Introduction

My journey into the world of energy futures and options was a captivating experience that unveiled the intricate dynamics of this complex market. As a nascent trader, I was drawn to the allure of trading in a sector that not only shapes global economies but also impacts our daily lives. Immerse yourself in this article to delve into the foundational principles that illuminate the fundamentals of energy futures and options, equipping you with the insights and knowledge necessary to navigate this dynamic trading landscape.

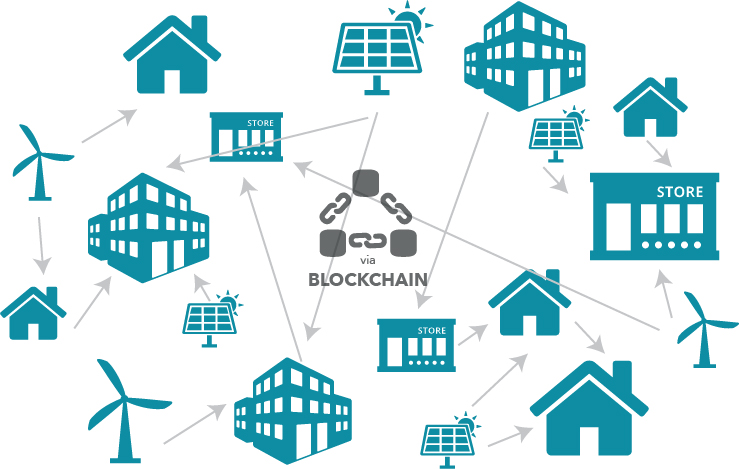

Image: www.somish.com

What Are Energy Futures and Options?

Energy futures represent legally binding contracts that mandate the purchase or sale of a specified quantity and grade of energy at a predetermined price on a particular future date. They serve as crucial risk management tools, enabling producers, consumers, and market participants to hedge against price fluctuations and secure future supply or demand.

Energy options, on the other hand, provide the right, but not the obligation, to buy or sell energy at a preset price within a specified time frame. Unlike futures contracts, options offer flexibility and the ability to exercise control over the timing of transactions, allowing traders to adjust their positions strategically based on market conditions.

A Comprehensive Overview

The energy futures market has evolved over centuries, with its origins tracing back to the 19th century when standardized contracts for agricultural commodities were introduced. Today, it encompasses a vast array of energy sources, including crude oil, natural gas, electricity, and renewable energy commodities. By offering standardized contracts, the futures market facilitates efficient price discovery and mitigates risks associated with physical delivery.

Types of Energy Futures Contracts

- Heating Oil: Futures contracts representing distillate fuel used for heating and other purposes

- Natural Gas: Contracts for the future delivery of natural gas, a key fuel for power generation and industrial processes

- Crude Oil: Futures instruments for various grades of crude oil, the lifeblood of the global energy system

- Electricity: Contracts enabling the trading of electricity, a critical component of modern infrastructure and energy consumption

Image: www.lojaofitexto.com.br

Options vs. Futures: Key Differences

| Characteristic | Futures | Options |

|---|---|---|

| Obligation | Binding commitment to buy/sell | Right, but not obligation, to buy/sell |

| Flexibility | Limited flexibility in timing | Flexibility in exercising control |

| Hedging Tool | Yes, primarily for price risk management | Yes, but also offers additional strategies |

| Premium | No premium paid | Premium paid to acquire the option |

Navigating the Energy Futures and Options Markets

Trading energy futures and options requires a comprehensive understanding of market dynamics, risk management strategies, and technical analysis techniques. Fundamental analysis, examining economic indicators and supply-demand fundamentals, provides insights into long-term price trends. Technical analysis, studying price charts and patterns, assists in identifying potential trading opportunities and market entry and exit points.

Tips for Effective Trading

- Research the market: Gather in-depth knowledge about the energy market, including key drivers, supply-demand dynamics, and geopolitical factors.

- Manage risk prudently: Utilize stop-loss orders to limit potential losses, and carefully calculate position sizing based on risk tolerance and capital.

- Control emotions: Discipline and emotional control are vital to avoid impulsive trading decisions that can erode profits.

- Leverage market sentiment: Monitor market sentiment and news events to gauge investor sentiment and make informed trading decisions.

Frequently Asked Questions (FAQs)

-

What is contango in the energy futures market?

- Contango refers to a market condition where futures prices for a given commodity are higher than the spot price, indicating expectations of higher prices in the future.

-

How do energy futures prices impact consumers?

- Futures prices influence the cost of energy for end consumers. Rising futures prices can lead to increased energy bills and higher inflation.

-

What are the advantages of trading energy options?

- Options offer flexibility, allowing traders to speculate on future price movements or hedge against risks without committing to physical delivery.

Fundamentals Of Trading Energy Futures & Options

Conclusion

Understanding the fundamentals of energy futures and options trading empowers traders with the knowledge and strategies necessary to navigate this dynamic market. By embracing research, managing risk, and utilizing a disciplined approach, traders can potentially reap the benefits of this complex and ever-evolving financial landscape. This article has provided an introduction to the intricacies of energy futures and options, but further exploration is encouraged to deepen your understanding and refine your trading strategies.

Would you like to delve deeper into the world of energy futures and options trading? I would be delighted to continue the conversation and provide additional insights. Stay tuned for more articles and updates on this captivating topic as I share my expertise and delve into the latest trends and developments shaping the energy markets. Embark on this exciting journey and harness the power of knowledge to succeed in the dynamic world of energy futures and options.