Options trading has emerged as a powerful tool for investors seeking to enhance their returns and manage risk. With its potential to unlock lucrative opportunities, options have gained immense popularity among seasoned traders and novice investors alike. However, venturing into the world of options trading requires a thorough understanding of its concepts and intricacies.

Image: ditycapylal.web.fc2.com

This comprehensive guide will delve into the intricacies of option trading, empowering you with the knowledge and strategies necessary to navigate this dynamic financial landscape. We will explore the fundamental principles, different types of options, and the strategies employed by successful traders. Armed with this knowledge, you’ll be equipped to harness the transformative power of options to achieve your financial goals.

Understanding the Options Landscape

Options contracts are financial instruments that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. They empower investors with flexibility and leverage, allowing them to speculate on price movements, hedge against risk, and generate income.

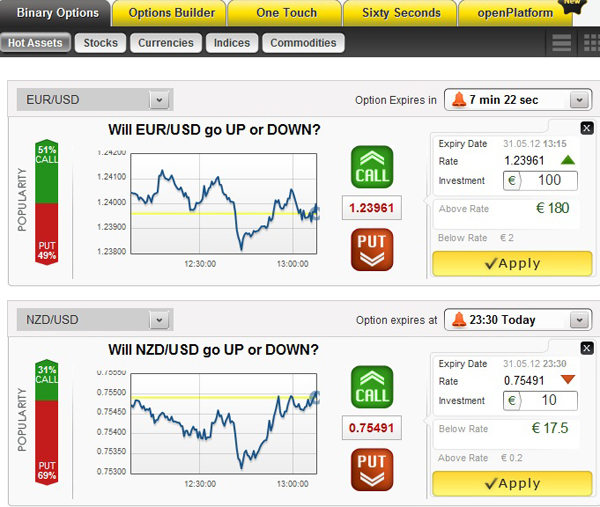

There are two main types of options: calls and puts. Call options give the buyer the right to buy the underlying asset, while put options grant the right to sell. Each option contract specifies the underlying asset, the strike price (the predetermined price at which the asset can be bought or sold), and the expiration date (the final day the option can be exercised).

The Mechanics of Option Trading

When you purchase an option, you are essentially acquiring the right to buy or sell the underlying asset at a fixed price, regardless of its current market value. If the price of the underlying asset moves in your favor, you have the potential to generate significant profits. However, if the price moves against you, you may incur losses up to the premium you paid for the option.

The premium is the price you pay to purchase an option contract. It represents the value of the right to buy or sell the underlying asset at the specified strike price and expiration date. Premiums fluctuate based on market volatility, the time remaining until expiration, and the likelihood that the option will be exercised profitably.

Option Trading Strategies for Success

Seasoned traders employ a wide range of option trading strategies to maximize their returns and manage risk. Some of the most popular strategies include:

-

Covered Calls: This strategy involves selling a call option against an underlying asset that you own. By doing so, you generate premium income while retaining the potential for appreciation in the asset’s value.

-

Protective Puts: Protective puts are purchased to hedge against potential losses in the underlying asset you own. By purchasing a put option, you gain the right to sell the asset at a predetermined price, even if its market value declines.

-

Iron Condors: Iron condors are more complex strategies that involve selling a call option and a put option at different strike prices, while simultaneously buying a call option and a put option at different (but closer) strike prices. This strategy is designed to generate income from time decay and market neutrality.

Image: builtin.com

Option Trading Torrent

Image: www.thestreet.com

Embark on Your Option Trading Journey

The world of options trading presents a wealth of opportunities for investors seeking to enhance their returns and achieve their financial goals. By understanding the fundamental principles, different types of options, and effective trading strategies, you can unlock the transformative power of this financial instrument. Remember to approach option trading with a sound understanding of the risks involved and a disciplined approach to investment. As you gain experience and expertise, you’ll become more adept at navigating the complexities of option trading and harnessing its potential to your advantage.