveal trend direction and support/resistance levels. Bollinger Bands, the vigilant guardians of volatility, delineate areas of high and low volatility, guiding traders towards opportune entry and exit points. By harmonizing these indicators, Thomsett deciphers the market’s whispers, anticipating future price action and exploiting market inefficiencies.

Image: www.youtube.com

Risk Management: The Bedrock of Sustainable Trading

In the ever-fluctuating financial landscape, risk management stands as an indomitable pillar, safeguarding traders from the perils of unbridled risk. Thomsett instills the imperative of risk management into the very core of his trading philosophy. By meticulously setting stop-loss orders, traders establish a predetermined threshold beyond which trades are automatically closed, limiting potential losses. Position sizing, the art of allocating appropriate trade size relative to account equity, ensures the preservation of capital. Through prudent risk management practices, traders can venture into the trading arena with confidence, knowing their financial well-being is securely shielded.

Emotional Mastery: The Unseen Force in Trading Success

In the realm of trading, emotions can often be an insidious force, capable of clouding judgment and leading to irrational decisions. Fear, greed, and overconfidence are the wolves that lurk within every trader’s psyche, threatening to devour profits. Recognizing the insidious nature of emotions, Thomsett emphasizes the significance of cultivating emotional control. By harnessing mindfulness techniques and practicing disciplined trading routines, traders can tame their emotional impulses, making sound judgments based on objective analysis rather than fleeting sentiments.

The Path to Proficiency: A Journey of Practice and Perseverance

Proficiency in options for swing trading requires dedication, practice, and an unwavering commitment to learning. By diligently studying market behavior, testing strategies through paper trading, and seeking mentorship from experienced traders, aspiring traders can embark on the path to mastery. Active participation in trading forums and webinars fosters a spirit of continuous learning, enriching traders with diverse perspectives and valuable insights. The road to success may be arduous, but with perseverance and an unyielding thirst for knowledge, traders can elevate their skills and achieve their financial aspirations.

Options For Swing Trading Thomsett

Image: thewaverlyfl.com

Conclusion: Unlocking the Treasure Trove of Options for Swing Trading

Options for swing trading, wielded with the wisdom of Thomsett’s strategies, unveil a world of potentially lucrative opportunities. By embracing technical analysis, mastering option strategies, employing risk management techniques, and maintaining emotional control, traders can navigate the financial markets with confidence and precision. The pursuit of knowledge and continuous practice is the key to unlocking the treasure trove of options for swing trading. As you embark on this path, remember to trade responsibly, always prioritizing the preservation of your capital and seeking counsel from experienced professionals when venturing into unfamiliar territory. May your trades be profitable, and may the markets favor your endeavors.